QUICK GUIDE TABLE OF CONTENTS

INTRODUCTION

SI Systems, Inc. has designed the SI Systems Software System as a complete

business solution, specifically designed to meet the unique and complex needs

of the commercial specialty contractor. Both hardware and software are designed

in modular format so your system can grow and change as you do. Your system

is backed by a 33 year old company, committed to meeting your needs.

Hardware is carefully chosen from top-of-the-line national brands, and components

are selected to meet your needs now and in the foreseeable future. As you grow,

your system can be expanded and upgraded, as you require.

Software is written in PROGRESS, a true 4th generation data base language

and multi-user database manager. The UNIX operating system provides a highly

reliable and efficient multi-user, multi-tasking environment. Built-in data

security allows you to specify authorized users and their access levels.

The Accounting Modules utilize the advanced features of the Progress database

language to provide an interactive environment for the entire accounting system.

Information entered by any user, in any part of the accounting system, (from

General Ledger, to Accounts Payable, Accounts Receivable, Inventory, Job Costing,

etc.) is immediately available to any user. This "Real Time" feature

provides management with a powerful tool to oversee the financial condition

of the company as a whole, or the profitability of any specific job. Each Module

provides a variety of standard management reports, and the database can be queried

for custom reports as well.

The Estimating Module is configured with a custom English language takeoff

library for Electrical, Mechanical, or General Contractors. The system will

accommodate multiple price tables, multi-user access, and will provide audit

trails, last minute alterations, and detailed printed bids.

The purpose of this Quick Guide is to provide an overview reference for getting

your system up and running, and to help new users become acquainted with turning

the SI Systems', Inc. server on and off. Detailed instructions on each procedure

are provided in the manual. If you have a question which is not covered in the

manual, or a problem you cannot resolve, please call our national service hotline,

800/422-2277.

Top

GENERAL SYSTEM INFORMATION

Turning On The Computer

NOTE: These power-up procedures relate to SCO machine

and will be slightly different for other Unix systems.

1. Turn on the power switch. This may be located in different places,

depending on the type of computer.

2. When the screen shows:

Boot:

type unix auto (case sensitive) then press <ENTER>.

3. When the screen becomes full of printing, ending with:

Type control-d to proceed with normal startup,

(or give root password for system maintenance):

Press control d (hold down the control key while pressing

the d key; then release both keys).

4. The system will then prompt:

Current system time is Thu May 31 10:10:00 EDT 1990

Enter new time ([yymmdd]hhmm):

Either type the correct date and time, or if the date and time are accurate,

press ENTER.

The time must be entered as four digits: (i.e. 0745 = 7:45 AM)

5. When the screen prompts:

login:

Type your operator name and press ENTER.

6. When the screen prompts:

password

Type your personal password and press ENTER.

7. Normally at this point you will be at the Main Menu.

Top

1. It is first necessary that someone "BOOT" the server.

2. When you turn on your terminal, press control d (hold down the control

key while pressing the d key; then release both keys).

3. When the screen prompts:

login:

Type your operator name and press ENTER.

This will display the Main Menu.

Top

If the power goes out or you accidentally pull the plug out of the wall,

the first thing to do is DO NOT PANIC. When the

power is restored, or the plug put back in, follow these steps:

1. Turn on the computer as described above.

At the Boot type unix auto <ENTER> , case sensitive.

The system will do a great deal of self- testing and will put reams of

information on the screen. You can ignore this.

On some systems, the computer prompts:

The system was not shut down properly, and the

root file system should be cleaned.

Proceed with cleaning (y/n)?

Type Y. At any other questions, you MUST ANSWER Y. The system

may take several minutes to clean the files before it displays the login

prompt.

2. When the system displays the prompt:

login:

You may continue from this point as described above in the daily power

up procedure.

Top

Shutting Down The Computer

1. Move back through the menus by pressing ENTER several times

until you reach the Main Menu.

2. From the main menu, type q and ENTER.

When the system displays:

login:

You may cut off the power to your terminal.

Top

1. Make sure that everyone else has logged off the system.

2. Back through the menus until you reach the Main Menu.

3. From the main menu, press q and ENTER.

4. When the screen displays:

login:

Type "shut-down" and press <ENTER>. At Password:

type yes then <ENTER>. The system may take several

minutes to complete this procedure.

5. When the screen displays this or a similar message:

Safe to power off

or

Press Any key to Reboot

You may turn off the main power.

Top

Backing Up Your Files

Despite the protection given to your data by the system, there are always

accidents which can damage the hard disk on which the data are stored. To protect

against such accidents and to keep you from having to re?enter all of your data,

you should back up your data files frequently, daily if at all possible.

To back-up your accounting files, follow these steps:

1. First be sure that no one else is using the system. After insuring that

all other users are logged off, move back through the menus to the Main Menu.

2. From the main menu press q and ENTER.

3. When the login: prompt is displayed, type bkupacct. Before pressing

ENTER, place a tape in the tape drive. Then press ENTER and the

computer will begin backing up your data. As another tape is needed, you will

be prompted by the screen to put in another one.

4. When the back-up is complete, the login: prompt will be displayed.

It is recommended that at least FIVE sets of tapes be used for back-up,

with at least one set kept away from the office. Rotate the sets of tapes so

that the first set is used one day, the second set is used the next day, and

the third set is used the third day etc. through the fifth day. Then start over

with the first set.

Top

GETTING STARTED

Required Setup

Certain areas of the system must be set up prior to using other areas of the

system. These are as follows:

|

Area to set up

Passwords

User access

General ledger divisions

General ledger chart of accounts

Accounts payable accounts

Accounts receivable accounts

Sales type information

Salesman information

Sales tax information

Customer information

Jobs (OH and STOCK)

Inventory

Class & union information

Misc pay & deductions

Department information

Employee information

| Area Affected

Entire system

All menu selections

General ledger

General ledger

General ledger & AP

General ledger & AR

Customer & order entry

Customer & order entry

Customer & order entry

Order entry & AR

Inventory, Payroll, Job Cost

Order entry, Purchase orders, Service orders

Payroll & employee

Payroll & employee

Payroll & employee

Payroll & employee

|

Items which you need to type, as well as keys you must press are shown in

bold type, and screen messages and prompts which you must answer are shown indented

and in bold type.

Top

Types of Menus

-

Vertical Menu

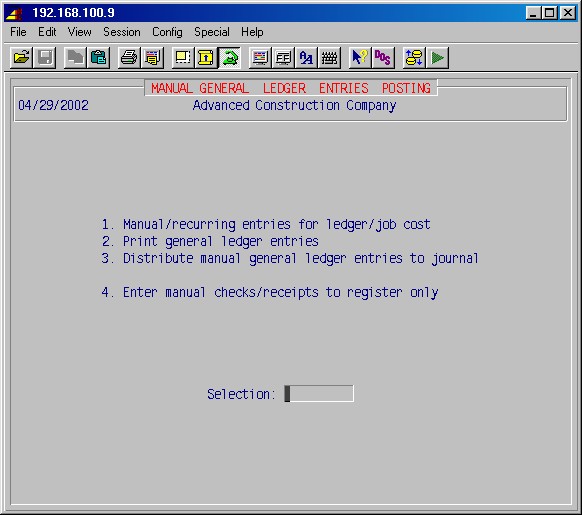

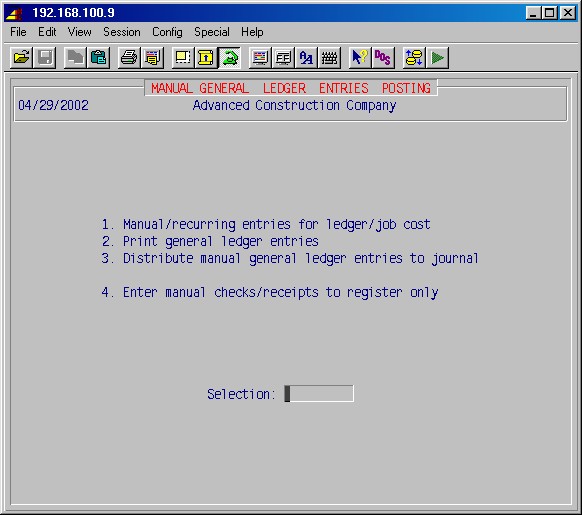

Two types of menus will be found in the system. The first is a vertical

menu, such as the one below:

To use this style of menu, simply type the number of the selection you

wish to use and press ENTER. To leave a menu, leave selection blank

and press ENTER.

-

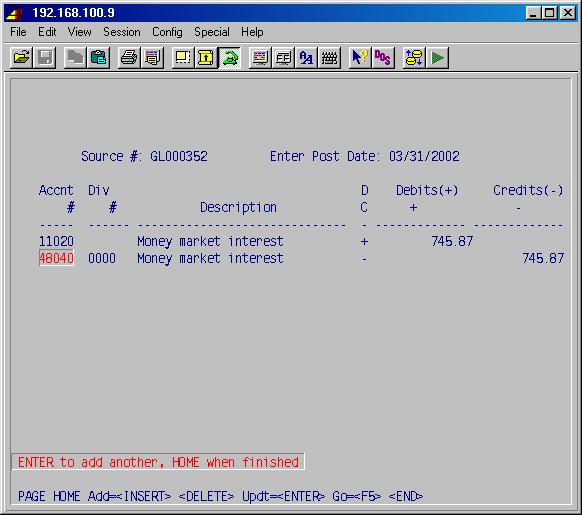

Horizontal Menu

The second style of menu is a strip or horizontal menu, such as the one

below:

To use this style of menu, press the indicated key for your choice of function,

or use the up/down arrow keys or page up/down to move through the displayed

data. Pressing the HOME key moves you to the last line of the displayed

data, pressing the HOME key again moves you to the first line of the

displayed data. Press ENTER to update information. After pressing the

INS key you will be in the add or insert mode and can continue to add

new lines without having to press the INS key for each new line. To get out

of the add mode, press any of these keys: HOME, Page-Up/Down

or Up/Down arrow, when finished with entering data on a line. To go

back from a horizontal menu to the previous menu, press the END key.

Top

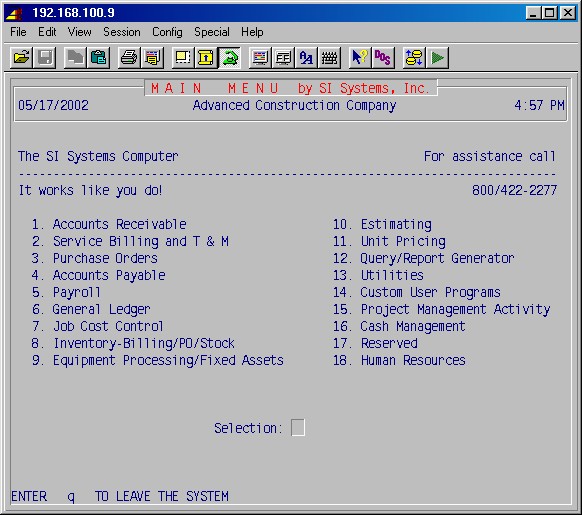

Main Menu

After you have booted up the system, logged in as a user, the Main Menu will

be displayed.

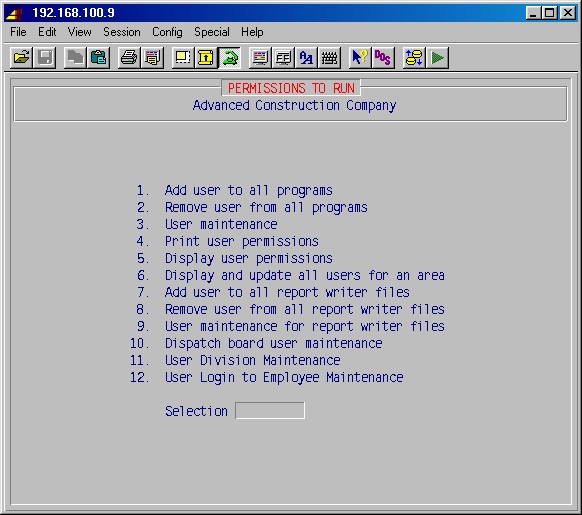

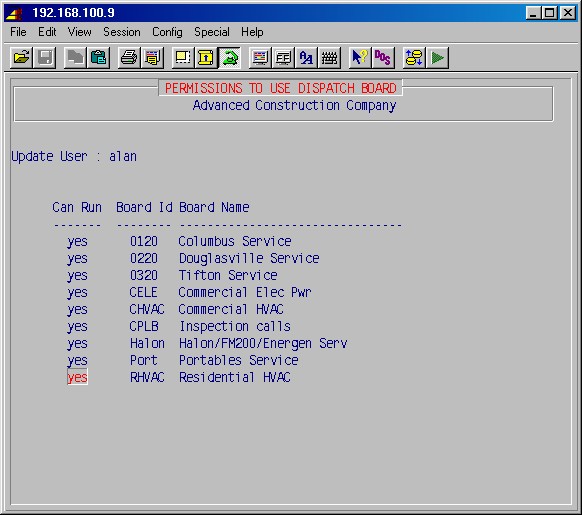

Setting Up User Access

Before you can start setting up your accounting system on the computer and

entering data, you must first authorize users for the system. This is done by

selecting 13-2: Permission to Run Programs from the Main Menu. This may

only be done by the system administrator, and the information on how to do it

should be removed from the Quick Guide and stored separately. This will have

to be done once for your original users, and again when new users are added,

or users are removed.

Selection 13-2: Permission to Run Programs from

the Main Menu displays the following menu:

You authorize users for the system and specify what modules and individual

programs they have permission to use by utilizing one or more of selections

#1, #2, or #3 from the 13-2: Permissions to Run Menu.

Top

-

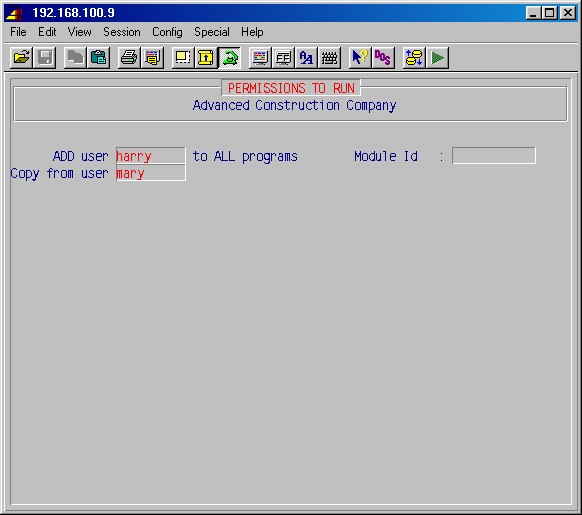

13-2-1 Add User to All Programs

This is used to add a user to all programs within a module. You may add

the user to all modules or specify particular modules, adding the user to

each module one-at-a-time.

This is the best procedure to use to either add a user to a few modules

or add a user to all except a few modules by using this procedure

in conjunction with 13-2-2: Remove User from All Programs,

which is described below.

Similarly, this is the best way to add a user to all except a few programs

within a module by using this in conjunction with 13-2-3:

User Maintenance, also described below.

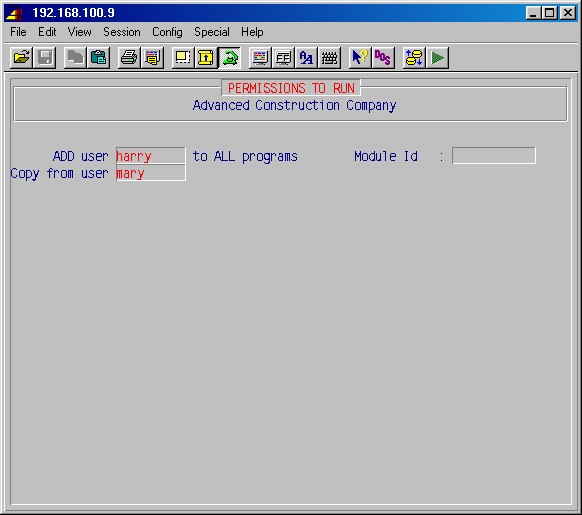

Selecting this procedure will display the following input screen:

The cursor will be positioned in the first field ready to type the name

of the user you want to add to the system. This name may be up to ten letters

or digits long and must be exactly the same as the name used to login.

Type the user name an used to login to the system and press ENTER.

The cursor will move to the Module ID field. You may specify a particular

module or leave blank for all. The module IDs are as follows:

|

MENU = Main Menu

AR = Accounts Receivable

SO = Service Billing (T & M)

PO = Purchase Orders/Submittals

AP = Accounts Payable

PR = Payroll

GL = General Ledger

JC = Job Cost

|

IN = Inventory-Billing/PO/Stock

TL = Equipment Processing/Fixed Assets

UP = Unit Pricing

UT = Utilities

CP = Custom User Programs

ML = List Management

HR = Human Resources

|

Type the module ID and press ENTER. The system will pause to update

the permissions database and the screen will return to the 13-2:

Permissions to Run Menu.

If you left the Module ID field blank, you have added this

user to all programs in all modules.

If you specified a particular module, you may now add that user to another

module by repeating the procedure.

NOTE: The name of the user and the module ID typed in those

fields remains there until you change it or until you exit the 13-2:

Permissions to Run Menu. This is to facilitate adding or removing

a user from particular programs or modules by using combinations of steps

#1, #2, and #3 as described in this section.

Top

-

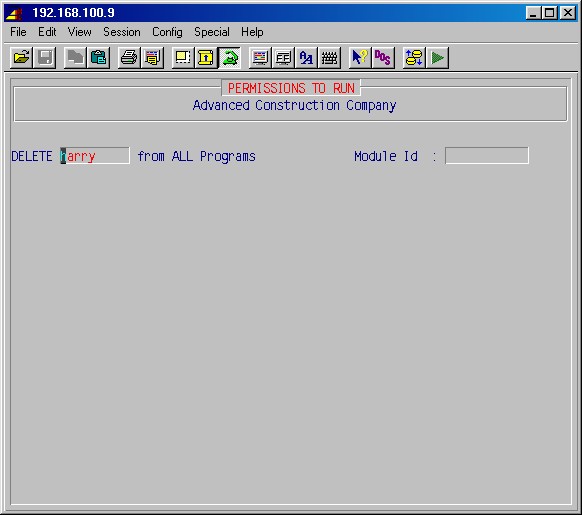

13-2-2 Remove User from All Programs

This is used to remove a user from all programs within a module.

You may remove the user from all modules or specify particular modules,

removing the user from each module one-at-a-time. This is the best procedure

to use to remove a user from the entire system if that person resigns or

is transferred to another department that doesn't require access to the

computer.

This is also the best way to set up a user on all except a few modules

by using this procedure in conjunction with 13-2-1

Add User to All Programs as described above.

Similarly, this is the best way prohibit a user to run all except a few

programs within a module by using this in conjunction with 13-2-3:

User Maintenance, described below.

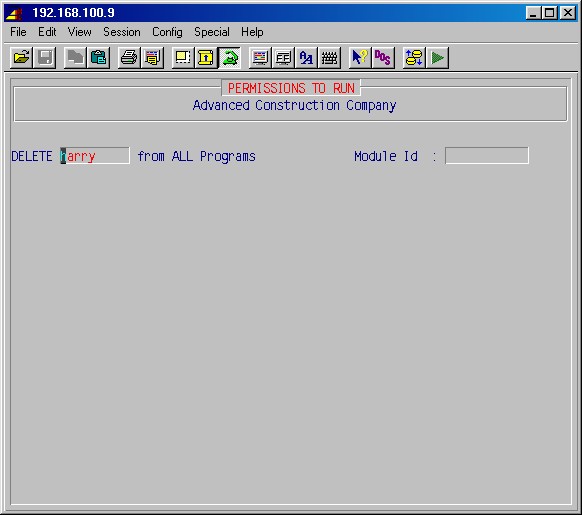

Selecting this procedure will display the following input screen:

As described in 13-2-1 above, type the user name and

the Module ID pressing ENTER after each. The system will pause to update

the permissions database and the screen will return to the 13-2:

Permissions to Run Menu.

If you left the Module ID field blank, you have removed this user from all

programs in all modules.

If you specified a particular module, you may now remove that user from

another module by repeating the procedure.

Top

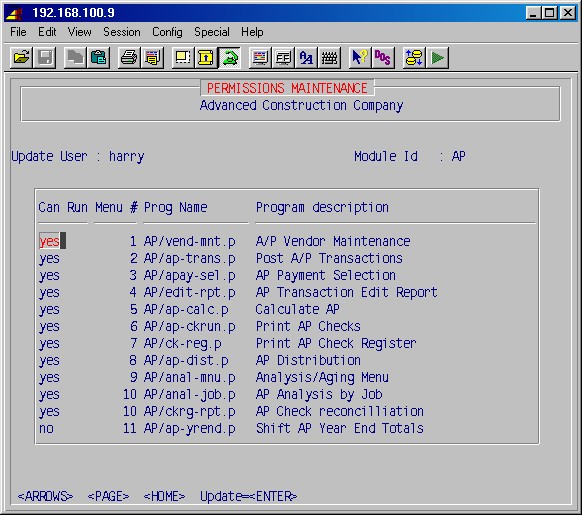

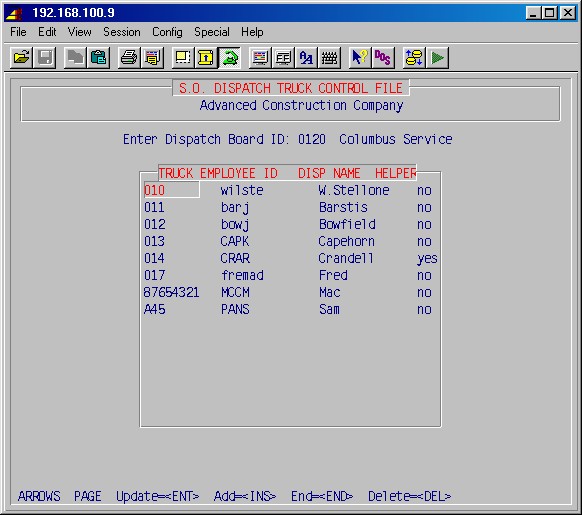

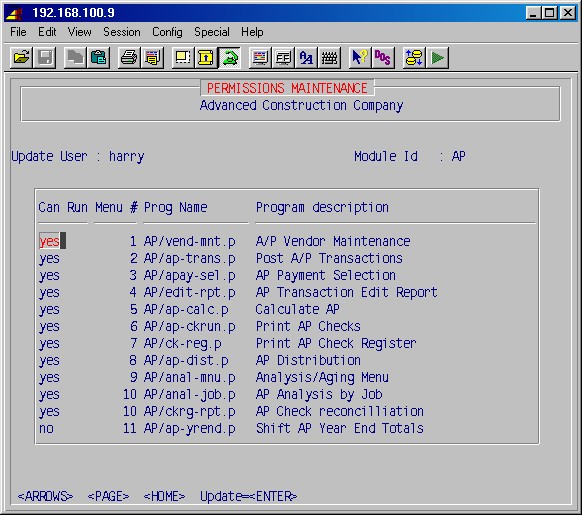

As described in 13-2-1 above, type the user name and

the Module ID pressing ENTER after each. The system will display the

first menu number of this module, representing a particular program or procedure,

with the cursor on the yes or no in the Can Run column.

Use the arrows to select the required line, then press <ENTER>

to change the permission.

Type YES to permit the user to run this program; type NO to

prevent the user from running this program; then press ENTER.

You may now select this procedure again and type a different Module ID which

will display the menu items for that module. Specify one line-at-a-time which

programs to permit the user to run.

You can completely set up a user by this method. If desired, you may also

leave the module ID blank and all menu items in all modules will be displayed

one line-at-a-time. This however, is not the most efficient way to accomplish

this task.

If you want to permit a user to run all except a few programs in a module,

first add the user to all programs by using procedure #1, and then use this

procedure #3 to remove the user from those you specify.

If you want to prohibit a user from running all except a few programs in

a module, first remove the user from all programs by using procedure #2, and

then use this procedure #3 to add the user to those you specify.

Top

Removing Users

If users leave the firm or change their positions so that they no longer need

access to all or part of the system, their names will need to be removed from

the menus to which they had access. This is done in the same manner in which

names are added to portions of the system using one or more of the procedures

described in Setting up User Access.

Top

General and Default Setups

13-1 Client information

Selecting 13-1 will display the following input screen:

1-6. Company name, address, & phone

Complete these fields with your company's name and address as you

wish them to appear on all reports and transmittals. This address will appear

on W2s, magnetic media, and all union, governmental, and other system reports.

7. Union payroll? First

month of FY

Answer YES if this company has a union payroll. This will

cause union areas to be accessible for input and payroll will be processed as

a union payroll.

Specify the first month (1-12) of your fiscal year (FY). This is a GL setup,

but must be completed because it controls the accounting.

The remaining fields are set up for the payroll module and are covered there.

Top

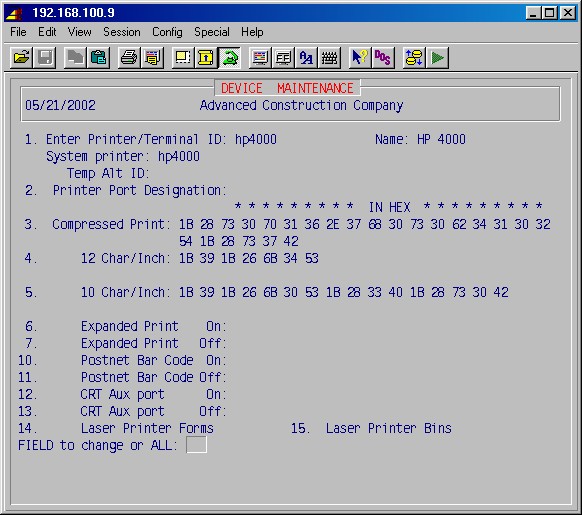

13-3 Printer Setups

Once system printers have been set up by your Unix and network supplier, as

needed, select 13-3: Printer Designation & Codes.

Enter Printer/Terminal ID:

Enter the code you want for the printer you are setting up here.

Name:

Enter a description for this printer.

System printer:

If the Printer/Terminal ID entered above is not the same as the operating

system's designation of the printer, enter that here.

Temp alternate ID:

If you wish to temporarily re-directed to another system printer,

enter its ID here.

Printer Port Designation:

Not used by the system. You can enter the port designation here,

just as a record. E.g. /dev/ttya12.

Compressed Print:

12 Characters/Inch:

10 Characters/Inch:

Expanded Print On:

Expanded Print Off:

Letter Quality On:

Letter Quality Off:

Postnet Bar Code On:

Postnet Bar Code Off:

CRT Aux port On:

CRT Aux port Off:

Enter the appropriate hex codes, as found in the printer's manual, for compressed

(16 - 17 characters per inch), 10 characters per inch, 12 characters per inch

and Post Net bar code printing (if you printer supports this).

ENTER A FIELD # TO BE CHANGED OR ALL:

If you need to change any of the above, enter the number of the field

you wish to change or type ALL to change all fields, or just press ENTER

to return to the previous menu.

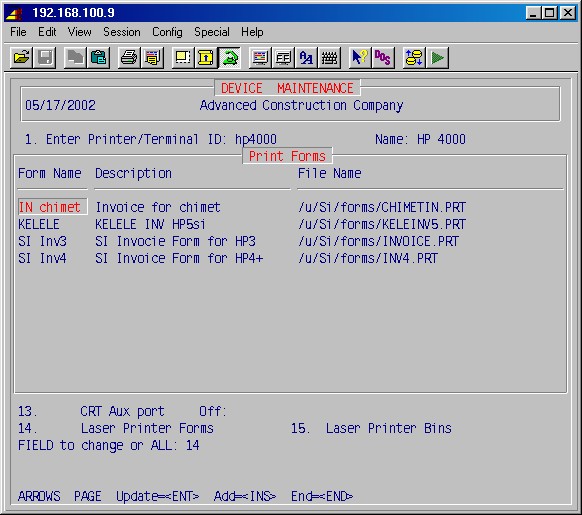

The laser generated forms for use with approved printers are listed here. This

screen is normally set up by SI Systems for you.

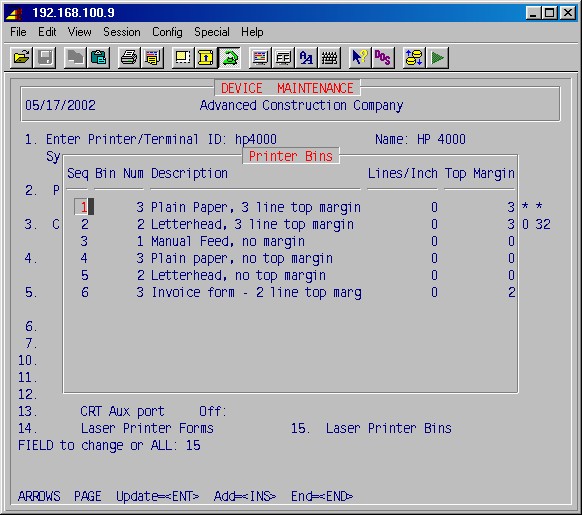

The listing of various bins avaliable for the laser printer, along with their characteristics is set up here. This is normally set up by SI Systems.

Top

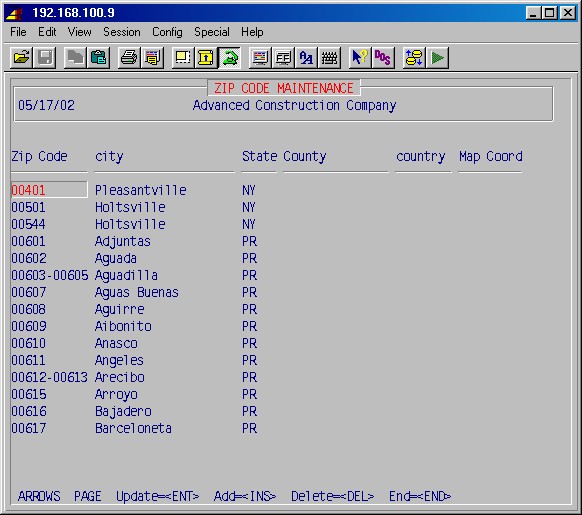

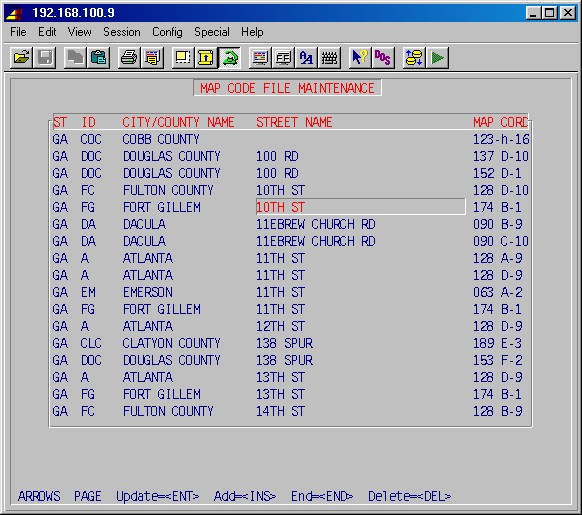

13-5 Zip/City Maintenance

If you need to change or add to the State/City/Zip Code table, select 13-5.

Zip Code

This is the standard 5 digit US postal zip code or zip code range.

City

This is the city for this zip code.

State

This is the state for this zip code.

County

The county is generally not used.

Country

The country is generally not used.

Map Coord

Map coordinates for this zip code is generally not used.

Press END when done.

Top

13-6 UPS Zone Chart Maintenance

Optional. Is used in 1-9: UPS Shipping. This selection

allows you to set up a table to translate the first 3 digits of a zip code to

the corresponding UPS zone.

13-7 UPS Zone Charge Maintenance

Optional. Is used in 1-9: UPS Shipping. This selection

allows you to set up a table of UPS charges for each UPS zone, for each type

of UPS shipping (Ground, Second Day, etc.) for various weights.

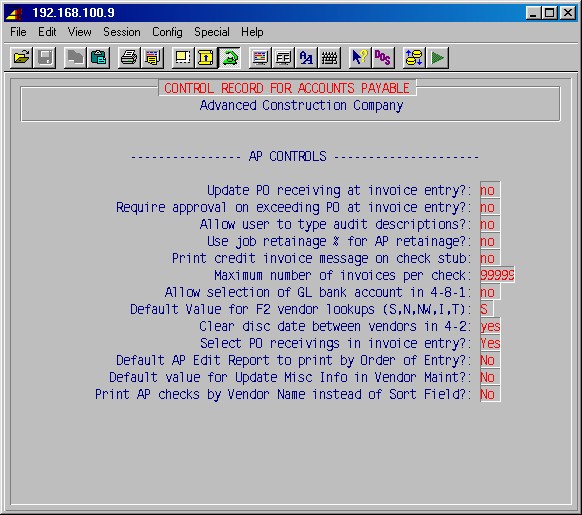

13-8-1 Accounts Payable

Update PO receiving at invoice entry?:

Normally No.

If this is set to Yes, then the PO receiving procedure will be run during

4-2: Enter Accounts Payable Invoices, if a PO number

has been entered for the invoice.

Require approval on exceeding PO at invoice entry?:

Normally No.

If you answer Yes, the system will warn you and require that you confirm

that you are exceeding the PO, and then let you enter the invoice. If you answer

No (usual answer), it only warns you that you are exceeding the PO.

Allow user to type audit descriptions?:

Normally No.

If answered Yes, when entering an AP invoice in 4-2,

the description on each GL and JC line may be edited by the operator.

Top

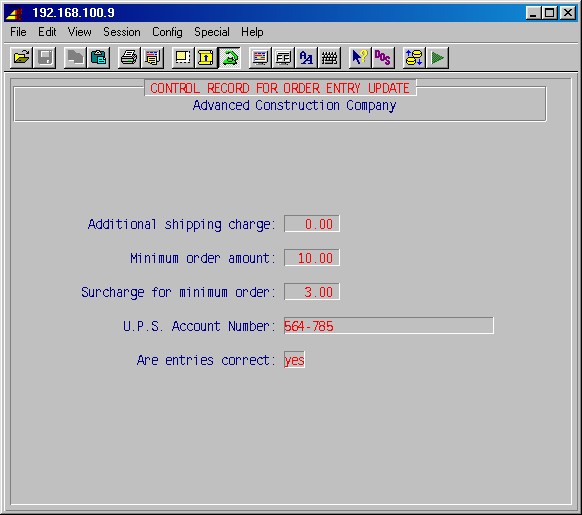

13-8-2 Order Update

Used in 1-10-3: Counter Sales.

Enter the appropriate amounts for you company, if applicable.

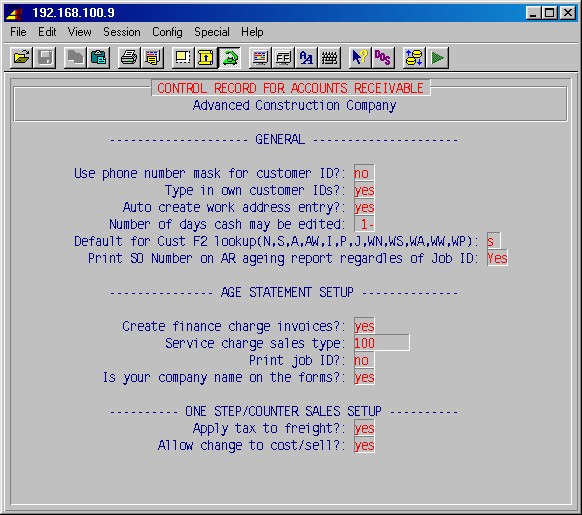

13-8-3 Accounts Receivable Customer

Use phone number mask for customer ID?:

Normally No.

Type in own customer IDs?:

If this is answered No the system will assign a unique customer

ID. This is usually used for systems with a high volume of service work where

service operators do not have time to make up a unique customer ID.

Auto create work address entry?:

The system allows for multiple work addresses for a customer. Set

to No if you are not using the service order module. If set to Yes,

the system will create a work address the first time a customer is created.

Otherwise, the system will create a work address the first time a service ticket

is entered.

Create finance charge invoices?:

If set to Yes finance invoices will be automatically created for

customers with past due invoices when you print customer statements.

Service charge sales type:

Enter the sales type (as set up in 1-4-1:

Sales Type Maintenance) for finance change invoices created as outlined

above.

Print job ID?:

Enter Yes if you want job IDs printed on customers statements.

Is your company name on the forms?:

If you'll be printing customer statements on forms with your company

pre-printed on them, answer Yes here.

Apply tax to freight?:

If freight is taxable in your area, enter Yes here.

Top

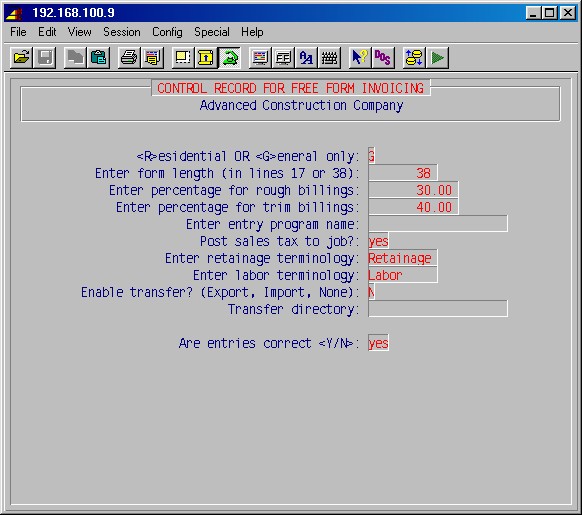

13-8-4 Free form invoicing

<R>esidential OR <G>eneral only:

Normally G.

This selects the billing type codes used in free form invoicing. Residential

will give you billing codes specific for home construction billing.

Enter form length (in lines 17 or 38):

Normally 38. 17 if you use the short invoice forms.

Enter percentage for rough billings:

Specify the percentage of the contract for this item as you want

it billed.

Enter percentage for trim billings:

Specify the percentage of the contract for this item as you want

it billed.

Enter entry program name:

Normally leave blank.

Post sales tax to job?:

If you select No, the amount of the invoice posted to the

job will not include the tax amount. If Yes, the tax amount will be included.

Enter retainage terminology:

The default for this field is the word Retainage which is the accepted

term in the United States. In Canada, this term is Holdback. You may specify

another term if you wish.

Enter labor terminology:

The default for this field is Labor which is the accepted spelling

in the United States. In Canada, this word is spelled Labour. You may specify

as required.

Enable transfer? (Export, Import, None):

Set this to N unless you have remote locations where invoices

are being created using a copy of this system and then transferred (e.g.

by magnetic media) to be incorporated into this systems main database:

I (Import) if this is the main database system.

E (Export) if this is the remote location where invoices are being created.

Transfer directory:

If the above (Export/Import/None) is set to

None leave this blank. Otherwise enter the directory that has been created

on this system where the invoice file to be exported is to be written to, or

where it's to be read from when importing invoices. (E.g. FP)

Top

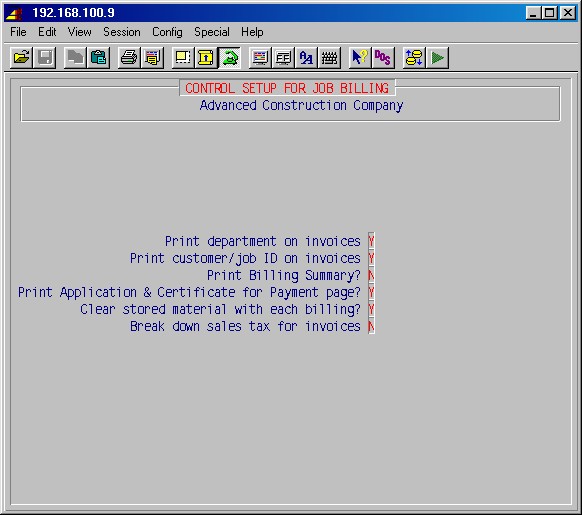

13-8-7 Schedule of values (Job) billing

Used in 7-6: Job Cost Billing.

Print department on invoices

Answer Yes if you want the department (sales type) to print

on invoices.

Print customer/job ID on invoices

If Yes then the customer and job ID will print on invoices.

Print Billing Summary?

If you want the Billing Summary page printed, answer Yes.

Print Application & Certificate for Payment page?

If you want the standard AIA form printed, answer Yes.

Break down sales tax for invoices

If Yes then taxes will be broken out on invoices.

Top

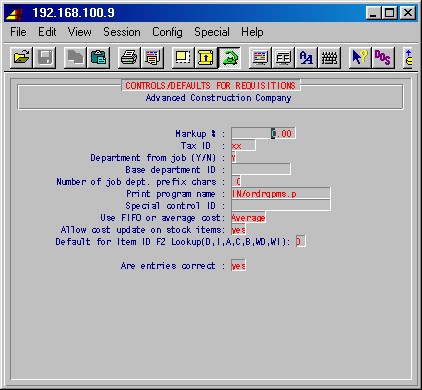

13-8-9 Order requisition control

Used in 8-16: Requisitions Processing.

Markup %

Enter the percentage that item cost is to be marked up when requisitioning

to a job.

Tax ID

Enter the tax ID for tax on item requisitioned to a job.

Department from job (Y/N)

If you want the department (sales type) for the requisition to come

from the job, enter Yes. If you want the department to be the default

below, enter No.

Base department ID

Enter the default department (sales type) for requisitions to jobs.

Number of job dept. prefix chars

Normally 0.

Print program name

Normally IN/ordrqpms.p

Special control ID

Leave blank.

Use FIFO or average cost

Specify for stock requisitions, POs and Service Orders whether the

system uses the actual cost of an item (FIFO) or a weighted average as

a basis for cost. Answer <A>verage or <F>ifo. If you

haven't been using FIFO, you can't just switch, so answer <A>.

Allow cost update on stock items

If answered no the system prevents you from changing the cost on

stock items during requisition.

Top

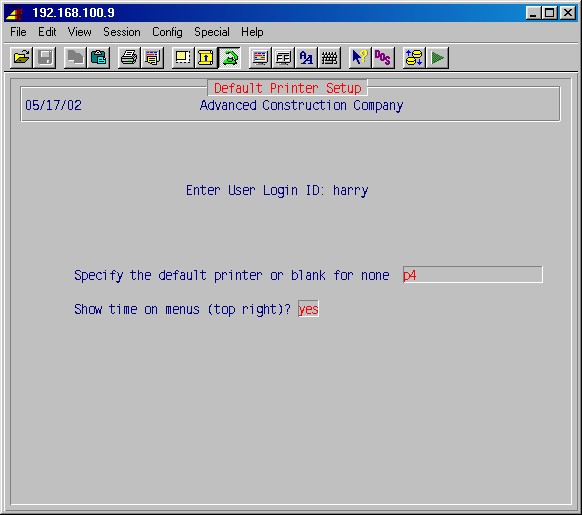

13-8-10 Default printer setup

This allows you to set up a default printer for a user. Whenever the user

is presented with the printer selection screen, the printer entered here will

have been filled in and the user just has to press ENTER to accept it.

Enter User Login ID:

Enter the ID of the user for whom you want to set up a default printer.

Specify the default printer or blank for none

Enter a printer number (as set up in 13-3) or

leave blank to force the user to always enter a printer number when printing.

Show time on menus (top right)?

Sometimes when printing to a printer attached to a terminal or PC,

the display of the system time in the upper right hand corner of menus will

interfere with the printing. In that case set this to No. Otherwise leave

it as Yes.

Top

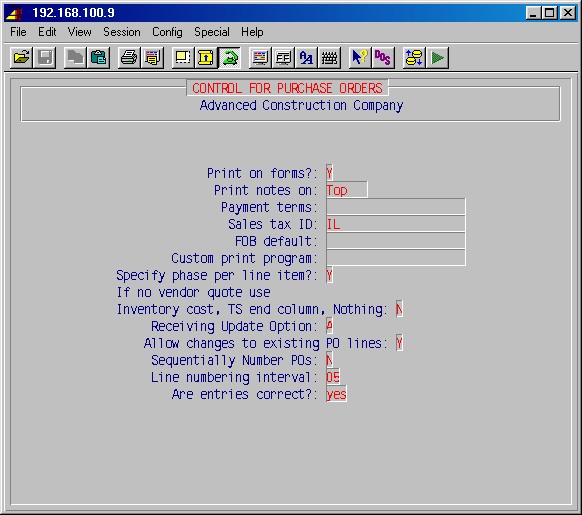

13-8-12 Purchase orders

Print on forms?

Select Yes if your POs are to be printed on preprinted forms,

or No to have them printed on plain paper.

Print notes on:

Select T to print PO notes in the top of the PO body, or B

to have them printed in the bottom of the PO (after item lines).

Payment terms:

Enter the default payment terms you want to have printed on POs,

e.g. Net30.

Sales tax ID:

Must be filled in but now comes from job.

FOB default:

You may enter a default answer here which will show on all POs.

Custom print program:

Normally blank.

Specify phase per line item?

If answered Yes, PO entry will ask for a phase on every line instead

of assuming the phase on the top of the PO.

If NoVendor Quote Use:

Inventory cost, TS end column, Nothing:

If there isn't a vendor quote in the vendor quote area for this item,

specify which cost basis to use: <I>nventory cost, <T>S

end column (Trade service end column cost), <N>othing. If you specify

N you must fill in the cost yourself.

Receiving Update Option:

Specify your inventory receiving cost basis. <A>verage,

<O>ld, <N>ew.

Allow changes to existing PO lines:

If you want a full audit trail of changes made to POs, set this to

No and changes to an PO will have to be changed by adding lines.

Sequentially Number PO's:

If Yes then POs will be automatically numbered.

If you wish POs numbered as per the PO # Option (7-1-1

#4), then answer No.

Top

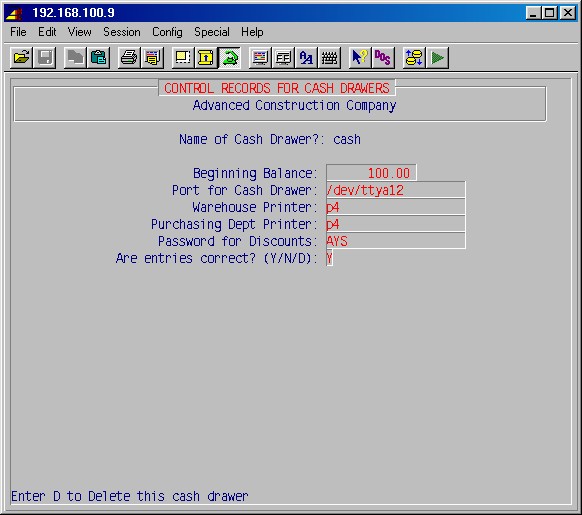

13-8-13 Cash Drawers

Used in 1-10-1: Order Entry,1-10-2:

Update Orders, & 1-10-3: Counter Sales.

Name of Cash Drawer?:

Enter the name/ID for this cash drawer.

Beginning Balance:

Enter any beginning balance.

Port for Cash Drawer:

Enter the operating system's designation for the port to which this

cash drawer is connected.

Warehouse Printer:

Enter the printer number of the printer on which list of items to

be pulled from stock is to be printed, if any.

Purchasing Dept Printer:

Enter the number of the printer to which purchase notes are to be

printed, if any.

Password for Discounts:

If not blank, this password will be required if giving discounts

on sales of items from stock.

Are entries correct? (Y/N/D):

Enter D to delete this cash drawer, N to go back and

correct entries, or Y when done.

Top

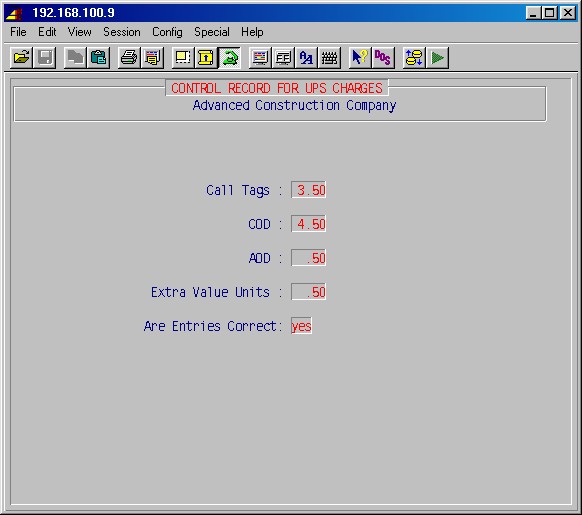

13-8-14 UPS Constants

Used in 1-9: UPS Shipping.

Call Tags:

Enter the UPS charge for call tags.

COD:

Enter the UPS charge for COD deliveries.

AOD:

Enter the UPS charge for acceptance of delivery evidence.

Extra Value Unit:

Enter the UPS value for this.

Top

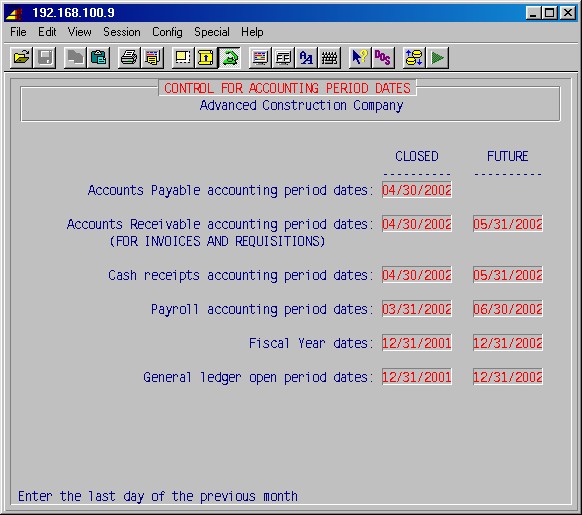

13-8-15 Accounting period dates

Used in AP, AR,

IN, PR and SO.

Enter appropriate dates to control the accounting dates (new transaction dates

entered will have to be later than the "closed" dates and before or

on the "future" dates). The purpose of these "date locks"

is to prevent inadvertent entry of wrong dates, e.g. wrong year.

Accounts Payable closed accounting period date

In 4-2: Enter Accounts Payable Invoices,

operators will not be allowed to start a new accounting cycle with or earlier

than this date.

Accounts Receivable closed accounting period date

Operators will not be allowed to enter invoice dates with or earlier

than this date.

Accounts Receivable future date limit

Operators will not be allowed to enter invoice dates later than this

date.

Cash receipts closed accounting period date

Operators will not be allowed to enter cash posting dates with or

earlier than this date.

Cash receipts future date limit

Operators will not be allowed to enter cash posting dates later than

this date.

Payroll closed accounting period date

Operators will not be allowed to enter payroll dates (e.g. payroll

batch beginning date) with or earlier than this date.

Payroll future date limit

Operators will not be allowed to enter payroll dates (e.g. payroll

ending period date) later than this date.

Top

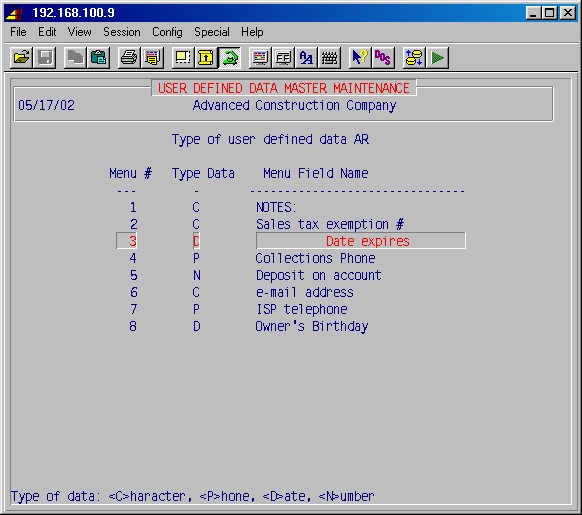

13-8-16 User Defined Data Maintenance

This setup area allows you to specify custom user-defined data entry fields

for each module which are accessed from the field called "Custom data"

in each module. You to enter up to 17 lines of user-defined data which may be

in the format of characters, numbers, phone numbers or dates. For example, on

the 1-1-1: Customer Maintenance Screen, choosing

field #23, Custom data, will take you to a new screen where you may access the

custom fields which you define here.

Type of user defined data

Enter the abbreviation for the module you wish to define custom fields

for:

AR - Accounts Receivable, 1-1-1: Customer Maintenance,

#23

AP - Accounts Payable, 4-1-1: Vendor Maintenance,

#18

PR - Payroll, 5-1-1: Employee Maintenance,

3rd screen #7

JC - Job Cost Control, 7-1-1: Job Description

Maintenance, 2nd screen #11

IN - Inventory, 8-1: Item Maintenance, #11 or

23

Menu #

Enter the number of the field; 1 - 17. This determines the sequence

in which the fields are shown.

Type Data

Enter on of:

Character (any letters, numbers or symbols can be types

in such a field)

Phone (only allows format of ###/###-#### ####, where # is any number)

Date (only allows dates to be entered)

Number (only allows numbers to be entered)

Menu Field Name

Enter the label of this field as you wish it to appear.

Top

General Ledger Setup

Once you have set up user access, certain information must be entered before

you can use the rest of the system. The next step is to enter account numbers

in the general ledger module. Here you will enter the chart of accounts, payables

account numbers, and division identifiers (optional). Selecting #6 General

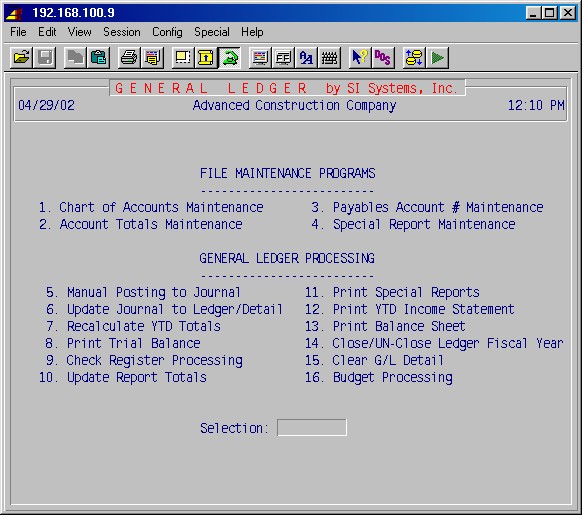

Ledger from the main menu will display the following menu:

6-1 Entering Chart of Accounts

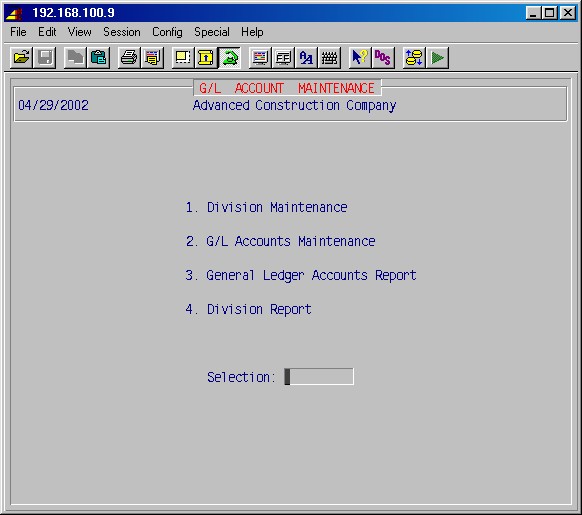

To enter the chart of accounts, select 6-1: Chart of

Accounts Maintenance from the general ledger menu. This selection will display

the following menu:

If your company operates with divisions, you must first set up the division

numbers.

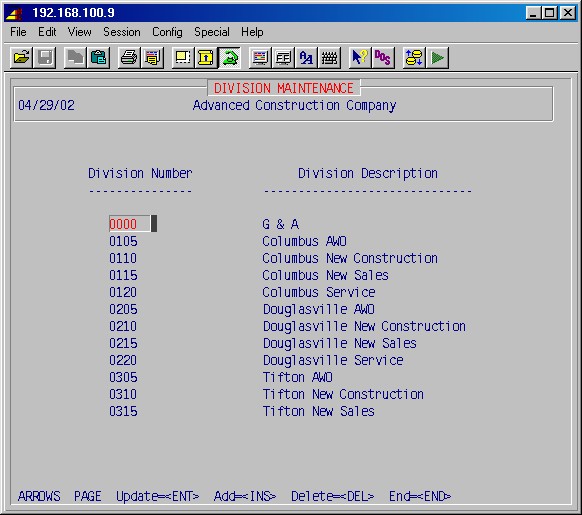

Selecting 6-1-1 Division Maintenance

will display the following input screen (items in bold type are examples):

Divisions may be though of as profit centers. One way to decide how many divisions

you need and what they should be is to specify a division for each partial Income

Statement required. A consolidated Income Statement may be printed for all divisions

(profit centers).

The first division should be for G & A (General and Administrative) expenses.

Type a three to six digit number for each division and the corresponding description

of that division. Press INS to add division numbers, or use Page

or Arrow keys to highlight a line and press ENTER to update a

line.

When you have entered your divisions, press END to return to the GL

Account Maintenance Menu.

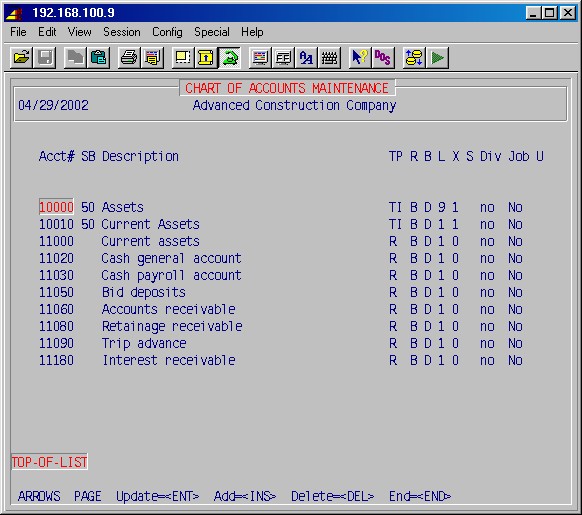

Selection 6-1-2 GL: Accounts Maintenance, will

allow you to input, or at a later time edit, the general ledger accounts. This

selection will display the following input screen:

You should have received a list of accounts from your accountant, and should

use this list to input the account numbers. The numbering system most easily

used by the computer is:

10000 - 19999 = Assets

20000 - 29999 = Liabilities and Capital

30000 - 39999 = Income

40000 & up = Expenses

Using this numbering system will allow the system to fill in most of the other

items with the typically correct answers.

Type a five digit account number for all accounts. For titles and totals,

enter a sub?account number of 50 - leave sub-account blank for everything else.

1 - The Division entry is either YES or NO. This will

be set automatically by the system.

2 - The Account Description is entered from the descriptions

on the list of accounts provided by your accountant. Do not indent any descriptions

since this will be handled automatically.

3 - Account Type - For the real accounts, as opposed

to titles and totals, enter R as the account type. For titles, such as

ASSETS, the account type is TI. For totals, such as TOTAL

CURRENT ASSETS, the account type is TO. If you use the

account numbering system as described in 13-1: Client Information,

items 4 and 5 will be set automatically by the system.

4 - The Report Type will be B for accounts used in the

balance sheet, and I for accounts used on the income statement.

5 - The Normal Balance will be D (debit) for asset and

expense accounts, and C (credit) for liabilities, capital and income

accounts. Using these codes will cause a debit balance in an account that normally

carries a credit balance to print with brackets.

6 - The Total Level determines where totals and sub?totals break.

Always 1 except on titles and totals.

7 - The Extra Lines entry determines when blank lines will be

placed after an account on the balance sheet and income statement. Often this

will only apply to titles and totals, and is used to make the reports more readable.

Always zero except on some titles and totals.

8 - The Special Code is an optional entry, but is required on

three accounts. The first is the grand total net profit or loss account

(P). This account is computed for the income statement and is then carried

to the balance sheet, where it is placed in the retained earnings for current

year account. The retained earnings for current year account (R)

is the second account needing a special code. The total income (I)

is the final account needing a special code.

9 - The Underline entry determines if (S)ingle or (D)ouble

underlines are placed under the accounts marked with an S or D.

The entry goes with the account above the total account.

10 - The Allocate By Job entry is either YES or NO.

If you answer YES, when you post items to this account, you will also

be asked to enter the job ID for the job to which the entry should also be posted.

Press ENTER while the account # field is blank to return to the GL menu.

Top

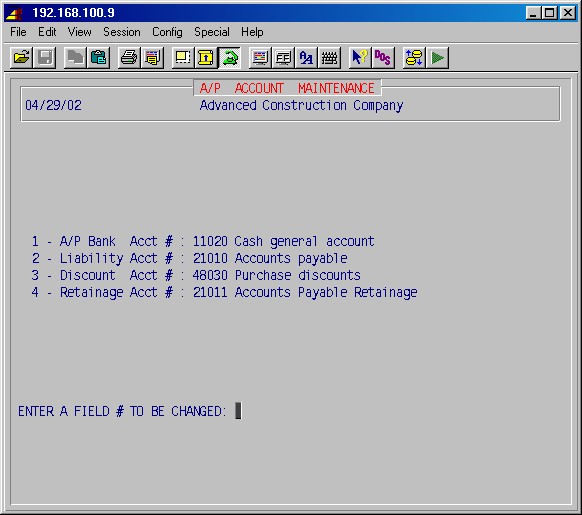

6-3 Payables Account Number Maintenance

The next area to be set-up is the payables account # maintenance. Selecting

6-3: Payables Account Number Maintenance, from the

General Lledger menu, will display the following screen:

Press ENTER while the field # field is blank to return to the GL Menu.

Top

Accounts Receivable Setup

1-4-1 Sales Type Information

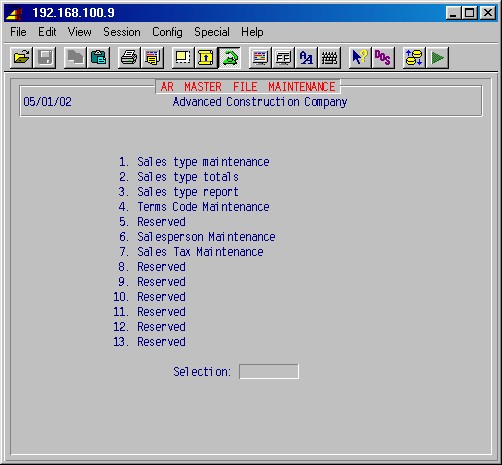

The next area to set up is the sales type information. This selection allows

you to set up the general ledger accounts for sales types (also called sales

departments or product types). The types are used to group various sales together

for reporting and accounting purposes.

From the main menu, select 1 Accounts Receivable. Then, from the Accounts

Receivable Menu, select 1-4: AR Master File Maintenance.

This will display the following menu:

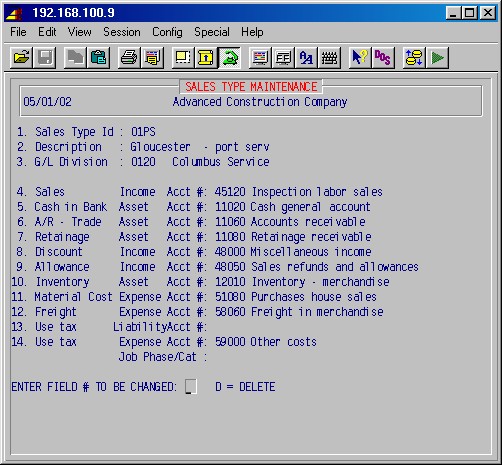

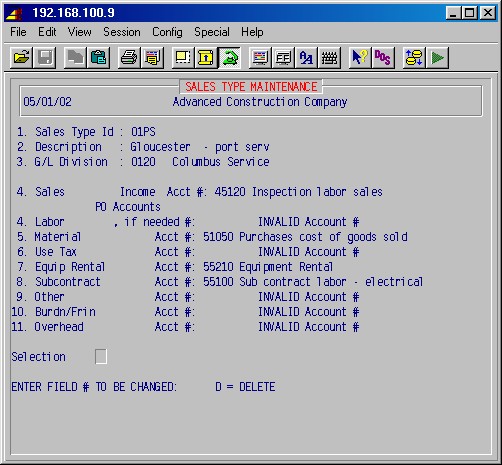

Selecting 1-4-1: Sales Type Maintenance from this

menu will display the following input screens:

The entries above are examples; use the appropriate accounts for your company.

At least two types should be set up:

requisitions

contract sales

Press ENTER while the type ID field is blank to return to the

sales type maintenance menu. Press ENTER at the sales type maintenance

menu to go back to the AR Menu.

Top

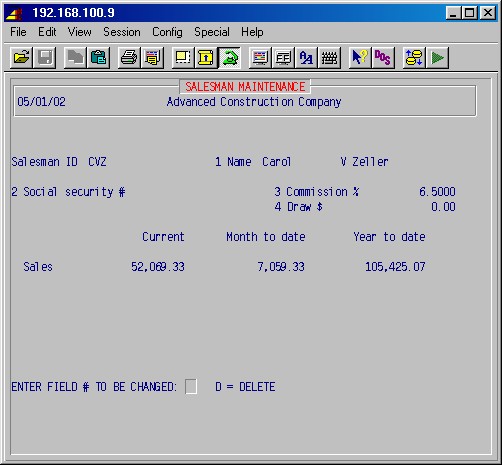

1-4-6 Salesperson Maintenance

The next area to be set up is the salesman information. From the Accounts

Receivable Master File Maintenance Menu, selecting 1-4-6

Salesperson Maintenance, will display the following input screen:

The Salesman ID may be up to 12 characters, but should be as short

and easy to remember as possible. One method is to use the three initials of

the salesman. Even if you do not normally credit sales to a salesman, at least

one ID, Misc for miscellaneous, must be entered. Type other information

as needed.

Press ENTER while the Field # field is blank to return to the

AR menu.

Top

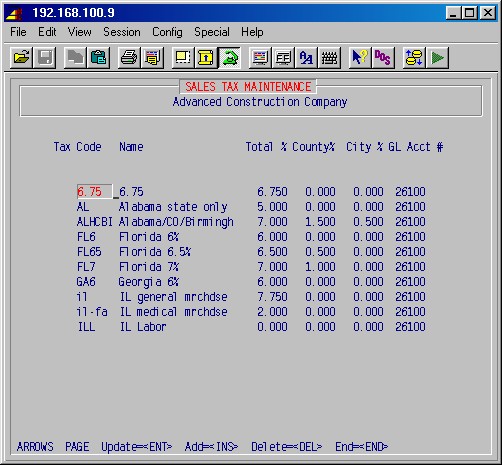

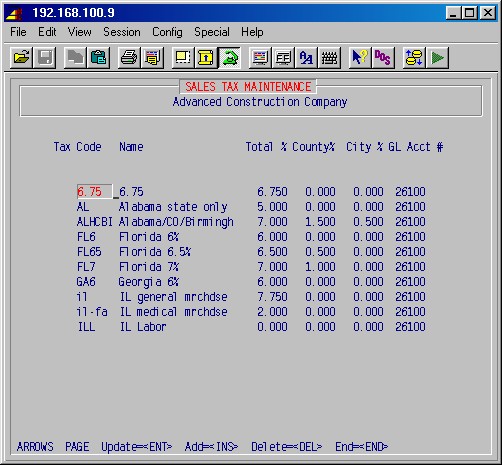

1-4-7 Sales Tax Maintenance

The next area to be set up is the sales tax information. Selecting 1-4-7:

Sales Tax Maintenance from the Accounts Receivable master file Maintenance

Menu will display this input screen:

The entries above are examples. You must input at least one two digit tax

code, XX for Exempt, with a percent of 0.00. The account

number is whatever general ledger account number you set up for sales tax liability

(sales taxes which you must pay).

Press INS to add codes, ENTER to change a code, and END

to go back to the AR master file maintenance menu.

Top

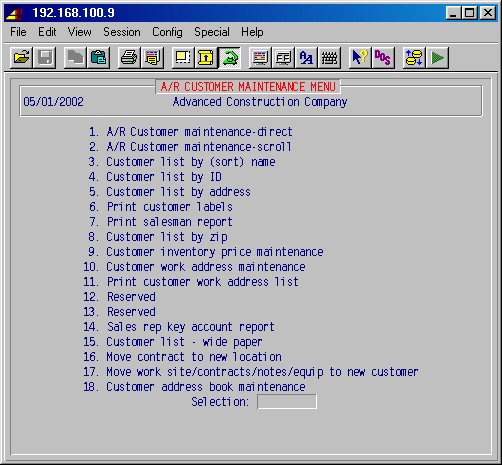

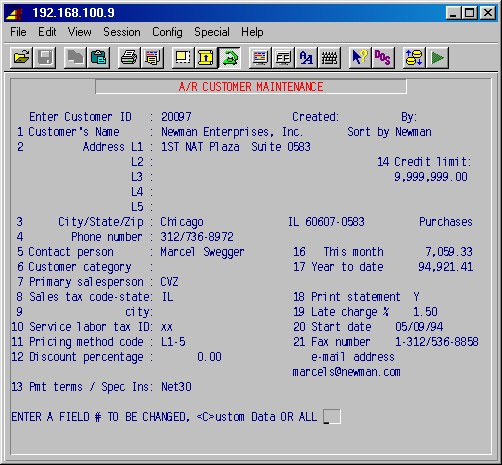

1-1 Customer Information

Next, you should enter the customer information, using selection 1-1:

Customer Information from the Accounts Receivable Menu. This will display

the following menu:

Selecting 1-1-1: AR Customer Maintenance from the

AR Customer Maintenance menu will display the following input screen:

1 - Customer ID is a 12 character code, letters or numbers. You may

use the same customer codes in the new system as you used in your old system

if you prefer. The new system can be set to automatically number each new customer

for you. Optionally, the operator adding the customer may assign a customer

Code/ID which might be a partial name.

The customer sort (or search) field is used to make looking up customers easier.

For instance, customer Dr. Frank Smith would have Dr. Frank Smith

in the name field so that invoices printed for him look nice. In the sort (search)

field, you should put something like Smith, Frank so that you may easily

look him up.

6 - Customer Category is an optional five character optional code used

to sort customers, such as RES for residential and COM for commercial.

7 - Primary Salesperson is a required code for the salesperson to use

for this customer during order entry. Use MISC if no salesperson is normally

used. This may be changed during order entry.

8-10 - Sales tax code - state is a required two to six character code

for sales tax computation during order entry. Use XX if the customer

is tax exempt. This may be changed during order entry. The city code is not

normally used. The labor tax code is required.

11 - Pricing Method Code is a required up to 10 character code used

to calculate prices during order entry. A code entered here may be changed during

order entry. For example, you may enter Cost or L1, L2,

L3, L4 for the various selling prices you have previously entered;

or C+5 for cost + 5%, or L1-10 for list price 1 - 10%.

12 - Discount Percentage is not used.

13 - Pmt terms/Spec Ins is a place for you to show special instructions

such as COD, or Net 10 or Net 30.

Top

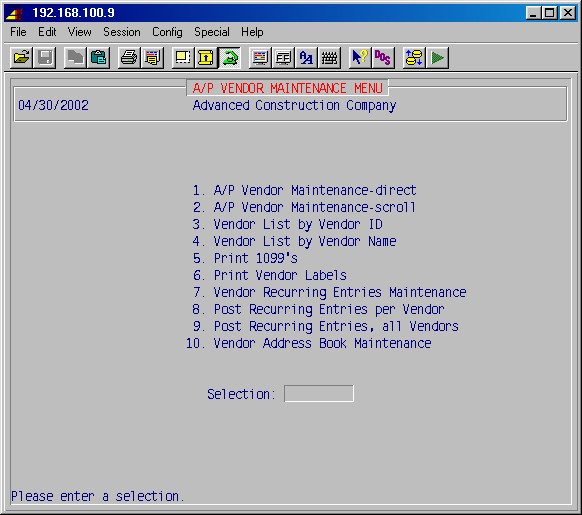

Accounts Payable Setup

Vendor Information

The next area to set up is vendor information. Vendor information is entered

by selecting 4-1: Vendor File Maintenance from the

accounts payable menu. This selection will display the following menu:

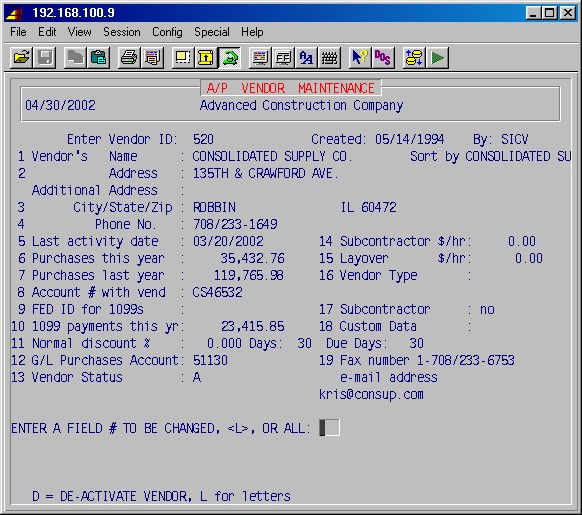

Selecting 4-1-1: AP Vendor Maintenance from the

AP vendor maintenance menu will display the following input screen:

Enter vendor ID:

You may type up to a twelve character vendor ID [H] or just press

ENTER to exit. If a vendor already exists with this ID, the information

for that vendor will be displayed. You may modify the information as desired.

If a vendor does not exist with this ID, then you will see a message:

No vendor exists. Do you want to create a new one? YES

Answer YES to this question and proceed to fill in the fields with

the information requested.

NOTE: Information in fields #5, #6, and #7, is updated

by the system and reflect current information for your use which is not

part of the accounting system. These fields are usually manually modified

only when setting up the system for the first time.

1-4 - Vendor name and address Type this information

as you want it to appear on reports, checks and purchase orders [H].

5 - Last activity date Date of last activity with this

vendor.

6 - Purchases this year Amount purchased this year to date.

7 - Purchases last year Amount of purchases last year with this vendor.

8 - Account # with vend Type the account ID this vendor uses for

your company.

9 - Fed ID for 1099s Type this vendor's federal ID for 1099s. This

may be filled in whether or not a 1099 is needed for this vendor.

10 - 1099 payments this year The amount of payments to this vendor

this year.

11 - Normal discount % Type the normal discount % allowed by this

vendor for your company. If this vendor normally has the dollar amount of

discount printed on the invoice, then leave this entry blank. Disc days is

the number of days after the invoice date during which discounts may be taken.

Due days is the number of days after the invoice date in which the invoice

must be paid regardless of discount.

12 - GL purchases account Type a GL ledger account number [H].

This is the general ledger account number to which purchases from this vendor

are normally debited. This may be left blank.

13 - Vendor status The status of a vendor may be A-active

or I-inactive.

Top

Jobs and Phases Setup

The next area to set up is jobs and phases. Information about jobs and phases

is entered into the job cost module. Note that two job are

already set up: OH and STOCK.

7-1 Job Description Setup

Active jobs, plus any jobs with open AP or AR invoices must be set up now.

At your leisure, all jobs which have been active this fiscal year may be set

up.

The first thing to set up in this area is information about each job which

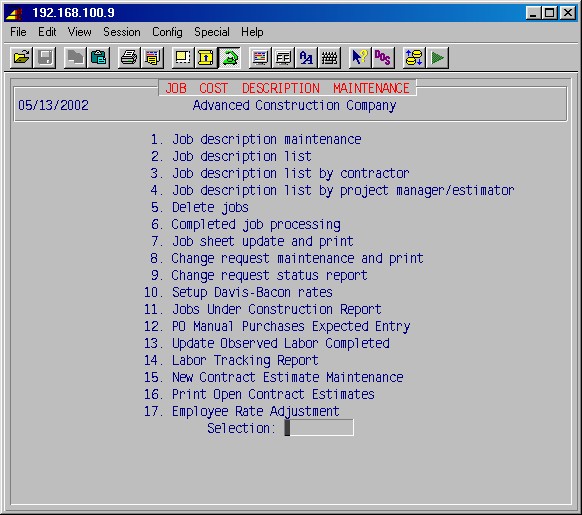

is currently active. Selecting 7-1: Job Description Maintenance

from the main menu will display the following menu:

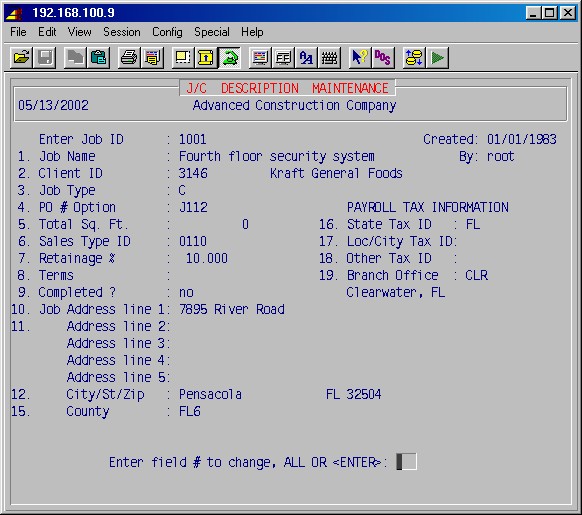

Selecting 7-1-1: Job Description Maintenance from

this menu will display the following input screen (items in bold type are examples):

Enter job ID:

Type a job ID of your choosing, up to 12 characters of letters and

numbers.

1. Job name:

Type a job name up to 30 characters. This is the name that will appear

in the heading of all job cost reports and invoices.

2. Client ID:

Type an existing customer ID [H] from the accounts receivable

customer list. This must be an existing customer or you cannot continue.

NOTE: If you have not yet set up this customer, you may use

the express key (press F2 twice), go to 1-1: Accounts

Receivable Maintenance, and set up the new customer. When you return

to this screen, type the new customer ID in this field and continue.

3. Job type:

This is a one or two character code. The first character must be

either a C for those jobs requiring certified payroll reports, or R for residential;

otherwise leave blank.

4. PO # option:

This field controls how the system automatically numbers the purchase

orders. Enter one of the following:

J001 = Consecutively numbers within jobs starting with 001.

J-P001 = Consecutively numbers within job phases starting with 001.

Blank = Requires you to manually put in the PO numbers.

5. Total Sq. Ft.

Optional. Type the square footage of the project if desired.

6. Sales Type ID:

Specify the accounts receivable sales department for this job. These

departments were entered as Sales Type ID in 1-4-1:

Sales Type Maintenance. This controls the GL entries that are affected by

invoicing.

7. Retainage %

Specify the retainage percentage (ie. 10% = 10.0) that is

normal for billings for this job.

8. Terms:

This is an informational field. You may use to specify your payment

terms if desired. (Example: Net 10 days).

9. Completed?

If the job is completed, type YES; this will cause the reports

to skip this job and prevent PR or AP postings to this job. Otherwise leave

blank. If completed, type the date for completion of this project. If this is

not available or unknown, press ENTER.

The next six fields are used to identify the job address and are used during

invoice printing and POs. The names of these fields are governed by the job

type in field #3, Job Type.

If this is a Certified type job, or if you left field #3 blank, the

following job address fields are displayed:

10. Job Address line 1:

11. Address line 2:

12. City:

13. St:

14. Zip:

15. County:

Complete these fields as you wish the job address to be identified

on invoices and POs.

If this is a Residential job, the following fields are displayed:

10. Model:

11. Lot:

12. Block:

13. Street:

14. Sub division:

15. County:

County:

If a valid tax ID is entered here and 7-1-1-1:

#4 Miscellaneous Information, field #3, Use tax exempt, is "no"

then this tax ID will be used to calculate use tax when requisitioning to the

job. Otherwise just enter the county.

16 - 18 PAYROLL TAX INFORMATION

These entries specify for payroll the state, locality/city and other

for income tax withholding for work on this job. The State tax ID is required.

When these fields are completed and corrected if necessary, press ENTER

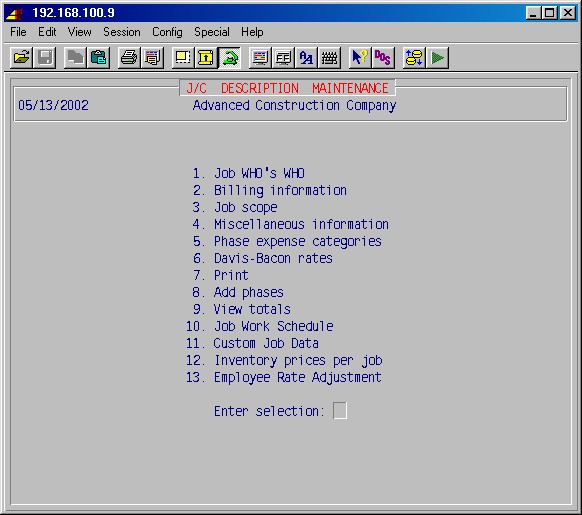

and the next input screen will be displayed as follows (items in bold type are

examples):

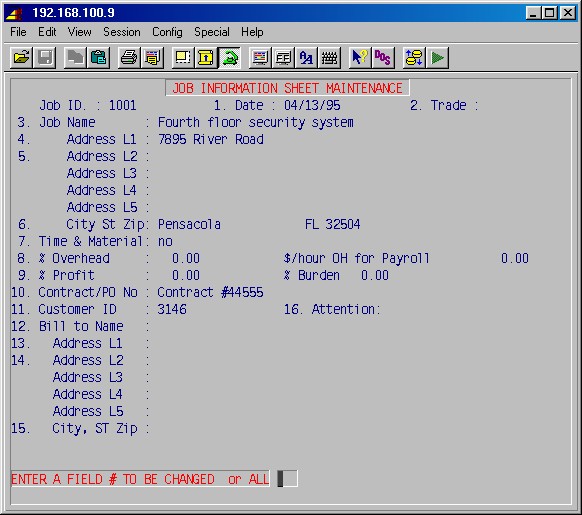

Selecting 2, Billing information, displays this input screen:

This screen will carry forward the job ID, job name and address, and customer

ID from the previous screen.

1. Date: (optional)

Type the date this job was booked.

2. Trade: (optional)

This field must be left blank, except for General Contractors.

3-6 Job:

Job name and address was transferred from the prior input screen.

Review and correct if necessary.

7. Time & material:

Type YES or NO to specify whether or not this job is

a time and material job.

8. % Overhead:

Type the normal overhead percentage used for this job. This percentage

can be used for preparing change orders.

$/hour OH for payroll:

Type a dollar per hour overhead to be used by payroll for this job.

Important: normally 0.

9. % Profit:

Type the normal profit percentage used for this job. This percentage

can be used for change orders.

% Burden

Type the normal burden percentage to be used by payroll for this

job.

10. Contract/PO No:

Type the contract or purchase order number specified by the customer.

11. Customer ID:

Transferred from the previous screen. Review and correct if necessary.

12-16 Bill to:

Type in the billing address for this job only if it is different

from the customer's address. If it is the same, leave blank.

When these fields are completed and corrected if necessary, press ENTER.

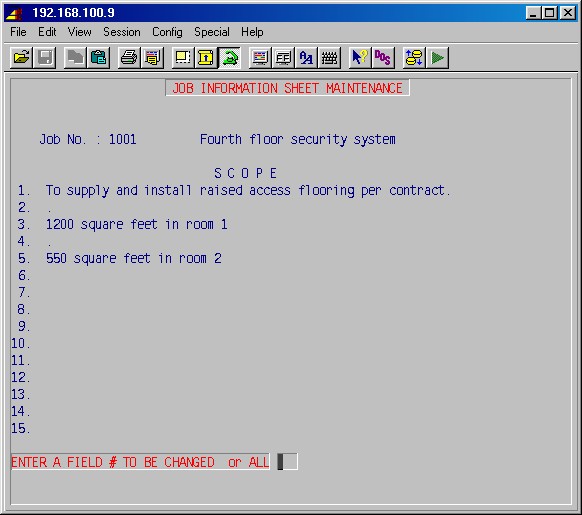

Selecting 3, Job Scope, will display the following screen:

This screen contains 15 lines available for description of the work to be done

on this job or

any other notations you may wish to make. When this screen is completed, press

ENTER.

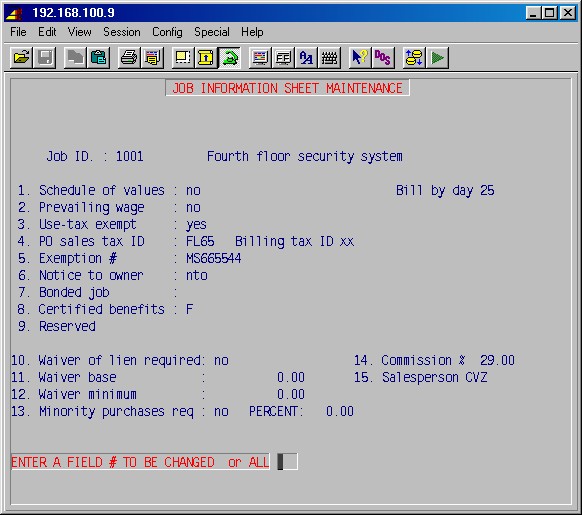

Selecting 4, Miscellaneous Information, will display this input screen as

follows (items in bold type are examples):

1. Schedule Of Values:

Type YES or NO to specify whether this job is to be

billed from a schedule of values (AIA billing).

2. Prevailing Wage:

Type YES or NO to specify whether this is a prevailing

wage job.

3. Use Tax Exempt:

Type YES or NO to specify whether this job is Use Tax

exempt. (If the is "NO" and a valid tax ID is entered in 7-1-1-1

#15, County, then that tax ID will be used to calculate use tax when requisitioning

to the job or entering AP invoices.)

4. PO Sales tax ID:

Enter the tax ID for sales tax to be paid on purchase orders (or

"xx" for none).

Billing tax ID:

Enter the ID of the tax authority for billings for this job or "xx"

if exempt.

5. Exemption number:

Type in the sales tax exemption number for this job if applicable.

6. Notice to owner:

Type three characters of your choice that will appear on the accounts

receivable aging report with any invoices for this job.

7. Bonded job:

Type three characters of your choice that will appear on the accounts

receivable aging report with any invoices for this job.

8. Certified Benefits:

This is a mandatory field if this is a certified job. Type a C

or F as follows:

C if you pay benefits in cash to bring their wages up to scale.

F if you pay benefits to a pension fund or other funds other than cash

to bring their wages up to scale.

9. Job Site Inventory:

Enter YES if this job has an on-site inventory or is set up

as an inventory.

10. Waiver of Lien Required:

Enter YES if a waiver of lien is required when issuing accounts

payable checks to subcontractors on this job.

11. Waiver Base:

Currently not used.

12. Waiver Minimum:

Enter the minimum amount for which a waiver of lien is required.

(Any purchase at or above this amount will generate a waiver of lien.)

Minority Purchases Rq:

Enter YES is minority purchases are required for this job.

PERCENT:

Enter the minority percentage of purchases required for this job.

When these fields have been completed, press ENTER.

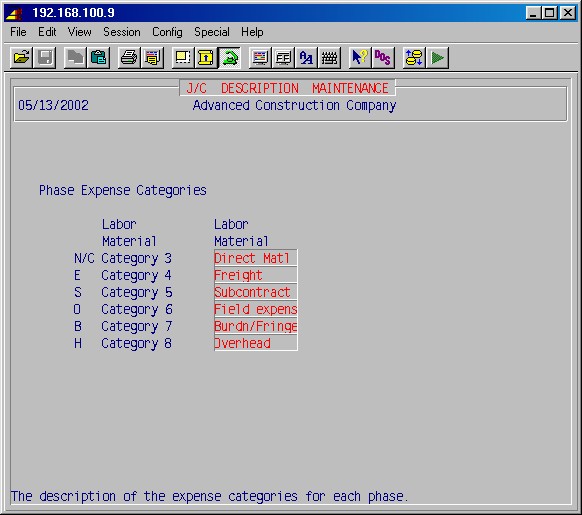

Selecting 5, Phase expense categories, will display the following :

Each phase of each job has eight possible categories of expense. Labor

and Material are fixed categories for every phase. The remaining six categories

may be altered as required from the master list.

NOTE: This master list is located in job ID OH,

which is a special job with information required by the system. The master

list of phase expense categories may be changed to your specifications

by selecting 7-1-1: Job Cost Description Maintenance,

entering OH as the job ID, and paging to the above screen to make

the changes.

The system will initially display a list with the standard categories as in

the example above. These may now be changed for this job if desired. If you

regularly use a different set of expense categories, it is best to change the

master list as described in the note above.

Selecting 7, Print, will print a two page report of this job with the information

you have entered in the above input screens. One page is a field copy and the

other page is an office copy with information and checklists appropriate to

each.

Phases may be entered by selecting 8, Add phases, as well as in step 7-2.

When done, hit ENTER twice to return to the JOB

COST DESCRIPTION MAINTENANCE menu.

Top

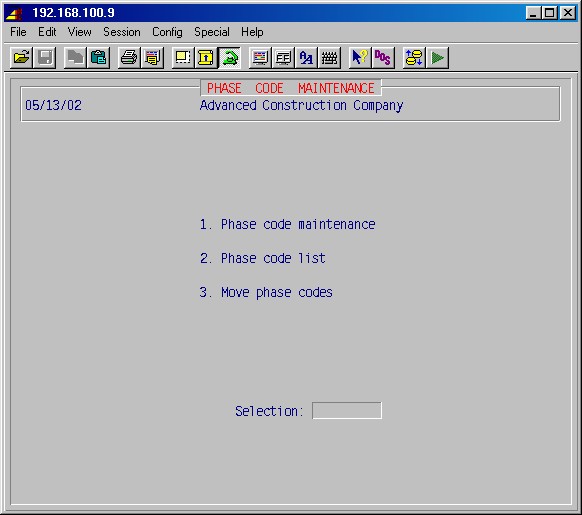

Phase Code Setup

This procedure allows adding phases to existing jobs, one at a time. Every

job must have at least one phase due to the fact that the system must post the

job costs to a phase.

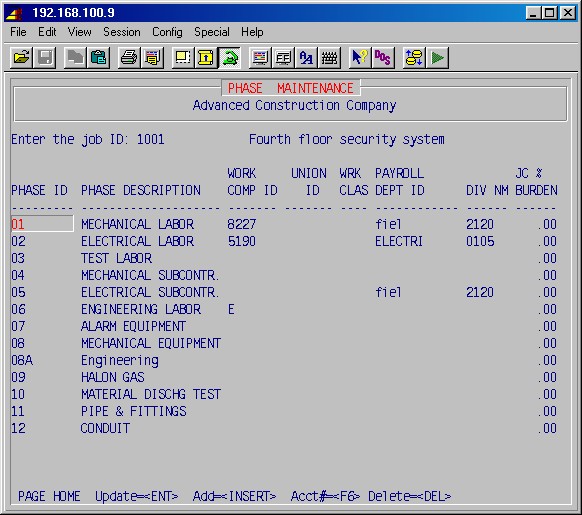

Select 7-2: Phase Code Maintenance from the job cost

main menu to display the following input screen:

Selecting 7-2-1: Phase Code Maintenance from this

menu will display the following input menu (items in bold type are examples):

Enter the job ID

This must be an existing job set up through the job description procedure.

When this is typed, the system will display the job name.

Use ARROW, PAGE, HOME, INS, DEL and ENTER

keys as described earlier (horizontal menu).

Phase ID

Type up to nine characters for the phase ID, letters or numbers.

The reports will alphabetize phases according to the phase IDs. If desired,

certain cost reports will subtotal phases based on the first two characters

of the phase ID.

Phase description

Type a short description for each phase.

When you have entered all phases for a job press END to exit this area.

You will be returned to the phase maintenance input screen to enter the phases

for another job.

Top

Payroll Setup

There are several payroll areas that must be set up before you can process

a payroll. The following setups must be completed in order:

General Setup

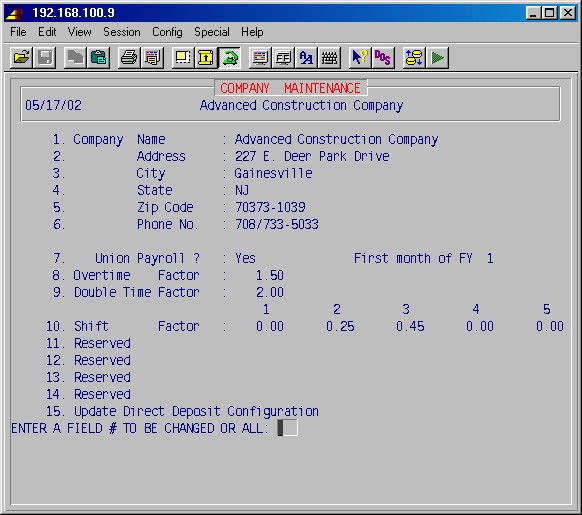

Step 13-1: Client Information has several fields

related to payroll that must be completed, including the company name and address

as it will appear on official reports and bank account information for direct

deposit. Selecting 13-1 will display the following input

screen (items in bold type are examples):

1-6. Company Name, Address, & Phone

Complete these fields with your company's name and address as you

wish them to appear on all reports and transmittals. This address will appear

on W2s, magnetic media, and all union, governmental, and other system reports.

7. Union payroll? First month of FY

Answer YES if this is a union payroll. This will cause union

areas to be accessible for input and payroll will be processed as a union payroll.

Specify the first month (1-12) of your fiscal year end (FY). This is a GL

setup, but must be completed because it controls the accounting.

8. Overtime factor

Specify (as a decimal) the hourly pay factor for overtime pay.

Example: Overtime pay is typically one and one-half times the normal hourly

pay and would be entered as 1.50.

9. Double time factor

Specify (as a decimal) the hourly pay factor for doubletime pay.

Example: Doubletime pay is typically two times the normal hourly pay and would

be entered as 2.00.

10. Shift factor 1 2 3 4 5

Specify, if applicable, the shift premium (extra pay per hour), you

pay for employees working different shifts. This is entered as a dollar amount

(Example: 25 cents per hour is entered as 0.25) and may be entered

for up to five shifts. The amount is added to the employee's basic rate at time

card entry.

11. Reserved

12. Reserved

13. Reserved

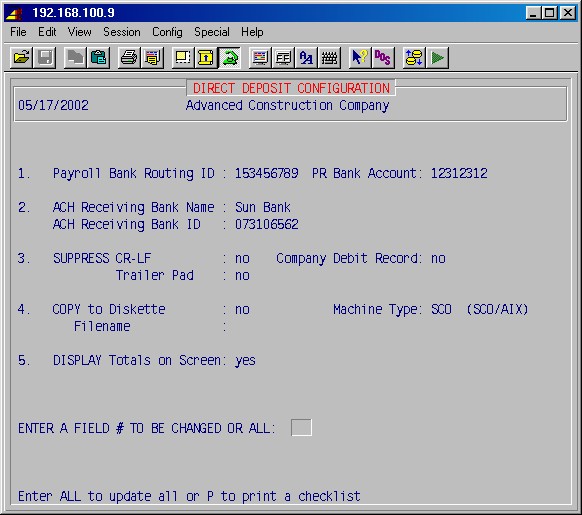

The next three fields are for direct deposit only and must be left blank if

you are not using the direct deposit feature of payroll.

NOTE: #14 and #15 should be left blank unless you are utilizing

the direct deposit feature

14. Company direct deposit account # Bank

ID:

Enter your bank account number (generally your payroll account number)

from which direct deposits from payroll will be deducted. The bank ID number

is the nine digit bank routing number which identifies your bank to the banking

system. This number is on your checks or you may call your bank for the proper

number.

15. ACH receiving bank ID

Enter the nine digit bank routing number for the ACH (automated clearing

house) bank ID. This is the bank where your bank will send the direct deposit

deducted from your payroll account for routing to your employee's bank. This

bank number must be obtained from your bank.

Miscellaneous Pay & Deductions

Step 5-3-1: Deduction Maintenance, explained

in the Payroll Manual, is used to create a list of all

possible employee deductions, miscellaneous pay, reimbursements and company

overhead categories.

Work Comp Classifications

Step 5-4-1: Work Comp Classification Maintenance,

explained in the Payroll Manual, is used to input the work

comp classification codes and rates for your employees.

Union Maintenance

Step 5-4-3-1: Union Maintenance, explained

in the Payroll Manual, is used to input the master files

for each union.

Union Work Class

Step 5-4-3-3: Union Work Class Maintenance,

explained in the Payroll Manual, is used to input union

work class information.

Union Contribution

Step 5-4-3-2: Contribution Maintenance,

explained in the Payroll Manual, is used to input the union

contributions for each union entered above.

Payroll Departments

Step 5-5-1: Department Maintenance, explained

in the Payroll Manual, is used to set up the various payroll

departments and the general ledger numbers associated with each department,

which control the accounting.

Tax Tables Setup

Step 5-7-1: Tax Table Maintenance, explained

in detail in the Payroll Manual, must be used next to maintain

tax tables for federal, state, and local taxes. Note that the FDM and FDS (Federal)

are the master tax tables from which the system pulls various information. In

addition to federal tax table information, the federal tax ID for all federal

reports including W2s, magnetic media, and direct deposit, as well as the FUTA

percent and limit are pulled from this table. It is essential that all information

on these tables be accurate.

Davis-Bacon skill setup

Step 5-7-6: Davis-Bacon Skill Maintenance,

explained in detail in the Payroll Manual, must be done.

Employee Information

Step 5-1-1: Employee Maintenance, explained

in the Payroll Manual, is where employees are set up and

most employee information is entered.

Employee Deductions

Step 5-3-2: Employee Deduction Maintenance,

explained in the Payroll Manual, may now be used to enter

each employee's deductions and miscellaneous payments.

Time Entry Setup

There are several options for time entry which must be set before

you process a payroll for the first time. These are set according to your preference

and company policy, and are normally set once at installation and not changed

again.

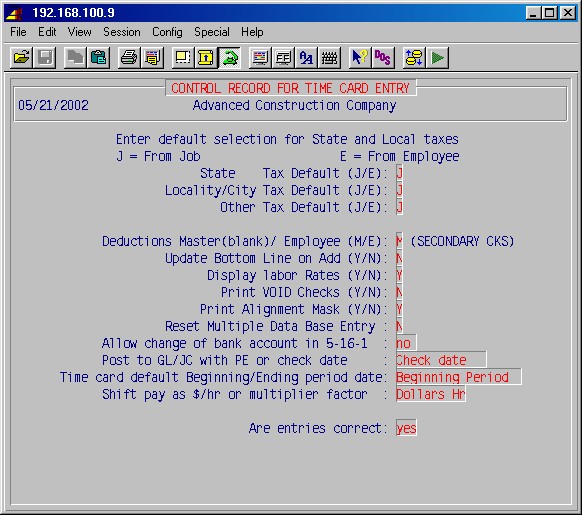

To access this setup screen, go to the main menu and choose #13 Utilities,

then #8 Control record maintenance, then #8 Time card entry/tax control.

Selecting 13-8-8: Time Card Entry/Tax

Control, will display the following input menu (items in bold type are examples):

State tax default (J/E):

Specify whether you want the location of the job, or the home state

of the employee to control the taxes. If your jobs are primarily in one state,

you will generally set this to Employee. If your jobs are in several states,

you will generally set this to Job.

Locality tax default (J/E):

This is similar to the state tax default option above. If your jobs

are in different localities that have local taxes, set this option to Job. If

not, set it to Employee.

Other tax default (J/E):

This is similar to the state tax default option above. If your jobs

are in different localities that have local taxes, set this option to Job. If

not, set it to Employee.

Deductions from master or employee (M/E):

This option relates to secondary or multiple checks created in step

5-8-6.

It is often necessary to omit or change all or some of the normal deductions,

as entered in 5-3-2: Employee Deduction Maintenance,

on a secondary check. This requirement necessitates the use of a deduction

screen if you are writing a secondary check.

This deduction screen may either be a complete listing of all possible deductions

with no amounts from the Master list in 5-3-1: Deduction

Maintenance, or the Employee deduction record for this employee with the

amounts per regular pay period, from 5-3-2: Employee

Deduction Maintenance.

Update bottom line on ADD (Y/N):

The time entry screens have a horizontal line of fields on the lower

third of the screen to input information for department, class and union information,

shift, and tax state. These fields are filled in with information from the master

files.

If you often need to change any of these fields in time entry, set this

option by typing Yes. This will allow you to access these fields in

the normal Add mode when you are doing time entry.

If you seldom change these fields, set this option to No. This will

cause the cursor to skip over these fields in the Add mode. They may be changed,

but only in the Update mode.

Display labor rates (Y/N):

This option allows you to omit the labor rates from time card entry

fields to maintain confidentiality of employee pay rates. If you set this to

No, you can have operators enter time without revealing pay rates to

them.

Print VOID checks (Y/N):

This option gives you the choice of printing void checks. This is

a matter of preference, sometimes for internal control purposes. If you set

this to Yes, you will have a paper check to account for each check number.

Print Alignment Check: (Y/N):

This specifies whether option to print alignment check is offered

during check printing.

Are entries correct: YES

If you need to make changes, type NO ENTER and make your corrections.

Otherwise press just ENTER.

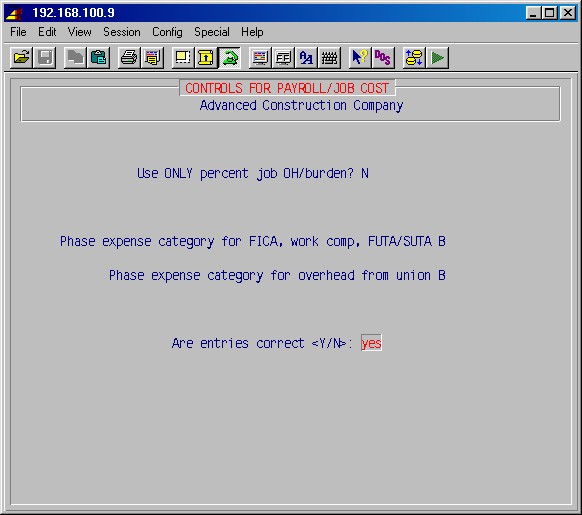

Selecting 13-8-5: Payroll to

Job Cost Burden/Fringe/Overhead, will display the following input menu:

Use only percent job OH/burden?

If you want to use a fixed percentage of payroll for job overhead/burden

cost, rather than actual cost (FICA, work comp, FUTA/SUTA, Medicare, Company

Overhead, etc.) type Y and press ENTER. The system will prompt:

Percent job OH/burden

Enter the overhead/burden percentage.

Phase expense category for OH/burden

Enter the percentage and phase expense category (one of L,

M, N, C, E, S, O or B, as viewed

in 7-1-1-#5).

Please note that the choice of these categories is a company

policy issue.

Otherwise just press ENTER, and the system will prompt:

Phase expense category for FICA, work comp, FUTA/SUTA

Phase expense category for overhead from union

Enter the phase expense category to be used for each.

Are entries correct <Y/N>: yes

If you need to make changes, type NO ENTER and make your corrections.

Otherwise just press ENTER, and the system will prompt:

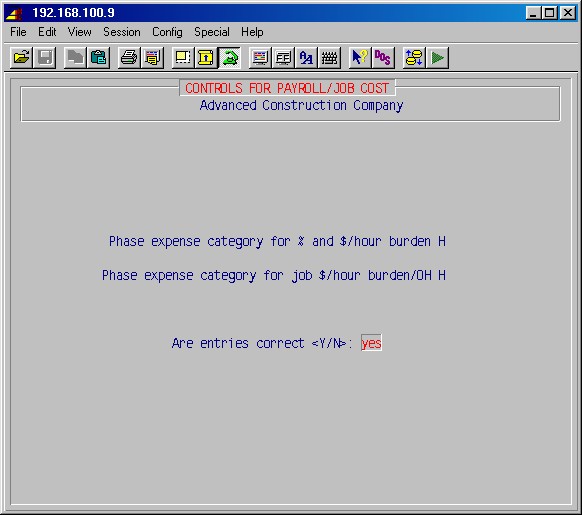

Phase expense category for % and $/hour burden

Phase expense category for job $/hour burden/OH

Enter the phase expense category to be used for each.

Are entries correct <Y/N>: yes

If you need to make changes, type NO ENTER and make your corrections.

Otherwise just press ENTER, and the system will prompt:

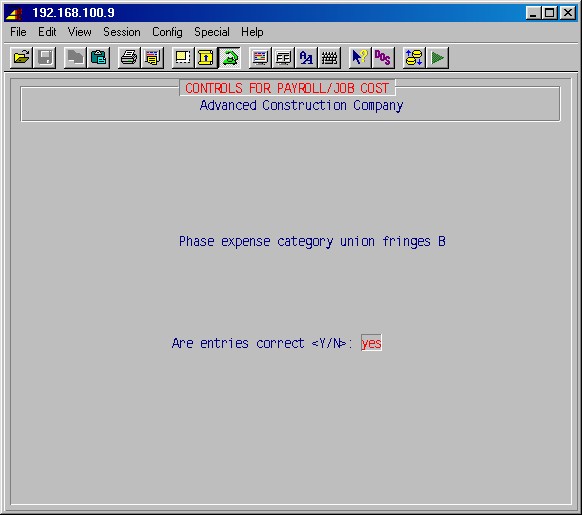

Phase expense category union fringes

Enter the phase expense category to be used for union fringes.

Are entries correct <Y/N>: yes

If you need to make changes, type NO ENTER and make your corrections.

Otherwise press just ENTER three times until you return to the main menu.

Top

Inventory Setup

Select 8-1: Inventory Maintenance

and ensure that the item with ID :M has been set up.

Select 8-10: Unit of Measure Maintenance:

This selection allows you to specify various units of measure and the count

that they represent.

When you are finished press END and the system will return you to the

Inventory control menu.

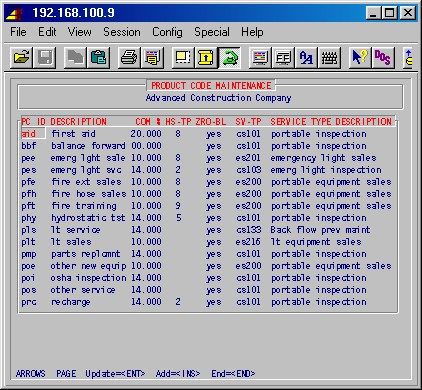

Select 8-18: Product Code Maintenance:

The product code allows you to identify items in inventory as belonging to

groups.

PC ID

Enter a product code ID of up to 5 characters.

DESCRIPTION

Enter the description of this product code.

COM %

Enter a commission percentage, if applicable.

HS?TP

If you have the Preventive Maintenance Contract Module, enter the

history type under which you want this product to show.

ZRO?BL

If you enter No you'll not be allowed to requisition or sell

more items than you have; if you enter Yes you'll be allowed to go below

zero on hand for items with this product code.

SV?TP

You may associate this product code with a service type by entering

a service type ID, as set up in 8-19: Service Type Maintenance.

SERVICE TYPE DESCRIPTION

This description will automatically display, once a service type

has been entered.

Set up at least one product code na.

When done, press END.

Top

Service Order Setup

There are several service order areas that must be set up before you can use

the service order module. The following setups should be completed in order:

General Setup

The following areas should already have been set up with printers, sales types,

employees and payroll departments to be used in the following setups as noted:

13-3 Printer Designation & Codes, used in

13-8-6 below.

1-4-1 Sales Type Maintenance, used in 2-15-3

and 2-15-8 below.

5-1-1 Employee Maintenance, used in 2-15-7

below.

5-5-1 Department Maintenance, used in 13-8-6

below.

The job service should already have been set up in 7-1-1:

Job Description Maintenance.

The item with ID :M should already have been set up in 8-1:

Inventory Maintenance.

Top

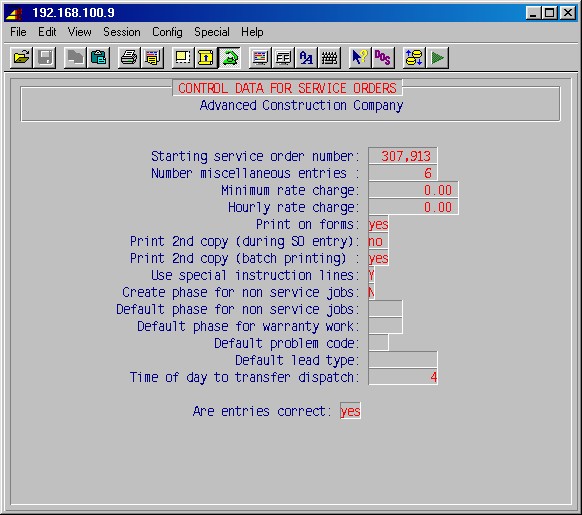

13-8-6: Service Orders

Selecting 13-8-6: Service Orders from the main

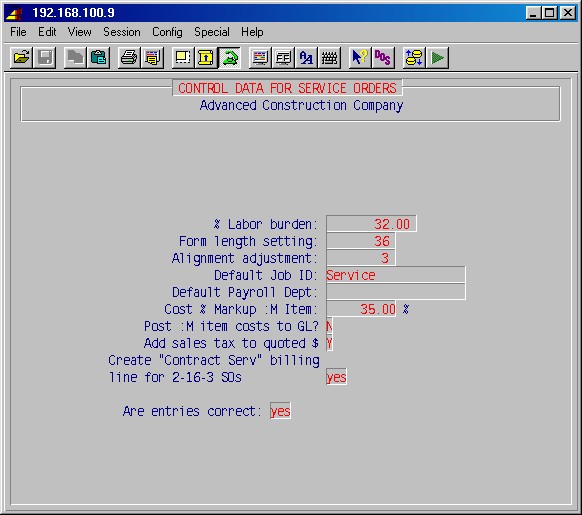

menu presents this input screen (items in bold type are examples):

Starting service order number:

This is used in the automatic numbering of service orders during

entry. Enter the first number to be used, e.g. 300,000 will number the first

service order entered as SO300000, thus establishing 6 digit service order numbers.

Number miscellaneous entries:

This determines the number of available miscellaneous charges you

can set up to choose from during service order billing (see the second screen

following this). Enter a number from 0 to 8.

Minimum rate charge:

Not used.

Hourly rate charge:

Not used.

Print on forms:

Enter YES if you want service orders to be printed in a format

that fits our standard form, or enter No to have them print on plain

paper.

Print 2nd copy (during SO entry):

If you are printing service orders on plain paper, you may want 2

copies printed. If so enter YES here to have 2 copies printed when you

ask to have a service order printed immediately following entry.

Print 2nd copy (batch printing):

Same as above, but when printing service orders after entering a

batch of them (2-7).

Use special instruction lines:

While entering a service order you may have four lines available

to enter special instructions in addition to the standard six lines for "work

description". Enter Yes here if you want these printed on service

orders.

Create phase for non service jobs:

The default job for service orders is normally "Service"

and when entering a service order a phase is created for the job "Service"

with the phase ID of the service order number, e.g. "300001". If you

also want phases created for jobs where the job ID is not "Service",

enter Yes here.

Default phase for non service jobs:

If you have entered Yes above, you may enter the default phase ID

here. If this is left blank, then the SO number will be the phase ID.

Default phase for warranty work:

Enter the phase ID for service orders done under warranty.

Default problem code:

Enter the problem code you want to automatically fill in when entering

new service orders in 2-1. (Problem codes will be set

up in 2-15-1: Problem Code Maintenance.)

Default lead type:

Enter the lead type code you want to automatically fill in when entering

new service orders in 2-1. (Lead codes will be set

up in 2-15-2: Lead Code Maintenance.)

Are entries correct:

If the above entries are correct, press ENTER to go to the

next screen. Otherwise enter No to go back and correct one or more of

the above.

% Labor burden:

Enter the labor burden in percent to be used in service order profit

analysis reports. (Actual burden is calculated and posted to jobs during payroll

processing, as determined by setups in 13-8-5: Payroll

toJob Cost Burden/Fringe/Overhead, and as set up for individual jobs in

7-1-1, second screen #2, Billing information, fields

#8, $/hour OH for payroll, and field #9, % Burden.)

Form length setting:

This is normally 30 for our standard form, but can be changed

to match forms with fewer or more than 66 lines per form.

Alignment adjustment:

Normally 8. Determines where the first line is printed on

the form.

Default Job ID:

Normally "Service". However, see

2-15-3.

Default Payroll Dept:

Enter the payroll department to be automatically filled in (in the

phase created for the service order, if any) when entering a new service order

in 2-1.

Cost % Markup :M Item:

The item with ID ":M" is a special item set up in

8-1 (Inventory) and is used for material charges for items that are not

in any inventory, i.e. miscellaneous material items. Enter the percentage

you want the customer to be charged over your entered cost.

Post:M item costs to GL?

If you want the costs of ":M" items (see above)

posted to the General Ledger, enter Yes here.

Are entries correct:

If the above entries are correct, press ENTER to go to the

next screen. Otherwise enter No to go back and correct one or more of

the above.

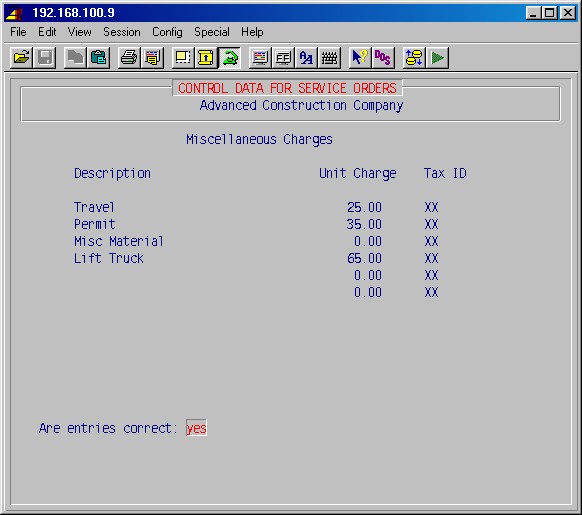

Here you set up the miscellaneous charges you can choose from when billing

a service order.

Description

Enter the description of the charge.

Unit Charge

Enter the amount of this charge.

Tax ID

Enter the tax ID for this charge, use XX for exempt.

Are entries correct:

If the above entries are correct, press ENTER to go to the

next screen. Otherwise enter No to go back and correct one or more of

the above.

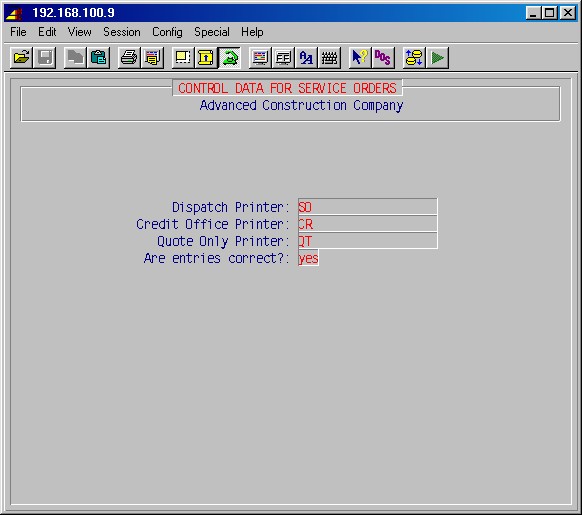

Here you may enter the printer numbers of printers as set up in 13-3:

Printer Designation & Codes. If any of these are left blank, you'll

be asked for the printer number each time you print.

Dispatch Printer:

Enter the number of the printer on which to print newly entered service

orders.

Credit Office Printer:

Enter the number of the printer where credit notices are to be printed.

Quote Only Printer:

If particular printer is used to print service order quotes, enter

its number here.

Are entries correct?:

If the above entries are correct, press ENTER to go to the

next screen. Otherwise enter No to go back and correct one or more of

the above.

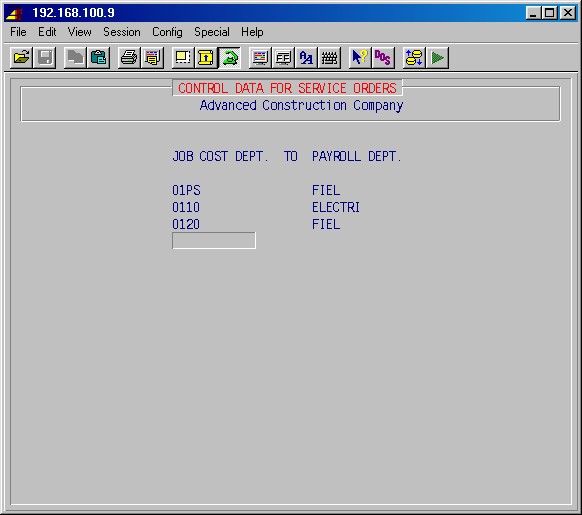

Here you may set up relations between sales types (departments) as set up

in 1-4-1: Sales Type Maintenance, and payroll departments

as set up in 5-5-1: Department Maintenance. Up to

seven such relations may be defined. This is used when transferring labor from

service orders into payroll (5-8-9).

JOB COST DEPT.

Enter a sales type ID as set up in 1-4-1.

TO PAYROLL DEPT.

Enter the payroll department, as set up in 5-5-1,

which is to receive the cost of the above sales type.

Press ENTER till you get back to the main menu, then select 2-12:

Labor Rate Maintenance.

Top

2-12 Labor Rate Maintenance

This procedure allows you to set up and maintain labor class tables with specified

labor rates for billing service orders. These are user-defined tables which

facilitate billing different labor rates for different classes of employees

and different customers. These tables are assigned "Labor class IDs"

which may be entered for each customer (7-1-2: Miscellaneous

Customer Data) or for each work address for a customer (1-1-10

or 2-14: Work Address Maintenance) in the field Labor

code. During service order entry (2-1), the system

will use the code set up for the selected work address or customer. The default

of S is set up for each work address and customer. Thus the table S must be

set up.

Each table is assigned an ID such as S = standard, R = retail,

P = preferred, or any code of your choosing. Then, you build a table by

work class, assigning the hourly rate you wish to charge.

If there is no need to bill a different labor rate for journeyman versus foreman,

versus helper, then a simplified labor rate table may be constructed with labor

classes of Reg for regular work, OT for overtime work, and DT

for doubletime work. Otherwise, the work class for each employee, such as J,

A65, A45, must be entered in the table with its appropriate billing

rates.

In order for the work class to automatically fill in when billing time for

an employee on a service order, the work class codes should correspond to the

codes entered for employees (5-1-1 #20). If you have

different trades, you should set up different work classes for each trade, e.g.

JP Journeyman - Plumber, A45P Helper - Plumber, JE Journeyman

- Electrician, A45E Helper - Electrician, etc.

This selection will display the following input screen:

Enter labor class ID:

If you are creating a new table, type an ID (up to four characters)

of your choice and press ENTER. When prompted NO ENTRIES ADD: Yes,

just press ENTER.

If you are updating an existing table, type the labor class ID [H]

and press ENTER. If this is a valid ID, the system will display the

work classes previously entered. Use the ARROW, PAGE, ENTER

and INSERT keys as needed to select, update and add entries, as needed.

WORK CLASS

Type the work classification code [H] and press ENTER.

DESCRIPTION

Type the description for this work class and press ENTER.

Reg RATE

Enter the rate in dollars/hour a customer is charged for regular

time.

OT RATE

Enter the rate in dollars/hour a customer is charged for overtime.

DT RATE

Enter the rate in dollars/hour a customer is charged for double time.

OH %

Not currently used.

Profit %

Not currently used.

When done with entering work classes for this labor class, press END.

Enter another labor class to set up, or leave blank and press ENTER to

return to the service order menu.

Top

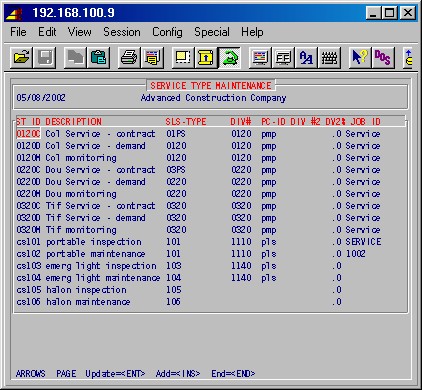

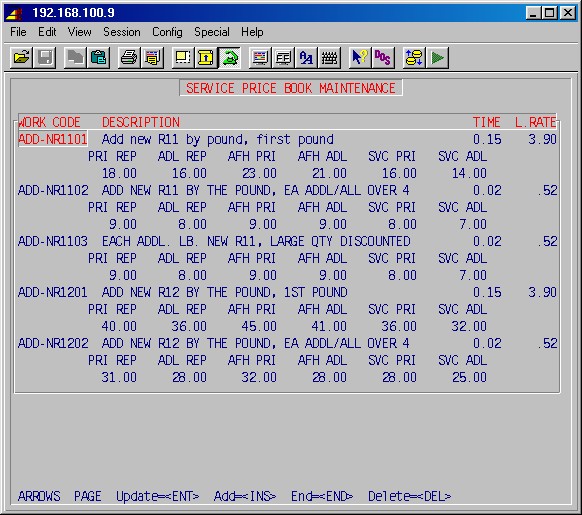

2-15-8 Service type maintenance

Select 2-15-8: Service Type Maintenance.

Service types parallel AR sales types (as set up in 1-4-1:

Sales Type Maintenance) and controls your accounting in service, but this