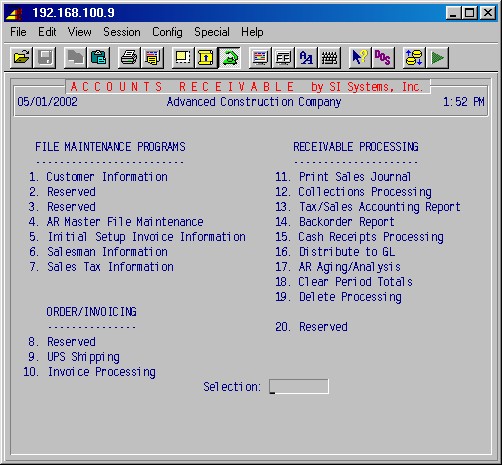

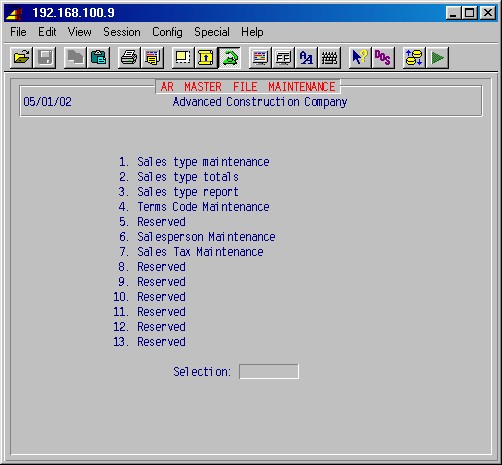

Selections 1, 4, 6, and 7 are the AR file maintenance procedures. This is where you set up customer information, sales type information, salesman information and sales tax information. These set up areas must be completed before you can begin to process accounts receivable. Step 1-5 Invoice Information is a loading area to enter AR invoices without updating general ledger, for use when you are first starting to use the computer, and is not used after the initial loading, except to review an invoice.

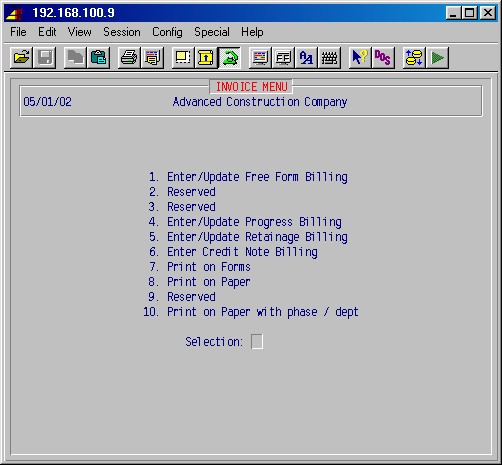

Selection 1-10 Invoice Processing displays a large menu of procedures for order entry, billing and invoice printing. Procedures are provided to handle one step order entry, counter sales, various types of free form invoicing, and manual invoice entry. Invoices may be printed on plain paper, letterhead, and forms and may be reprinted as required. Selection 1-9 is a UPS shipping area, for high volume UPS shipping situations, designed to facilitate the preparation of UPS shipping tags and manifests.

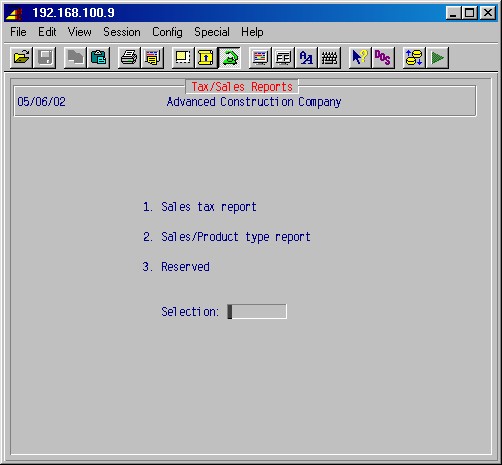

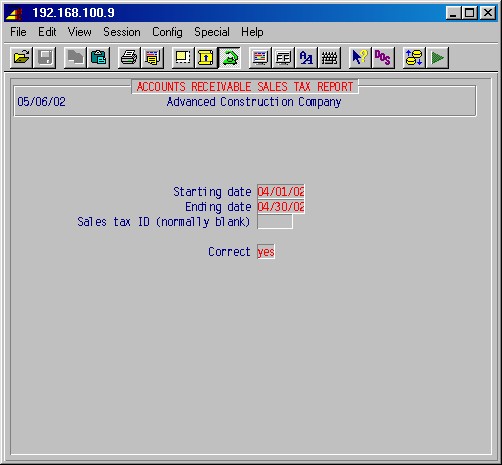

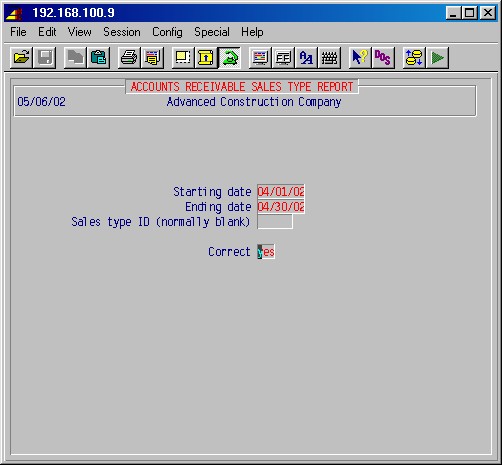

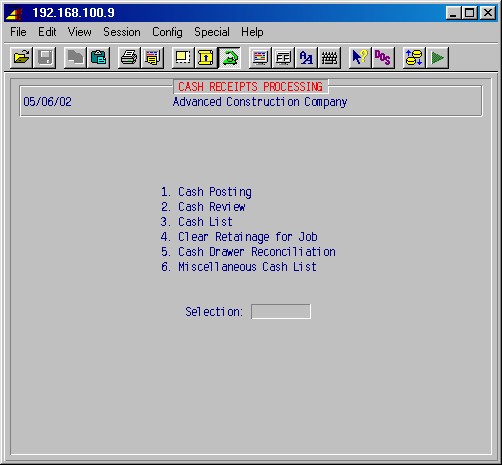

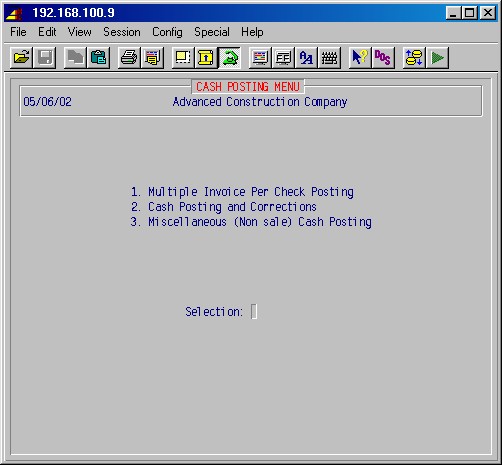

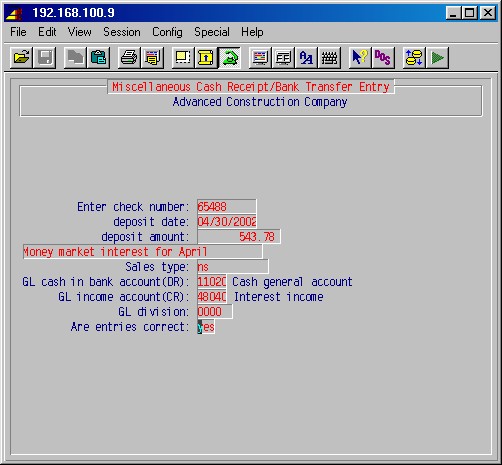

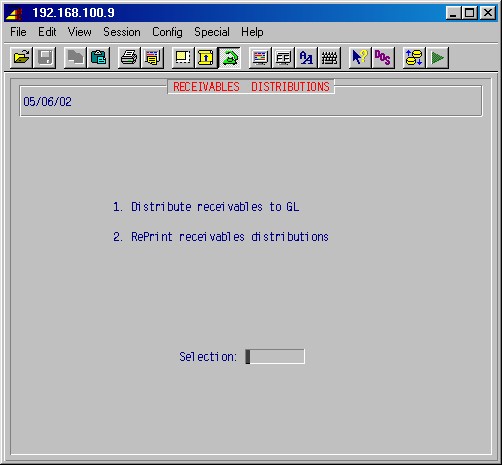

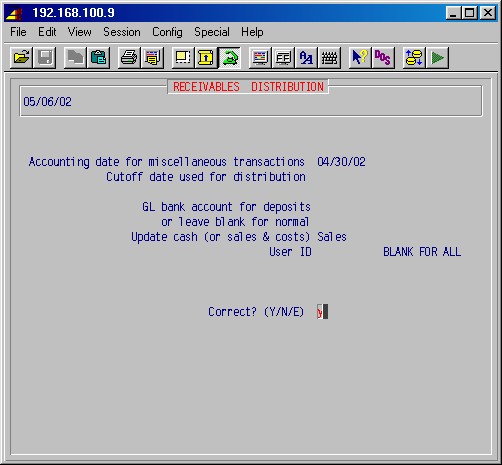

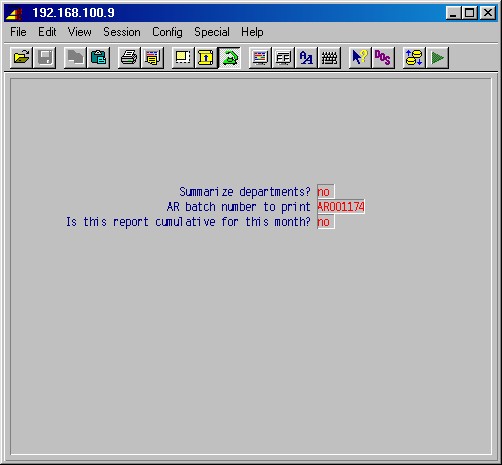

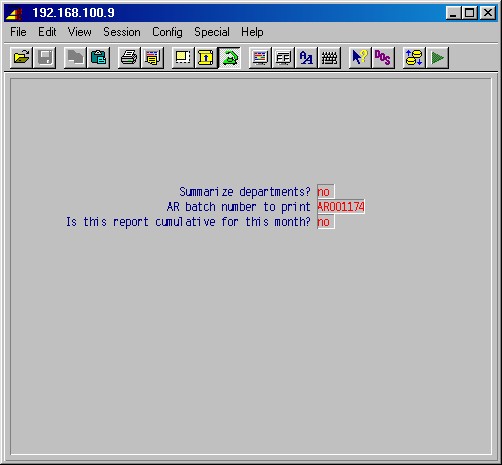

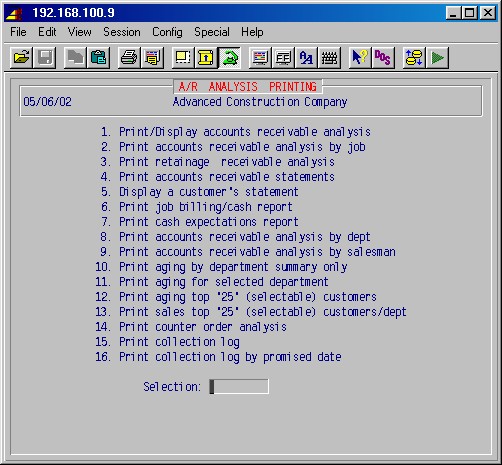

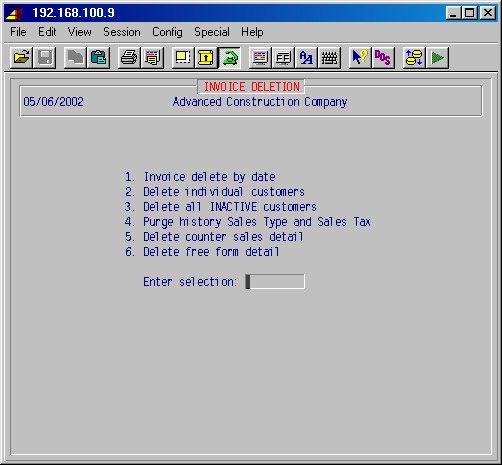

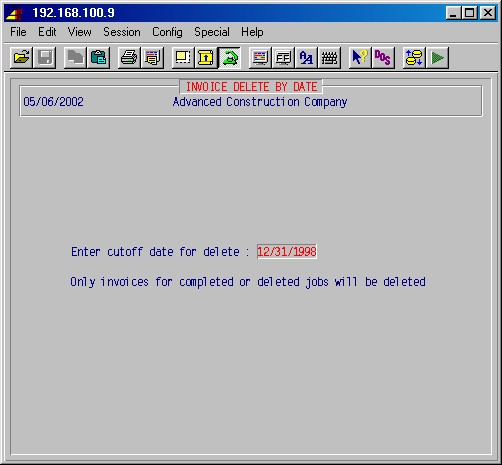

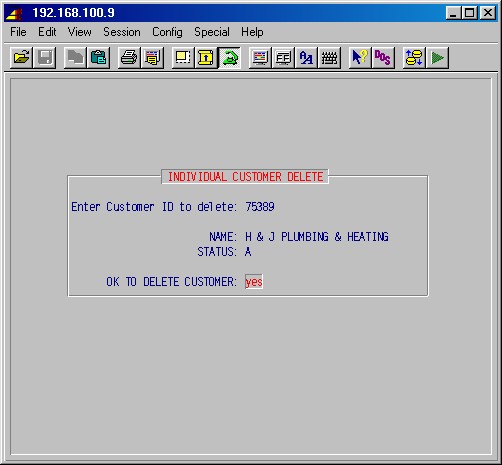

Selections 11 through 19 are the general ledger updating, collections processing, cash receipts posting, and report printing procedures. Procedures are provided to print sales reports, sales tax reports, sales/product type reports, salesman reports, backorder reports, and numerous AR aging and analysis reports. Step 1-19 provides a way to delete customers and invoices.

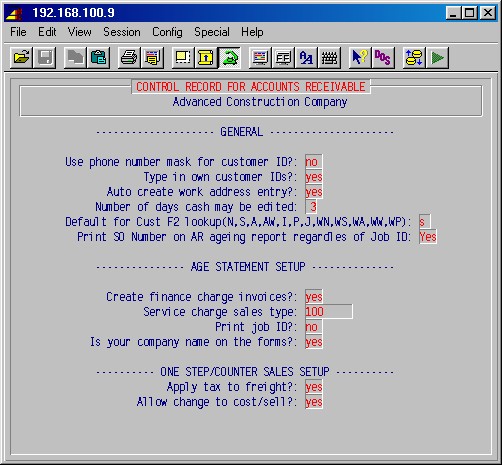

In addition to setting up Sales Types, Sales Taxes and Sales Persons in 1-4-1, AR Master File Maintenance, there are some important setup areas that must be addressed to allow various procedures to work as you want them in accounts receivable. These are management decisions and should be set prior to using AR and should not need to be set again. They are in #13 Utilities, under #8 Control record maintenance. Note that accounting period dates in 13-8-15, are usually changed each month or quarter.

Use phone number mask for customer ID?: NO

The default is NO which allows you to designate your customer ID's according to your rules. If you select YES, the customer's phone number will be the customer ID number and the system will require and prompt for a phone number for the customer.

Type in own Customer ID's: YES

The default is YES which allows you to designate your customer ID's according to your rules. If you select NO, the computer will assign customer ID numbers.

Auto create work address entry?

The system allows for multiple work addresses for a customer. Set to no if you are not using the service order module. If set to yes, the system will create a work address the first time a customer is created. Otherwise, the system will create a work address the first time a service ticket is entered.

Create finance charge invoices?: NO

The default is NO which will not create invoices for finance charges. Finance charges will be calculated and shown on the statement, but no invoice is created. If you answer YES, any monthly finance charges will cause the system to create an invoice for that month's finance charges due.

Service charge sales typeIf you specified YES above to create finance charge invoices, specify the sales type (as set up in 1-4-1: Sales type Maintenance) for those invoices here.

Print job ID? YES

The default YES will print the job ID on the statement. Selecting NO will not print the job ID on the statement. You should match the type of form you have.

Is your company name on the forms?

Answering NO will cause the computer to print your company name on AR statements. If your forms are pre-printed, select YES.

Apply tax to freight?: NO

Answer YES if you are in a state or area that taxes freight.

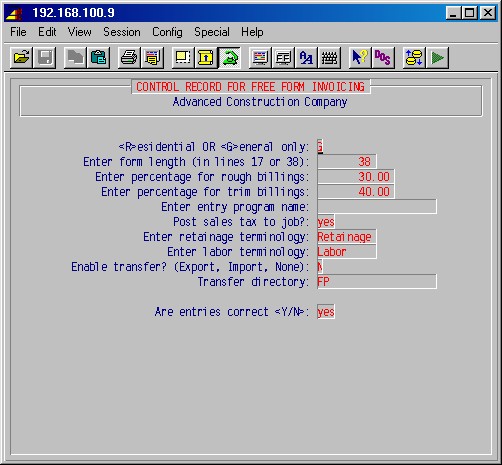

Top<R>esidential OR <G>eneral only:

Normally G.

This selects the billing type codes used in free form invoicing. Residential will give you billing codes specific for home construction billing.Enter form length (in lines 17 or 38):

Normally 38. 17 if you use the short invoice forms.

Enter percentage for rough billings:

Specify the percentage of the contract for this item as you want it billed.

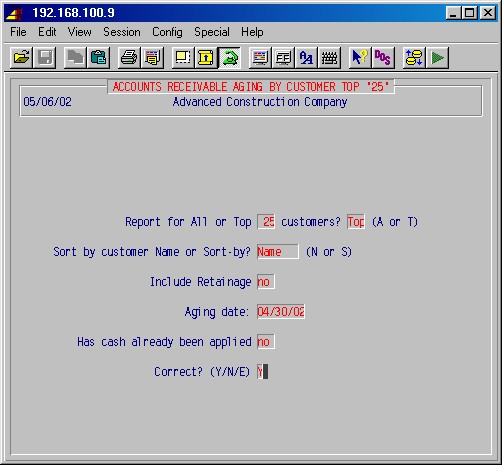

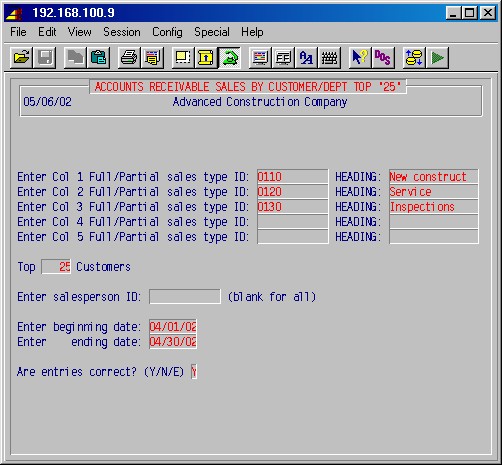

Enter percentage for trim billings:

Specify the percentage of the contract for this item as you want it billed.

Enter entry program name:

Normally leave blank.

Post sales tax to job?:

If you select No, the amount of the invoice posted to the job will not include the tax amount. If Yes, the tax amount will be included.

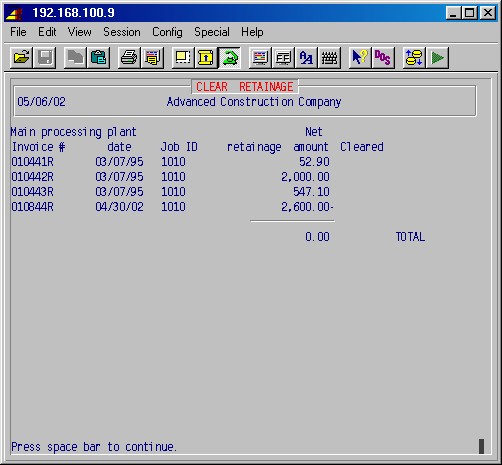

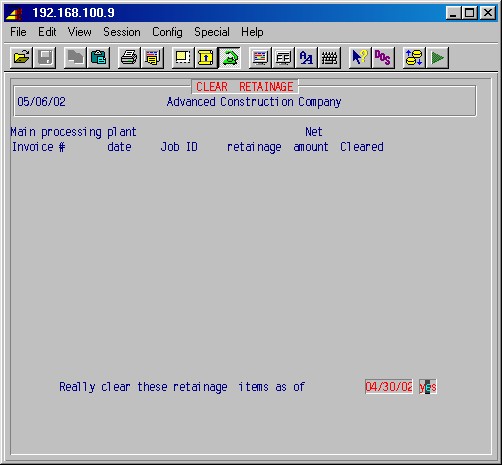

Enter retainage terminology:

The default for this field is the word Retainage which is the accepted term in the United States. In Canada, this term is Holdback. You may specify another term if you wish.

Enter labor terminology:

The default for this field is Labor which is the accepted spelling in the United States. In Canada, this word is spelled Labour. You may specify as required.

Enable transfer? (Export, Import, None):

Set this to N unless you have remote locations where invoices are being created using a copy of this system and then transferred (e.g. by magnetic media) to be incorporated into this systems main database:

I (Import) if this is the main database system.

E (Export) if this is the remote location where invoices are being created.Transfer directory:

If the above (Export/Import/None) is set to None leave this blank. Otherwise enter the directory that has been created on this system where the invoice file to be exported is to be written to, or where it's to be read from when importing invoices. (E.g. FP)

Are entries correct <Y/N>: YES

Answer NO to go back and make changes or press just ENTER to accept these settings and return to the previous menu.

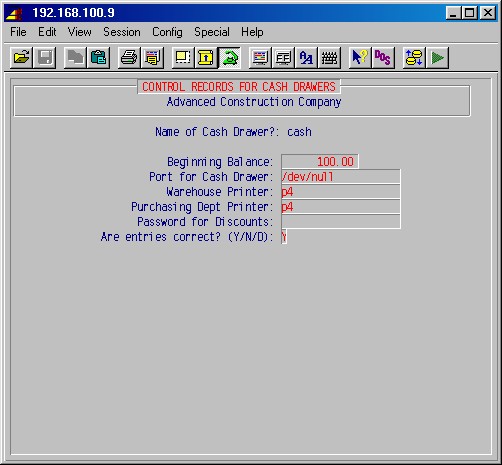

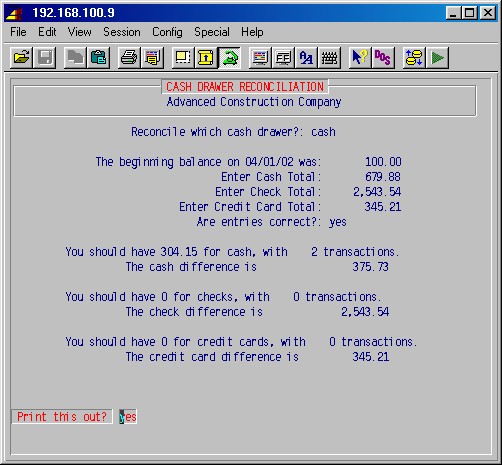

This allows the supervisor to set up a new cash drawer or update the original settings on cash drawers. This selection will first prompt:

Name of Cash Drawer?:

Type the drawer designation and press ENTER. If you are setting up a new drawer, the system will prompt:

Cash drawer does not exist. Create it? YES

Press just ENTER to create a new cash drawer. Whether you are creating a new drawer or updating an existing drawer, the following input screen will be displayed :

Beginning balance:

This is the amount of cash you put in the drawer the first time it is set up only. Normal daily balancing procedures will keep it up to date.

Port for cash drawer:

This is the operating system designation for the physical computer port where this cash drawer is connected.

Warehouse printer:

This is your database designation for the warehouse printer if you use the system to print picking lists in the warehouse from counter sales.

Purchasing dept printer:

This is your database designation for the printer in the purchasing department that prints the back ordered items from counter sales. Must be filled in.

Password for discounts:

The system will not let operators give discounts unless they enter a password. If you allow discounts, specify that password here; otherwise, leave blank.

Are entries correct? (Y/N/D): Y

Type NO to go back and make changes, or type "D" to delete this cash drawer. Press YES ENTER to accept these settings and return to the previous menu.

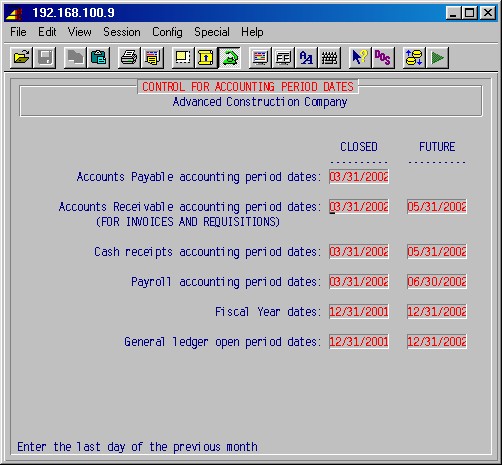

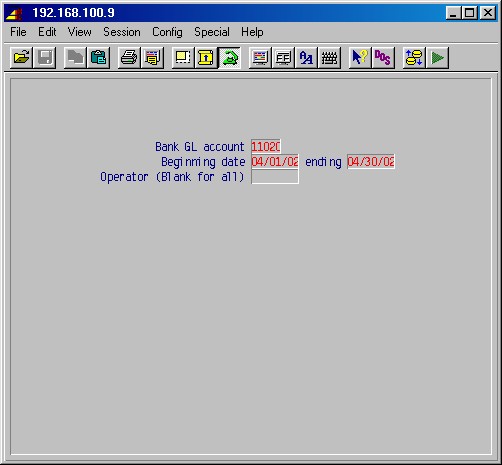

Enter appropriate dates to control the accounting dates (new transaction dates entered will have to be later than the "closed" dates and before or on the "future" dates). The purpose of these "date locks" is to prevent inadvertent entry of wrong dates, e.g. wrong year.

Accounts Receivable closed accounting period date

Operators will not be allowed to enter invoice dates with or earlier than, this date.

Accounts Receivable future date limit

Operators will not be allowed to enter invoice dates later than this date.

Cash receipts closed accounting period date

Operators will not be allowed to enter cash posting dates with or earlier than this date.

Cash receipts future date limit

Operators will not be allowed to enter cash postings dated later than this date.

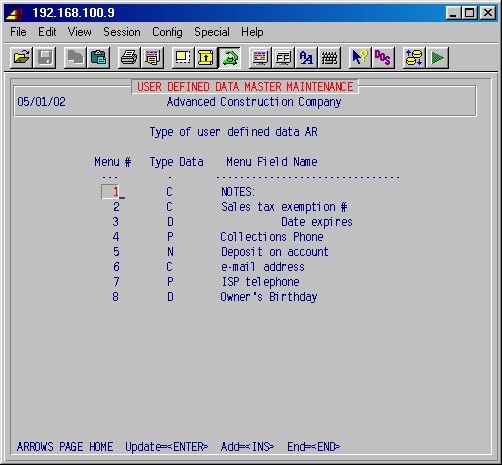

This setup area allows you to specify custom user-defined data entry fields for each module which are accessed from the field called "Custom data" in each module. You may enter up to 17 lines of user-defined data which may be in the format of characters, numbers, phone numbers or dates. For example, on the 1-1-1 Customer Maintenance screen, choosing field #23, Custom data, will take you to a new screen where you may access the custom fields which you define here.

Type of user defined data

Enter the abbreviation for the module you wish to define custom fields for:AR - Accounts Receivable, 1-1-1, Customer Maintenance, #23

AP - Accounts Payable, 4-1-1, Vendor Maintenance, #18

PR - Payroll, 5-1-1, Employee Maintenance, 3rd screen #7

JC - Job Cost Control, 7-1-1, Job Description Maintenance, 2nd screen #11

IN - Inventory, 8-1, Item Maintenance, #11 or 23Menu #Enter the number of the field; 1 - 17. This determines the sequence in which the fields are shown.Type Data

Enter one of:

Character (any letters, numbers or symbols can be types in such a field)

Phone (only allows format of ###/###-#### ####, where # is any number)

Date (only allows dates to be entered)

Number (only allows numbers to be entered)Menu Field Name

Enter the label of this field as you wish it to appear.

Press END when done.

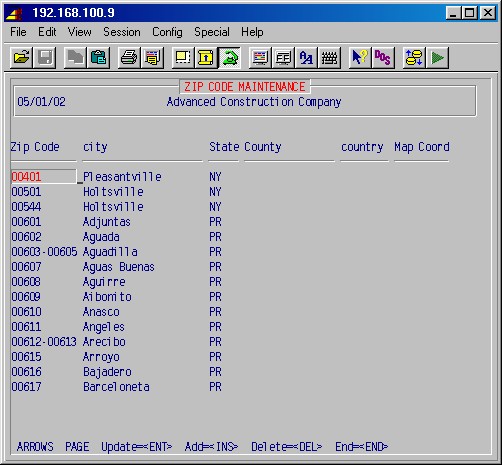

Zip Code

This is the standard 5 digit US postal zip code or zip code range.

City

This is the city for this zip code.

State

This is the state for this zip code.

County

The county is generally not used.

Country

The country is generally not used.

Map Coord

Map coordinates for this zip code is generally not used.

Press END when done.

Optional. Is used in 1-9: UPS Shipping. This selection allows you to set up a table to translate the first 3 digits of a zip code to the corresponding UPS zone.

TopOptional. Is used in 1-9: UPS Shipping. This selection allows you to set up a table of UPS charges for each UPS zone, for each type of UPS shipping (Ground, Second Day, etc.) for various weights.

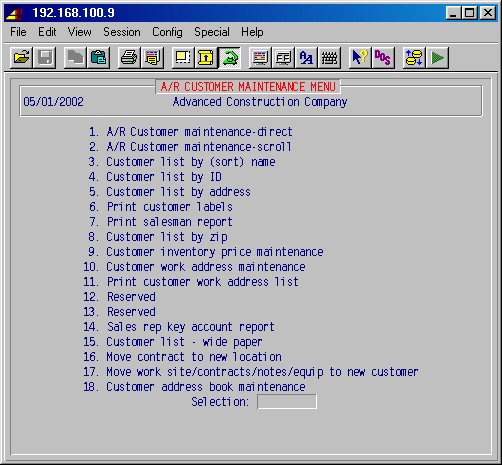

This procedure is used to update and add customer information to the system. Customer information must be entered first before you may enter invoices. This selection will display the following input screen :

Enter Customer ID

This is a unique identifier which may be up to 12 characters, numeric or letter. You may use the same customer codes in the new system as you used in your old system if you prefer.

The new system can be set to automatically number each new customer for you. Optionally, the operator adding the customer may assign a customer Code/ID which might be a partial name. One good system is to use the first three letters from the first name and the first three letters from the last name of the customer. For example, the identifier for Cox Lumber Co. would be coxlum. You may use all capitals or all lower case letters.

If the identifier (customer ID) has already been used, the information on the customer will appear in the remaining fields on the screen. If this is a new customer ID, the system will prompt:

NO CUSTOMER EXISTS. DO YOU WANT TO CREATE A NEW ONE ? yes

Type NO ENTER to exit this procedure. If you want to continue and enter the customer information for this new customer ID, press just ENTER.

Sort by

The customer sort (or search) field is used to make looking up customers easier. For instance, customer Dr. Frank Smith would have Dr. Frank Smith in the name field so that invoices printed for him look nice. In the sort (search) field, you should put something like Smith, Frank so that you may easily look him up.

1. Customer's name

2. Address

3. City/State/Zip

Type your customer's complete name (up to 30 characters) and address (up to 2 lines of 30 characters each, plus a fourth line for city, state, and zip) as you wish it to appear on invoices. Note that after you first enter the zip code, the city and state will automatically be filled in for you (as defined in 13-5: City/Zip Maintenance).

4. Phone number

Type your customer's complete area code and phone number. There is also room for up to a five digit extension number.

5. Contact person

Optional. Specify the name of your contact person (up to 20 characters) here if you wish.

6. Customer category

Optional. This is an optional code (up to 5 characters) which may be used to sort customers, such as RES for residential and COM for commercial.

7. Primary salesperson:

This required code is used to automatically enter the normal salesman for this customer during order entry. The code MISC may be used if no salesman is assigned to a customer. This ID must first be set up in selection 1-4-6: Salesperson Maintenance, prior to use here.

8. Sales tax code-state:

This is a required state sales tax code, used to compute sales tax during order entry. XX is used for tax exempt customers. These codes must first be entered into selection 1-4-7: Sales Tax Maintenance, prior to use here.

9. Sales tax code-city:

Optional. This is an optional city sales tax code, used to compute sales tax during order entry. These codes must first be entered into selection 1-4-7: Sales Tax Maintenance, prior to use here.

10. Service labor tax ID:

This is a labor tax code, used in service order billing. These codes must first be entered into selection 1-7 Sales Tax Information, prior to use here.

11. Pricing method code:

This required code (up to 10 characters) is used to calculate the material price to be used during billing and order entry for this customer. Even if a code is entered here, you will be given the option of overriding this during order entry.

Some possible codes are:

L1-10 List price column 1, minus 10%

C+20 Cost plus 20%

L1 Straight list price column 1

C Straight cost

12. Discount percentage:

Not currently used.

13. Pmt terms / Spec Ins:

Optional. For payment terms, if you enter the number of days, e.g. N10, N30 or Net 10, the due date will be automatically set on invoicing.

Spec Ins is a place for you to enter special instructions such as COD.

14. Credit limit:

Specify the maximum amount of credit allowed for this customer.

16. This month (purchases)

17. Year to date (purchases)

Values in these fields are normally only entered on initial system set-up, and are otherwise automatically added to by the system as invoices are created.

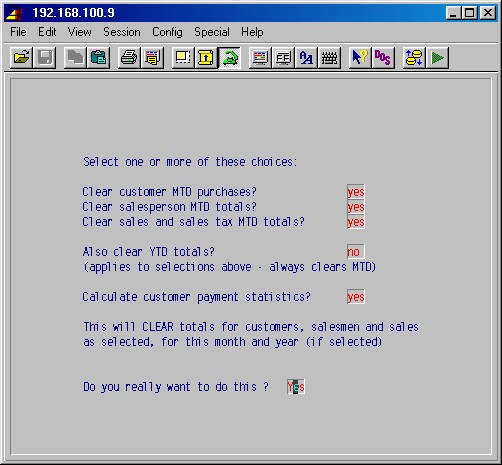

Note that these fields are not automatically being reset to zero. This has to be done through 1-18: Period End Processing, which lets you selectively clear This month, or This month and Year to date.

18. Print statement

Enter Y to print statements for this customer, or N not to print statements.

19. Late charge %

Optional. If you wish a late charge to be added on the statement for past due invoices, enter the percentage, as a decimal, of that late charge here (Example: 1.5% late charge is entered 1.5).

20. Start date

Optional. This is the date this customer opened this account.

21. Fax number

Optional. Enter the customer's fax number if you wish to record it here.

22. Status

Specify the current status of this customer as follows:

A = active

X = inactive

H = credit hold

23. Custom data

This gives you access to used defined notational fields as set up in 13-8-16: User Defined Data Maintenance.TopNote: In order to ease the task of entering new customers, the above entry screen looks for a customer with the ID SETUP and uses it as a template for default tax codes, payment terms, pricing method, discount percentage, etc. To use this feature, create a customer with an ID of SETUP and enter applicable default items for future new customers. New customers entered after creating the customer SETUP will assume those defaults, all of which may be overridden. If you later want to change the default values that appear on the above screen when entering new customers, simply change the values for the customer SETUP.

ENTER A FIELD TO BE CHANGED OR ALL:

If you need to make changes, specify a field number, press ENTER, and update just that field. If you want to update several or all of the fields, type all, press ENTER, and make the required changes, pressing ENTER to move through the fields. When you are ready to continue, press ENTER.

The system will prompt:

Update Misc no

The information entered thus far in 1-1-1: AR Customer Maintenance is the basic information required to set up a new customer. Additional customer information may now be entered is step 1-1-2 Miscellaneous Customer Data.

This prompt gives you immediate access to step 1-1-2. If you do not want to enter additional information now, press just ENTER and you will return to the 1-1 Customer Information menu. If you with to input additional customer data now, type the customer ID and press ENTER. This step is explained in 1-1-2 Miscellaneous Customer Data.

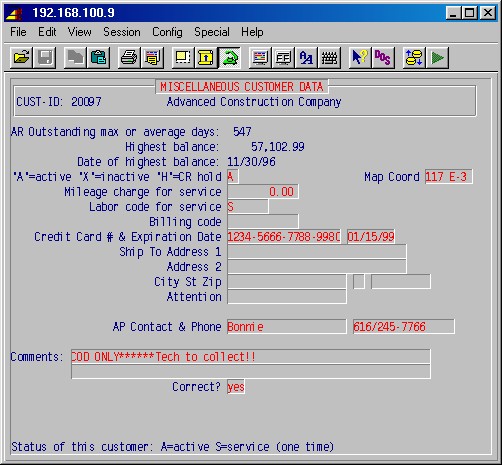

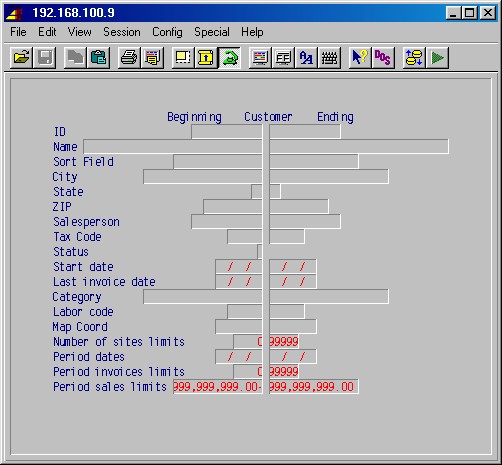

This step allows you to enter or view additional information about your customer. The system uses only the customer status information and the labor code and Map Coord for service. All other fields are entered by the user and are not updated by the system. This selection will display the following input screen :

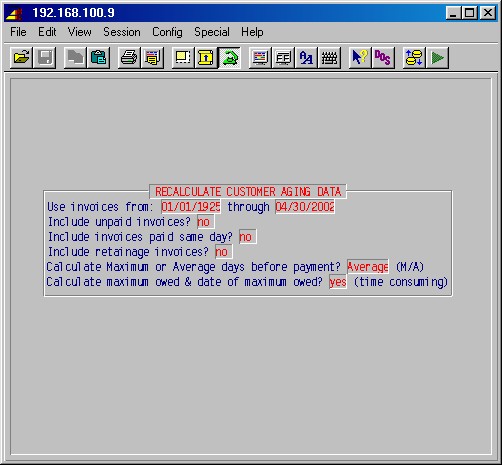

TopThe following three fields are calculated by running 1-18: Period End Processing, answering Yes to "Calculate customer payment statistics?":

AR Outstanding max or average days:

Either the highest number of days this customer had an unpaid invoice, or the average number of days before full payments, depending on how you answered the options when you calculated payment statistics in 1-18: Period End Processing.

Highest balance:

The highest outstanding balance this customer had, if calculated.

Date of highest balance:

The (earliest) date of the highest outstanding balance, if calculated.

'A'=active 'X'=inactive 'H'=CR hold

The status of this customer may be updated on this screen as well as the one in step 1-1-1. You may specify the current status of this customer as follows:

A = active

X = inactive

H = credit holdMileage charge for service

If you charge a per mile rate on service calls, enter the charge per mile here. This is currently notational, and is not used in any processing step.

Labor code for service

If you use the service order module, enter the labor class ID for service and T&M billings here. These labor class codes are set up in the service order module, step 2-12 Labor Rate Maintenance. The normal labor class ID is "S".

Billing code

This is a special code not applicable for most companies.

Credit card # & expiration date

Enter the customer's credit card number and expiration date for your records, if you wish.

Ship to address 1

Address 2

City St zip

Attention

If the shipping address is different from the customer's address, enter the "ship to" address here.AP Contact & Phone:

Here you may enter the name of the person to contact when collecting on outstanding invoices for this company. This is also accessible in 1-12: Collections Processing, and is printed on the agings produced in 1-17-1.

Comments:

Two lines have been provided for any brief comments you wish to record about this account.Correct? YES

Type NO ENTER if you want to go back and make changes. When you are ready to continue, press just ENTER and the system will prompt you for another customer ID.

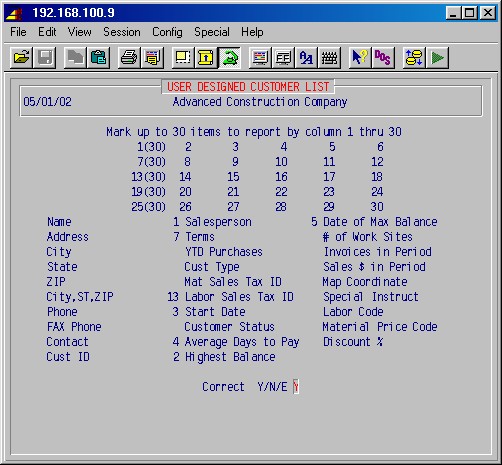

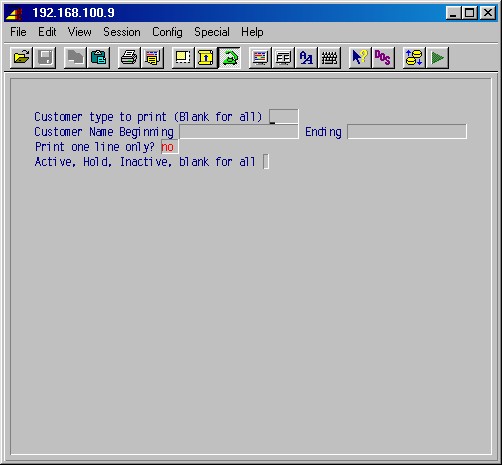

This procedure will print a list of all specified customers alphabetically by customer name. This may be either a one line report or a longer report with the complete address. The one line report shows the customer ID, name, phone number, contact, tax ID, price code, labor code and billing code. The long report shows the customer ID, name and address, phone number, contact, last activity, tax code, purchases MTD, and purchases YTD.

This selection will display the following input screen:

Customer type to print (Blank for all)

This corresponds to Customer category (field #6) in 1-1-1: AR Customer Maintenance. If you wish to limit the list to just one customer category, enter it here. Otherwise leave blank; press ENTER.

Print one line only? NO

Press just ENTER to specify the long report. Type YES ENTER for the one line report.

Active/Inactive/Both B

Press just ENTER (both is the default) if you want a report showing all customers. Specify A for a list of all active customers or I for a list of all inactive customers.

The printer selection screen will now be displayed. Type the printer number and the number of copies and press ENTER. Your report will now be printed and the system will return to the 1-1: Customer Information menu.

This procedure is similar to 1-1-3 above, but will list customers in order of customer ID, rather than by customer name.

Branch designations are not applicable for most companies. Branches may be designated by special coding of the customer ID when the customer IDs are first set up. Basically, the last three characters of the customer ID may be designated as the branch code.

This procedure is similar to 1-1-3 above, but will list customers in order of branch, rather than by customer name.

If addition to the input screen shown in 1-1-3 above, this procedure will also prompt:

Branch to print or blank for all

If you wish to limit the list to just one branch, enter it here. Otherwise leave blank; press ENTER.

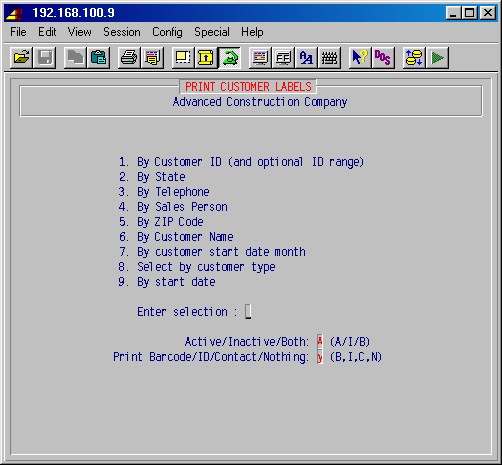

This procedure prints mailing labels for specified customers, which may

be sorted in a variety of different ways as you specify. This selection

will display the following input screen:

Top

Enter selection:

Enter the method, number 1-9 shown on this menu, by which you want your customers sorted for the labels you are about to print.

(#8, By customer type, corresponds to Customer category (field #6) in 1-1-1: AR Customer Maintenance.)Active/Inactive/Both A (A/I/B):

Specify which customers you wish to print: Active, Inactive, or Both and press ENTER.

Print Barcode or ID: Barcode (B/I)

If your printer is capable of printing the postal barcode as part of the address (and has been set up for it in 13-3), answer B here. Otherwise enter I.

Print ID:

If you want your customer ID to print on the label, press just ENTER. If you don't want the customer ID to appear, type NO ENTER.

The printer selection screen will now be displayed. Type the printer number and the number of copies and press ENTER. Your labels will now be printed and the system will return to the 1-1: Customer Information menu.

This procedure is similar to 1-1-3 above, but will list customers in order of salesman, rather than by customer name.

If addition to the input screen shown in 1-1-3 above, this procedure will also prompt:

Beginning salesman

Ending salesman

Specify the range of salesman IDs for which you wish to print this customer list. If you want a report for just one salesman, enter that salesman ID in both fields. If you want a report for all salesmen, press just ENTER for both fields.

This procedure is similar to 1-1-3 above, but will list customers in order of zip code, rather than by customer name.

If addition to the input screen shown in 1-1-3 above, this procedure will also prompt:

Beginning ZIP

Ending ZIP

Specify the range of zip codes for which you wish to print this customer list. If you want a report for just zip code, enter that zip code in both fields. If you want a report for all zip codes, press just ENTER for both fields.

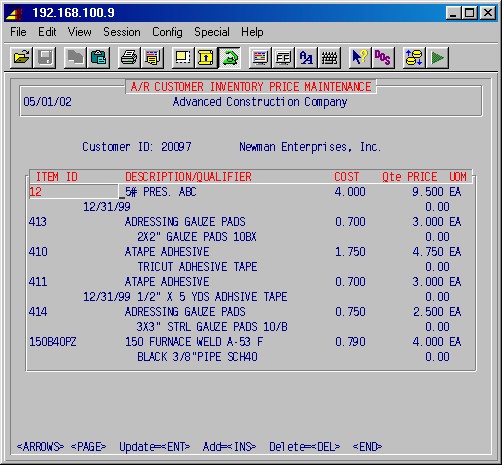

TopCustomer ID:

Enter the ID [H] of the customer you want and press ENTER.Use the INS, DEL and ENTER keys to add, delete and update entries as needed.

ITEM ID

Enter the ID [H] of the item you want and press ENTER.Qte PRICE

Enter the price for this item the customer has been quoted.Press END when done with quoted prices for this customer. Press ENTER to return to the A/R Customer Maintenance menu.

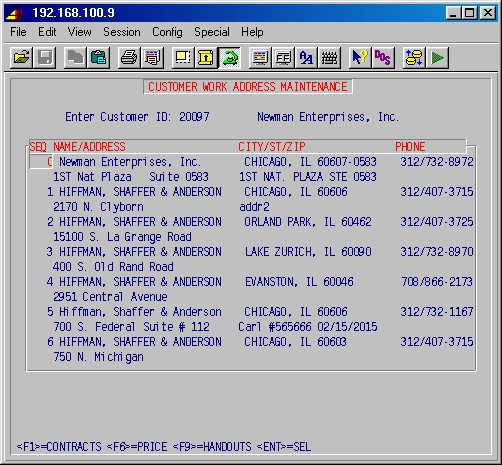

This procedure allows entering one or more job addresses for a customer to facilitate writing a service order in step 2-1 Service Order Entry. This procedure is generally used in situations where you write numerous service orders for one customer for work to be done at numerous different addresses.

This feature allows the person entering the service order to press F2 at the work address field and select from the previously entered addresses. Also, work addresses entered in 2-1 Service Order Entry, are automatically incorporated into the address list in this step.

This procedure allows you to add, delete, and update these addresses. This selection will first prompt:

Enter customer ID:

Type the customer ID [H]. If this is a valid ID the system will display the customer name. Press ENTER and the following menu screen will be displayed:

All previously entered work addresses for this customer will be displayed in numbered line entries. You may view all of the entries by using a combination of the ARROW, PAGE and HOME keys. If you want to update or delete a line, highlight the line number, and press ENTER or DELETE.

To add a new address press INSERT and complete the name, address, and phone number fields as prompted.

Note that the F1, F4, F6 and F9 keys give access to the contracts, service history, price book and handouts for the work address, as covered in detail in the Service Order manual under 2-16-1: Contract Maintenance.

When you are finished with this area press END and the system will return to the A/R Customer Maintenance menu.

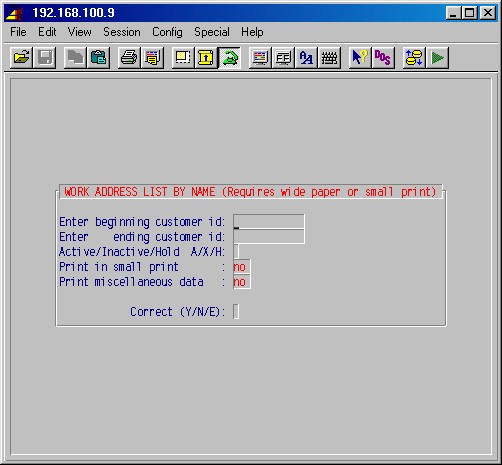

This procedure allows you print work addresses, as entered in 1-1-10 above. This selection will first prompt:

Enter customer ID:

Type the customer ID [H]. If this is a valid ID the system will display the customer name. Press ENTER and the following input screen will be displayed:

Enter beginning customer ID:

Enter ending customer ID:Type the range of customer ID's you wish to print, or leave both fields blank to print a lost with all customers' addresses.

Print in small print:

As the report prints 4 work addresses across the page you will need to either use wide paper or use small (compressed) print. If you are not using a wide carriage printer, type Yes and press ENTER.Print miscellaneous data:

Type Yes if you also want the Tax IDs, Labor Codes and Price Codes printed for each work address.Correct (Y/N/E):

Type Y to start printing, N to go back and correct the above or E to abandon printing, then press ENTER.The printer selection screen will now be displayed. Type the printer number and the number of copies and press ENTER. Your report will be printed and the system will return to the A/R Customer Maintenance menu.

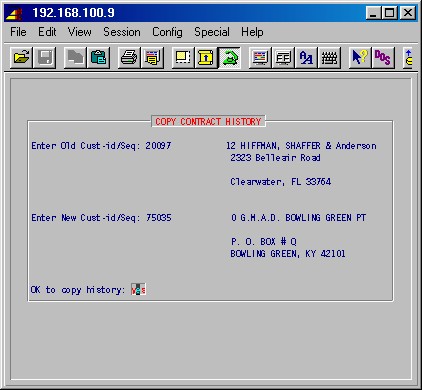

This selection allows copying the service history for one work address (customer ID/work address number) to another. You'll be prompted :

TopEnter Old Cust-id/Seq:

Type the customer ID and work address number from which you want to copy service history.Enter New Cust-id/Seq:

Type the customer ID and work address number to which you want to copy service history.OK to copy history:

When you are sure you have entered correct customer IDs and work address numbers, answer Yes and press ENTER.To exit this procedure, leave customer ID blank and press ENTER.

This selection is similar to 1-10-12 above, but it also copies any equipment from the specified work address.

At least two types should be set up:

requisitions

contract sales

You may wish to set up two or more departments with department IDs that start with the same characters in order to group common sales types. This is most valuable when you run step 1-1: Print Sales Journal, where you may specify the sales department to print - if you specify the starting common characters as you have grouped the common sales types, the report will print all departments that start with those common characters.

For example: You may have several categories of service department income which you want to group together. You could create department IDs such as:

ser-comm (service-commercial)

ser-res (service-residential)

In printing the sales journal, you could specify department "ser" and it would print all of the departments grouped together with department ID's beginning with "ser".

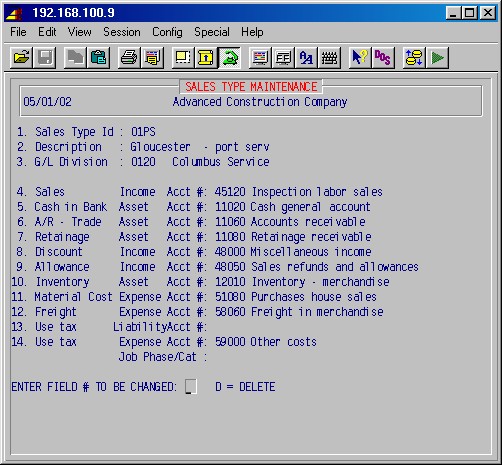

This selection will display the following input screen :

The entries above in bold type are examples; use the appropriate accounts for your company.

Sales type ID:

If you are setting up a new sales type, enter the sales type ID and press ENTER. Next, enter a description (up to 20 characters) for this sales type and press ENTER.

Next, enter the G/L Division if applicable.

At least two sales types should be set up: 1) requisitions 2) contract sales.If you have previously entered a sales type and you wish to view or edit the general ledger entries, type the sales ID [H] and press ENTER; the description, division, and previously entered GL numbers will now be displayed.

4. Sales Income acct #:

5. Cash in bank Asset acct #:

6. A/R - Trade Asset acct #:

7. Retainage Asset acct #:

8. Discount Income acct #:

9. Allowance Income acct #:

10. Inventory Asset acct #:

11. Material cost Expense acct #:

12. Freight Expense acct #:Enter the appropriate general ledger account number for each of these ledger categories. Each category used must have a general ledger number. The general ledger number must have been previously entered into the system or you will see a message "coa record not on file" and you will not be able to continue until you enter an existing GL number.

The following fields are used in 8-16-1 and 8-16-3 (after printing the requisition), as well as Accounts Payable in the automatic accrual of use tax, if the automatic accrual is turned on.

Automatic accrual of use tax will be activated if the job is NOT use tax exempt (7-1-1, second screen, #4 Miscellaneous information, field #3 use tax exempt), and if a valid sales/use tax code is entered in 7-1-1, Field #15 county. After use tax is activated, in requisitions, use tax will always be accrued.

Accounts payable will automatically accrue use tax if the PO for the job shows no purchase tax.

13. Use Tax Liability Acct

Normally left blank. If filled in, use tax will be posted to this account.

If left blank use tax will be posted to the sales-tax account.14. Use tax Expense Acct

Use tax will be posted to this expense account. (Mandatory)

Job Phase/Cat

If filled in, use tax will post to this Job Cost phase and category. If left blank, use tax will post to the same phase and category as the material.ENTER FIELD # TO BE CHANGED: __ D = DELETE

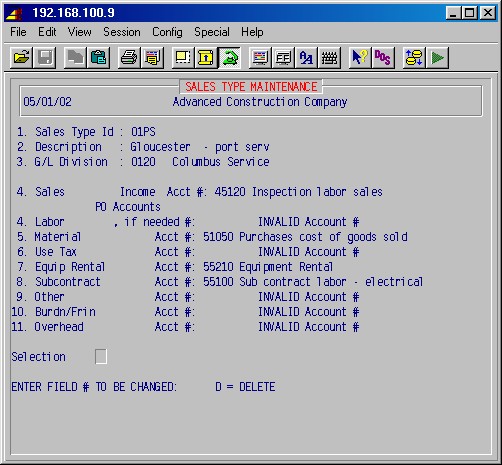

When the above entries are correct, press ENTER, and the next screen will appear:

TopPO Accounts

4. Labor if needed #:

5. Material Acct #:

6. Maintenance Acct #:

7. Equipment Acct #:

8. Subcontract Acct #:

9. Other Acct #:

10. Burdn/Frin Acct #:

11. Overhead Acct #:

In 3-1 PO Entry, the system will fill in the general ledger number for the operator, if these are entered here. (The names of fields 4 through 11 above come from the phase expense categories from the job "OH".)Enter GL numbers for the categories you use on POs, (typically only "material" and "subcontract") leaving the others blank. After completing these setups, when an operator is entering a PO, the system will look at the sales type from the job for the PO and the category code, and select the appropriate GL number.

ENTER FIELD # TO BE CHANGED: D = DELETE

Type the number of the field you wish to change and press ENTER.

When you are ready to continue, just press ENTER.The system will now prompt you for another sales type ID. To exit this procedure, press ENTER again and you will return to the 1-4 AR Master File Maintenance menu.

The system will display current, month-to-date, and year-to date totals for each GL number based on the work processed.

This selection will display the following input screen :

Sales type ID

Description

GL divisionSpecify the sales type ID [H] and press ENTER. The description and GL division designated with that sales type ID will be displayed.

The system will display the GL account numbers and the current, MTD, and YTD totals for each of the nine categories under this sales type ID. These totals may be updated as follows: First, type the category c (current), m (month-to-date), or y (year-to-date), and press ENTER. Second, type the field number of the ledger category (1 through 9) to be changed and press ENTER. Next, type the new dollar value you wish that field to equal and press ENTER.

CAUTION: Changing the figures in the current field may affect your GL balances and should not be done here. The MTD and YTD fields also should not be changed after the initial setup.

When you are finished updating fields, press ENTER and the system will prompt you for another sales type ID. To exit this area, press ENTER again and the system will return to the 1-4 AR Master File Maintenance menu.

This procedure will print a list of all sales types, as they were set up in step 1-4-1 Sales type maintenance, showing the sales type ID, description, division, and the general ledger numbers for each of the eleven ledger categories and optional PO account numbers.

Selecting this procedure will display the printer selection screen. Type the printer number and the number of copies and press ENTER. Your report will be printed and the system will return to the 1-4 Sales type information menu.

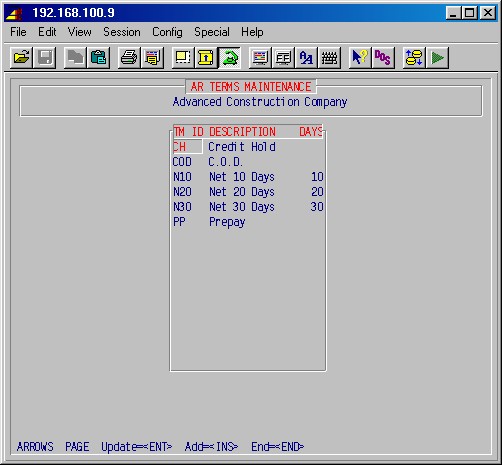

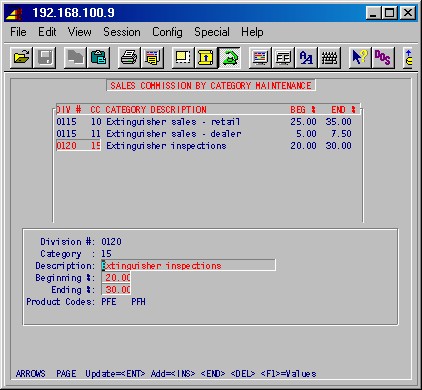

Note: Used in 1-10-4.

DIV # - Division #:

Enter the division number [H].CC - Category:

Enter a category code (up to two characters).CATEGORY DESCRIPTION - Description:

Enter a description for this category.BEG % - Beginning %:

Enter the beginning profit percentage for this category.END % - Ending %:

Enter the ending profit percentage for this category.Product Codes:

Enter up to 15 product codes (as set up in 8-18: Product Code Maintenance).To add an entry press INS. Use the ARROW, PAGE and ENTER keys to update an entry. Press DEL to delete an entry.

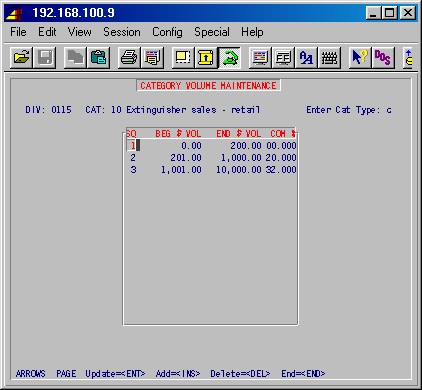

Press F1 to set up volumes for the category. You'll first be prompted:

Enter Cat Type:

Type either C for city or R for rural. Press ENTER, and the following maintenance screen will appear : (Press F1 twice to get through product codes):

SQ

This number is automatically assigned by the system.BEG $ VOL

Enter the beginning dollar amount for this bracket.END $ VOL

Enter the ending dollar amount for this bracket.COM %

Enter the commission percentage for this bracket.To add an entry press INS. Use the ARROW, PAGE and ENTER keys to update an entry. Press DEL to delete an entry. Press END when done, and you'll be returned to the previous screen.

Press END when done.

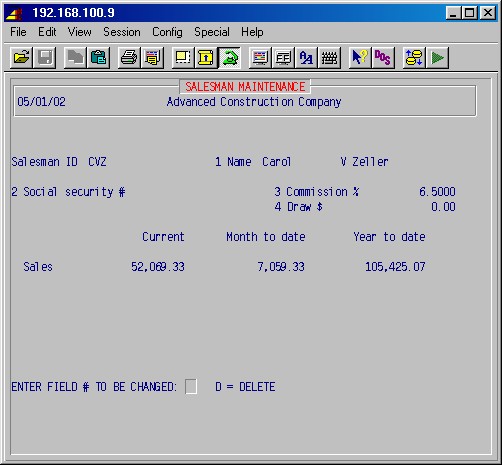

This allows you to enter or correct information about the salesmen, using the screen below. The figures shown here are what will be printed on the 1-13-3 Salesman report. The system will update these totals through normal processing. This selection will display the following input screen:

Salesman ID

Specify the salesman ID [H]. If this is a valid ID, the system will display all information available for the rest of the fields. If this is a new salesman ID, the system will prompt;NO SALESMAN EXISTS. DO YOU WANT TO CREATE A NEW ONE ? YES

To exit this area, type NO ENTER. If you want to create a new salesman file, press just ENTER.

1 Name

Type the salesman's full name, first name, middle initial, last name.2 Social security #

Type the complete social number.3 Commission %

Type the commission for this salesman as a percentage.4 Draw $

If this salesman is eligible for a draw against commissions, enter that amount here.ENTER FIELD # TO BE CHANGED: D = DELETE

You may now update any of these four fields by entering the field number and making the change. If you want to delete a salesman record, type "d" and press enter. Answer the next prompt YES to delete the record.

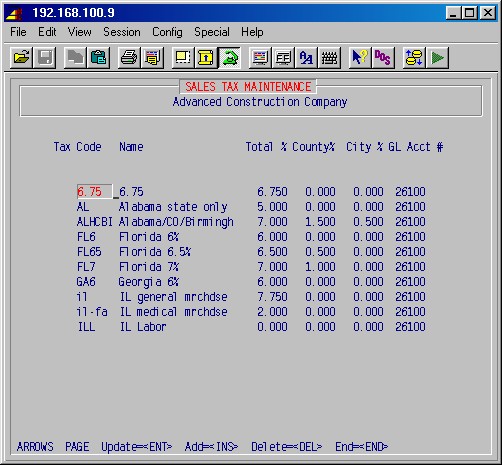

1-4-7 Sales Tax Maintenance

This allows you to enter Sales Tax Information to be used to calculate tax on sales invoices. Tax codes set up in this procedure are entered in the 1-1-1 Customer information setup; sales tax will then be automatically calculated in the various billing areas of the system for the specified customer. This selection will display the following input screen (items in bold are examples):

Top

Use the INS, DEL and ENTER keys to add, delete and update entries in this area.Tax code

Specify a tax code for this sales tax authority. This may be of your choosing but usually consists of the state, county, or city designation plus any other characteristics. Example: FL6 might be a designation for 6% Florida state sales tax.Name

Type a short description of the tax authority (up to 20 characters).Total %

Specify the sales tax percentage for this authority.County %

City %

Currently not used.GL Acct #

Specify the general ledger liability account for this sales tax.Press END to return to the 1-4 AR Master File Maintenance menu.

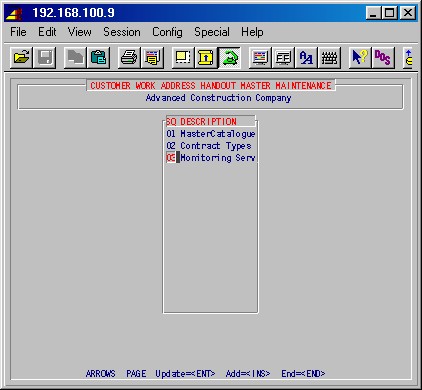

TopSQ

This is a number automatically assigned by the system for this handout.DESCRIPTION

Type the description of this handout.To add an entry press INS. Use the ARROW, PAGE and ENTER keys to update an entry. Press END when done.

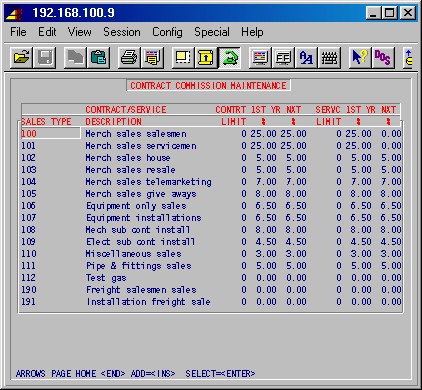

TopSALES TYPE

Enter the ID [H] of the sales type for which you want to set up commission percentages and limits.CONTRACT/SERVICE

DESCRIPTION

The description of the sales type (department), as set up in 1-4-1, will automatically be displayed.CONTRT

LIMIT

Enter the limit in whole dollars on which the commission will be paid on a contract.1ST YR %

Enter the commission % for the first year for contracts.NXT YR %

Enter the commission % for subsequent years for contracts.SERV

LIMIT

Enter the limit in whole dollars on which the commission will be paid on service.1ST YR %

Enter the commission % for the first year for service.NXT YR %

Enter the commission % for subsequent years for service.To add an entry press INS. Use the ARROW, PAGE and ENTER keys to update an entry. Press END when done.

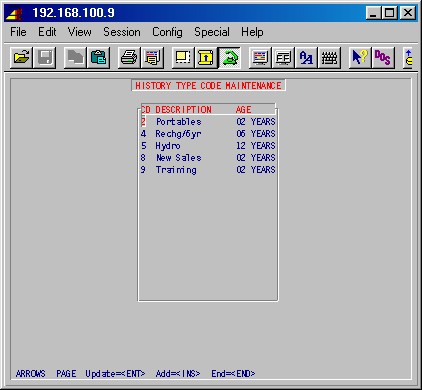

This selection allows setting up and maintaining types of work address service histories. When looking up or printing the service history for a work address you may limit the list to one of these history types.

CD

Enter a one digit or letter code (the letter E must not be used) for this type of history.DESCRIPTION

Enter the description for this type of history.AGE

Enter the number of years that this type history is to be kept.To add an entry press INS. Use the ARROW, PAGE and ENTER keys to update an entry. Press END when done.

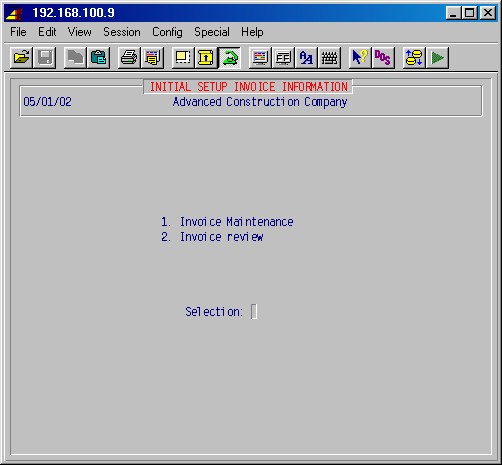

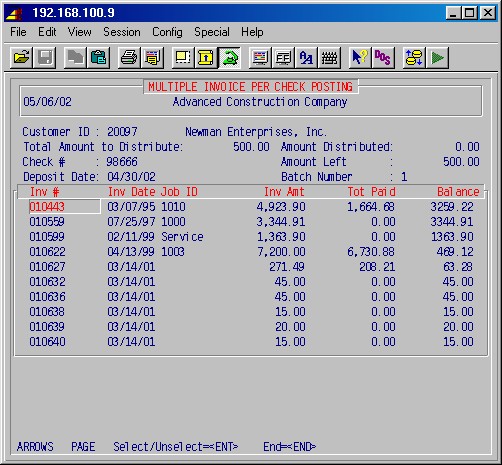

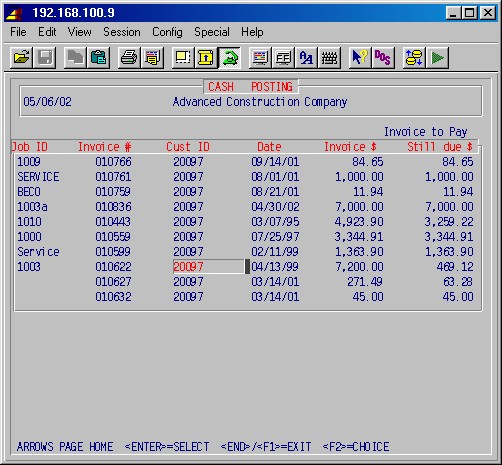

These procedures allow you to view and update invoices, review balance outstanding and payments posted against invoices. This selection will display the following menu:

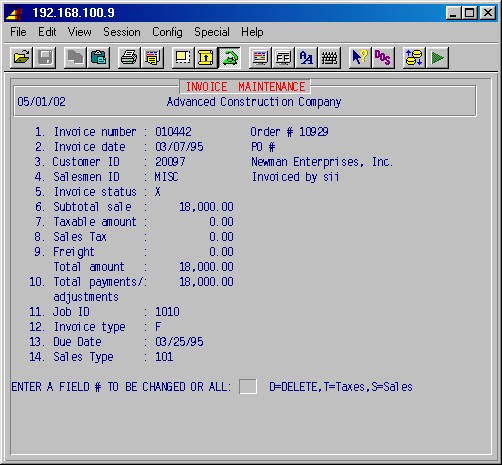

This procedure will allow you to view and update invoice information. This is primarily used to input outstanding invoice information when setting up the system for the first time. This makes these invoices available to print on the sales journal and to post payments against. You may also look at the payment history for the invoice, as well as add payments. General ledger is not updated by this function and must not be used to input new invoices and their payments.

CAUTION: Adding or updating invoices and payments in this area will not update general ledger or job cost. This area is normally only used to enter invoices when first setting up the system.

This selection will display the following input screen :

Top1. Invoice number

Specify the invoice number and press ENTER.

If this invoice number is not in the database, the system will prompt:NO INVOICE EXISTS. DO YOU WANT TO CREATE ONE ? YES

Type NO ENTER if you want to exit this area. Press just ENTER to create a new invoice with this invoice number.

If this invoice was created previously, the system will display information from this invoice.

Order #

Specify an order number or just press ENTER and the system will assign and order number.PO #

Enter the customer's PO number for this purchase, if applicable.2. Invoice date

Specify the date of the invoice.3. Customer ID

Specify the customer ID [H]. The system will display the name of the customer.4. Salesman ID

Optional. Specify a salesman ID here.5. Invoice status

Press just ENTER for the default X (completely processed). If this invoice was previously entered, the system will display the current status of this invoice.6. Subtotal sale

7. Taxable amount

8. Sales tax

9. Freight

Enter the dollar amounts of each field for this invoice, as applicable.Total amount

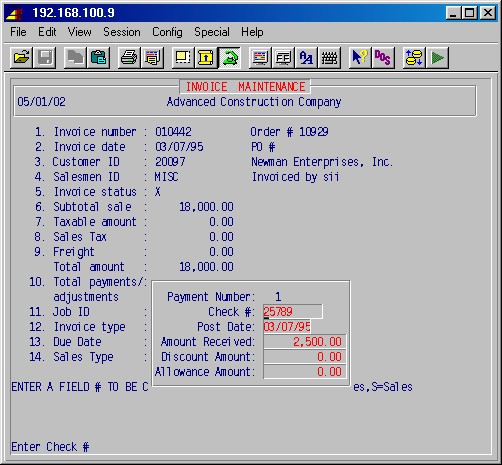

The system will total the four previous fields and display the total here.10. Total payments/adjustments

This shows the total of any payments/adjustments.

Select this field (type 10 and press ENTER) to see any payments:

To just look through each of the payments/adjustments without changing any numbers, just press F1.

When entering an invoice (e.g. when first setting up the system) you'll be asked if you wish to create a payment for it. This would be advisable as some AR reports look at payments for an invoice to determine if it has been paid.

11. Job ID

If this invoice is job related, enter the job ID here. Otherwise, leave blank.12. Invoice type

Leave blank for normal invoices. Enter R for a retainage invoice, S for a service order invoice, F for a free form invoice, or J for a job cost invoice.13. Due date

Enter the due date here.14. Sales type

Specify the sales type ID [H] for this invoice.

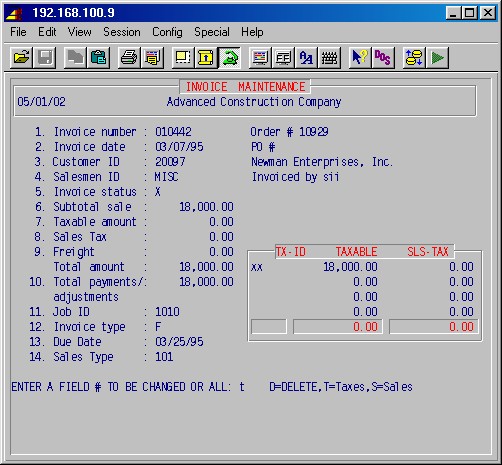

Select T to record Sales Tax breakdown.

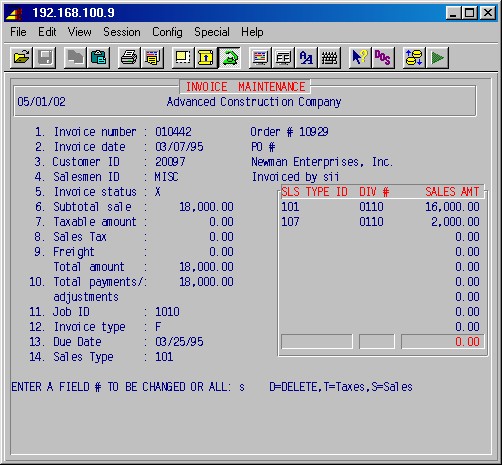

Select S to record Sales Type breakdown.

ENTER A FIELD # TO BE CHANGED OR ALL: ___ D = DELETE INVOICE

You may specify a field number to change of type "D" to delete this invoice.If you are ready to continue, press just ENTER. The system will prompt you for another invoice number. Press just ENTER to exit this area and return to the 1-5 Invoice Information menu.

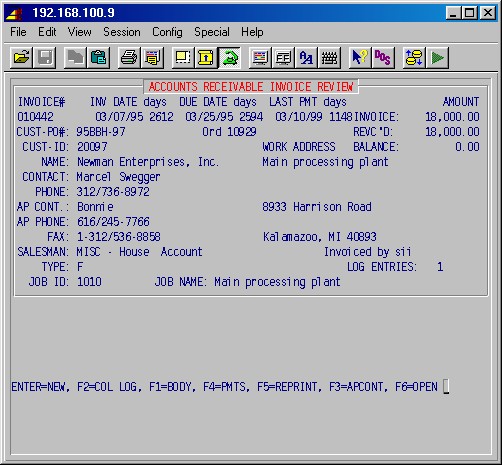

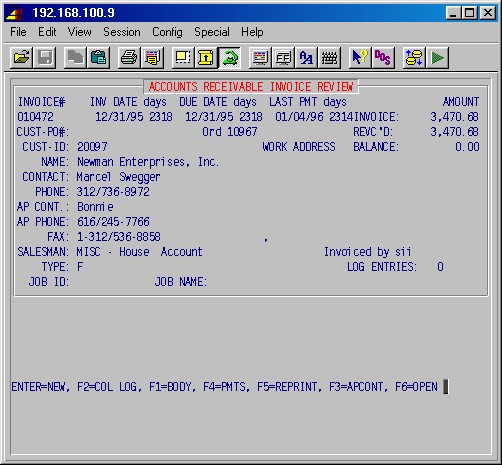

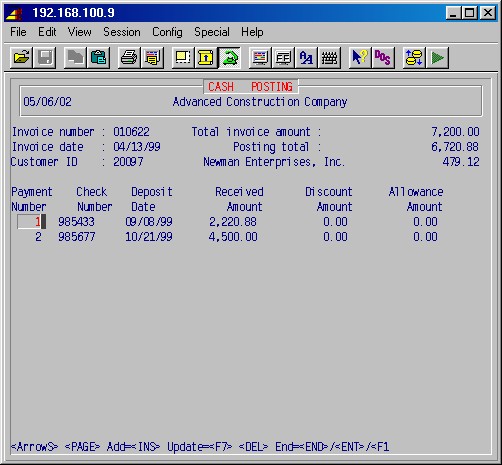

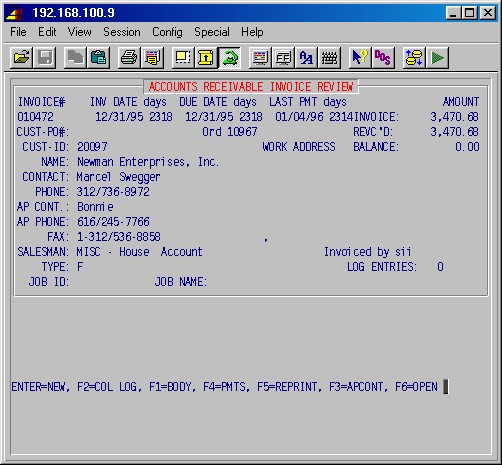

This procedure allows you to review a specified invoice for the balance outstanding and all payments posted against that invoice as well as various other information as shown in the example below. This selection will first prompt:

Enter invoice #

Specify the invoice number [H] you wish to review and press ENTER.

If the invoice number is valid, you'll see the following screen:

Press ENTER when done viewing the invoice. The F1, F2, F3, F4 and F5 keys lets you view the body of the invoice, access the collections log, change the AP contact name and phone, view payments and reprint the invoice, as shown below.

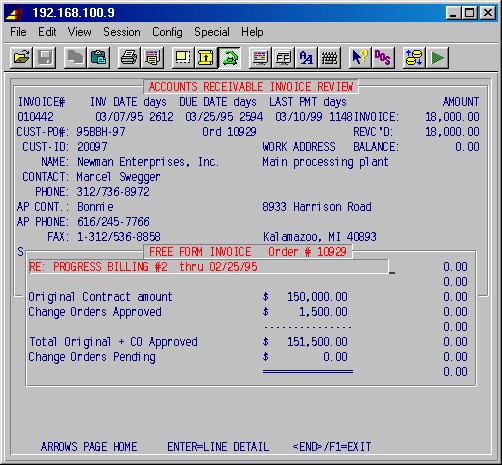

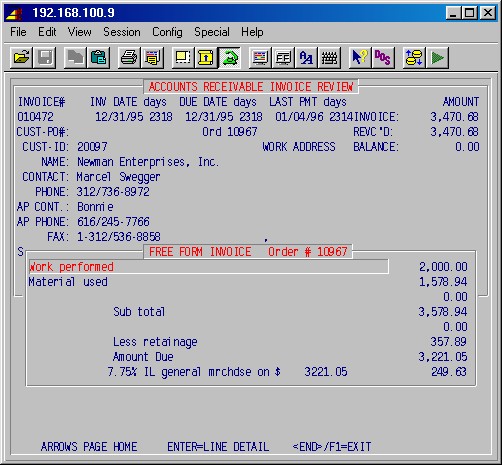

Press F1 to see the body of the invoice:

Use the ARROW, PAGE and HOME keys to view different parts of the body. Press END when done.

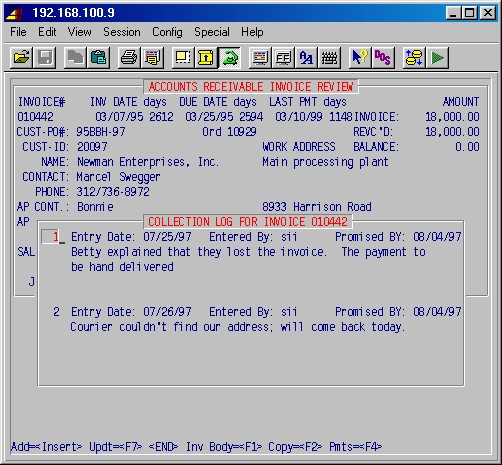

Press F2 to access the collections log:

TopUse the INS key to add entries. Use ENTER or F7 to update entries.

Press END when done.

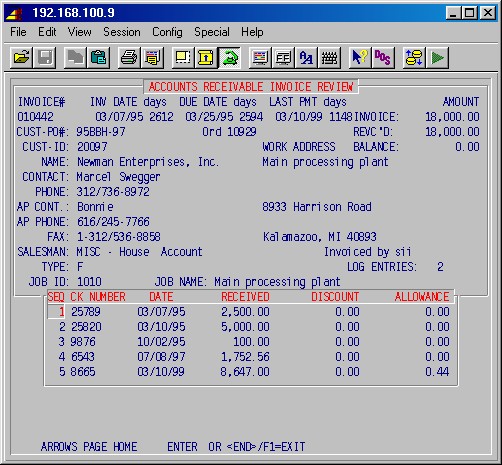

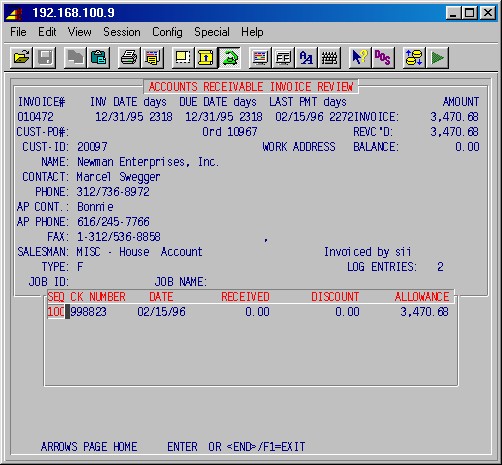

Press F4 if you wish to see the payments on this invoice:

Use the ARROW, PAGE and HOME keys to look through payments if there are more than will fit on the screen. Press END, F1 or ENTER when done.

When you are finished viewing the invoice, press ENTER and you will be prompted for another invoice number. To exit this area, press ENTER again and you will return to the 1-5 Initial Setup Invoice Information menu.

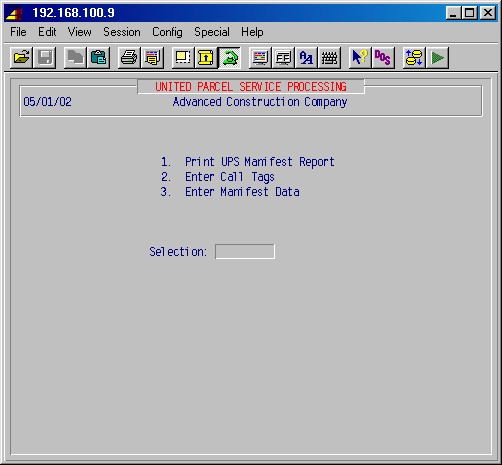

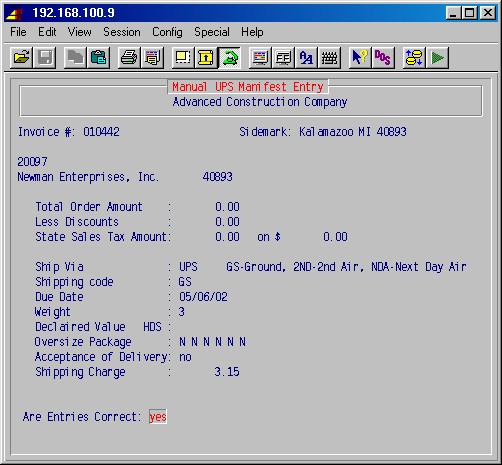

These procedures allow you to print a UPS manifest report for all orders taken through order entry and enter and print call tags for UPS pickup at one of your customers. This selection will display the following menu:

This procedure will print a UPS manifest report for all orders taken through order entry since the last time this report was printed. This report will show the date, customer, order number, weight, and charges, as well as summary information regarding the shipping categories and totals, declared value summary, and daily zone summary. This selection will first prompt:

Enter Pickup Ticket Number GS: Enter Pickup Ticket Number IS:

Type the UPS pickup record number and press ENTER. The printer selection screen will now be displayed. Type the printer number and the number of copies and press ENTER. Your report will be printed and the system will prompt:

Did Report Print OK? Enter <YES> to Clear File: NO

If you need to reprint for any reason, press just ENTER. If the report printed ok, type YES ENTER. The file that holds this information will be cleared and the system will return to the 1-9 UPS Shipping menu.

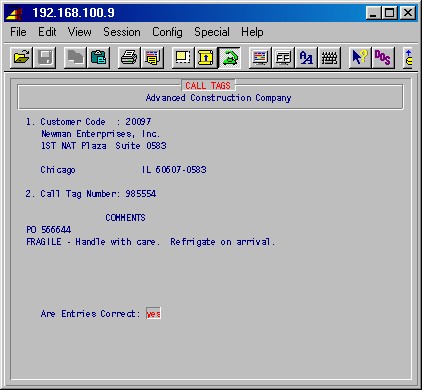

This procedure will print CALL tags for UPS pickup at one of your customers. This selection will display the following input screen :

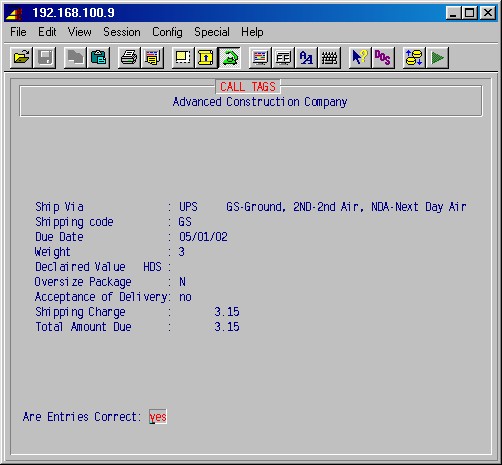

Simply enter your customer ID, changing the address if necessary, the call tag number, and any comments. If entries are correct, press just ENTER. The system will next display the following input screen:

TopComplete this screen. Shipping charges will be automatically calculated. If this information is correct, press ENTER and the printer selection screen will be displayed. Type the printer number and the number of copies and press ENTER. The call tag will be printed and the system will prompt:

Did call tag print correctly: YES

If the call tag did not print correctly, it may be reprinted now or press just ENTER and the system will prompt for another customer code. Press ENTER again to return to the 1-9 UPS Shipping menu.

The procedures in this area allow you to create, print, and re-print sales orders and invoices in three different ways:

(1) Order Entry (one step)

This is generally used in the case of orders (at the counter, by phone or by mail) where the order is entered into the system, a picking ticket is generated, and the warehouse ships and prints invoices. The customer may pay now or later and one or more invoices may be produced as material is shipped and billed, as in the situation where not all materials are immediately in stock.(2) Counter Sales

This is used for your typical counter sale situation where the customer walks up, buys material you have on hand and takes it with him. The material is keyed in by hand or with a bar code reader, an invoice is printed, and the customer pays for the material or it is put on account.(3) Free Form Invoicing

This area may be used for any type of invoicing. It is the most flexible in that you may type descriptions of almost any length, apply various sales taxes, and deduct retainage.

This selection will display the following menu screen:

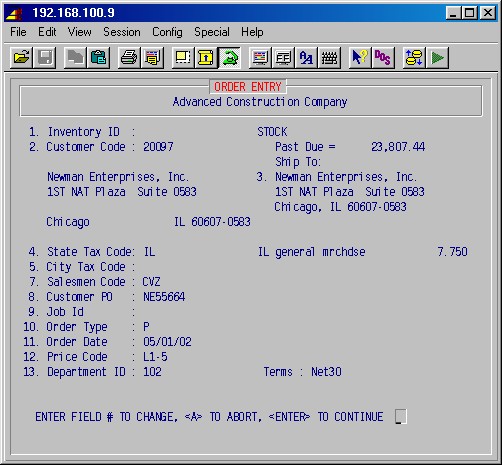

This procedure is generally used for phone, mail, or written orders that go through a shipping cycle of entering an order, printing a picking ticket, and shipping the material and producing invoices (as opposed to counter sales where the product is generally delivered on the spot. Each order may have one or more invoices as material is shipped and billed as in the situation where all materials are not immediately in stock. This selection will display the following input screen :

1. Inventory ID

Normally press just ENTER, which specifies the main stock inventory. Specify another inventory ID as required.2. Customer code

Specify the customer ID [H] of the customer to receive this invoice.If the customer is not in the database, the system will prompt:

CUSTOMER NOT FOUND ADD? YES

If you want to continue with this order, you must enter the customer. Press just ENTER and the system will reveal an abbreviated customer entry screen where you may input the essential customer information to process this order. When that screen is completed, the system will return you to this area and you may proceed with the order.

If the customer is in the database, the customer information will be displayed and the system will prompt:

YES CORRECT CUSTOMER (Use F2 to see order history) ?

If you want to see the order history (all orders except counter sales), press b. If you want to change the customer, type NO and make the change. If you press F2, the following screen will be displayed :

Press F1 to exit this screen. The system will prompt:

YES CORRECT CUSTOMER (Use F2 to see service history) ?

This gives you a chance to correct the customer code, if you specified the wrong one; just answer NO and put in the correct one. Otherwise, press just ENTER to continue.

3. Ship to

Press just ENTER if the "ship to" address is the same as the customer's normal address. Otherwise, fill in the correct shipping address.4. State tax code

Mandatory. This defaults to the customer's tax code, but may be changed as required.5. City tax code

Optional. Specify a valid sales tax code or press just ENTER.7. Salesman code

Mandatory. Normally press just ENTER and your customers's salesman will be entered. If salesmen are not used, then select misc.8. Customer PO

Optional. Specify your customer's purchase order number for this invoice or leave blank.9. Job ID

Optional. If this is job related, specify the job ID; otherwise, just press ENTER.10. Order type

Specify one of the following:

c = Counter sales - to produce an immediate invoice

b = Bill later - to record the list of materials with the invoice printed later

p = Picking ticket - to produce a picking list with later update of the items shipped with the invoice printed later11. Order date

This is normally today's date which is filled in by the system. This may be changed as required.12. Price code

This is normally the price code specified for this customer in the customer information set up area. This may be changed to any other valid code as required.13. Department ID

Required. The appropriate sales department [H] must be entered here. - this controls the accounting.Terms

Specify the terms of this sale with one of the following;C = Cash

N10 = Net 10

N30 = Net 30You may now enter a field number to change anything on this screen, press A to abort this order, or press ENTER to continue. The next screen allows specifying the item numbers and quantities for the materials to be sold and invoiced as follows :

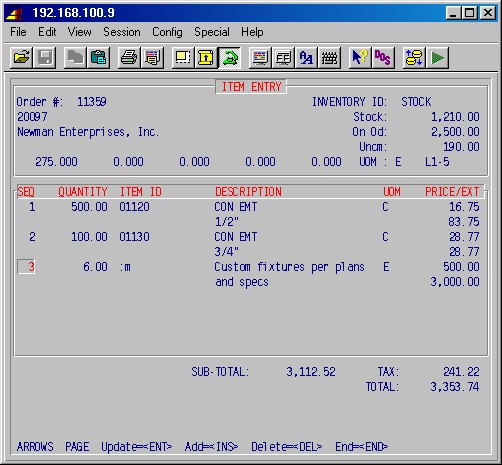

Top

Quantity

Specify the quantity ordered. Use a minus quantity for credit memos.Item number

Enter the item number, DCI number, or local part number, or press F4 to end. If the item ID is not known, type the first part of the item's description (Example: CON EMT) and press F2 to display a list of all items that begin with the specified description. Select the correct item and press ENTER.If the needed item is not in the inventory, use an ID of :M for manual. Then fill in the description as needed, as well as the price and cost.

When the item number is entered, the system will display in the box at the top, from the inventory item maintenance database, five dollar values in the box at the top of the screen. These values are:

Unit Cost Sell Price 1 Sell Price 2 Sell Price 3 Sell Price 4

In addition, some other pieces of information are displayed in this box to aid you in making this order:

Stock: - The number of this item in inventory

On Od: - The number of this item on order

Uncm: - The number of this item uncommitted. This number is immediately updated when anyone requisitions material or enters an order.

UOM: - Unit of measure for this item

The pricing code for the customerDescription

The description for this item previously entered into inventory will be displayed. For :M entries, type in the description.Price

The price displayed is a result of the price code. If it is not as needed for this sale, manually change it. For :M entries you'll be prompted to first enter cost, then price.Extended

The extension is displayed.Note the running totals at the bottom of the screen.

Keep adding entries, as needed. When done and there are no corrections to be made, press END.

If you do have corrections to make, press any of the HOME, ARROW or PAGE keys, then use ENTER, INS, DEL keys to update, add or delete entries.

Press END when done.The printer selection screen will then be displayed. Type the printer number and the number of copies and press ENTER. Your order will be printed and the system will prompt for another inventory ID. If you want to leave the procedure here, just press ENTER.

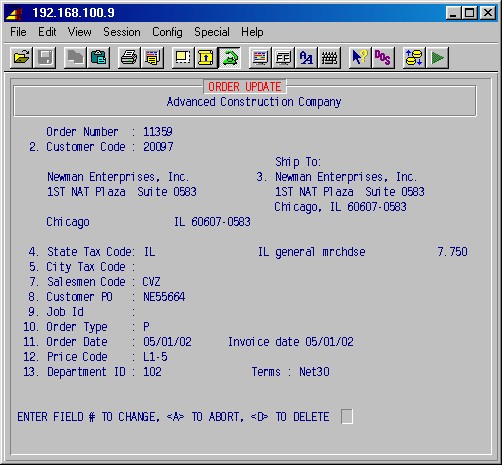

This procedure is usually used to ship part or all of the order and produce an invoice for one-step orders. In addition, any of the billing information may be changed as well as the items added to or deleted, quantities changed, etc. as required. This selection displays the following input screen :

TopTo pull the correct order use one or the other of the following two fields (order number or customer code. If you want to pull through the customer code, press just ENTER in the order number field and then enter your customer code. If you want to pull with the order number, enter it in the order number field.

Order number

Enter the order number you wish to update and press ENTER. If this is a valid order number, the system will display the information as it was entered in step 1-10-1 Order Entry. The system will prompt:CORRECT ORDER? YES

If this is not correct, type NO ENTER and specify the correct order number, or press just ENTER through this field and go to the customer code to pull a list of orders.

2. Customer code

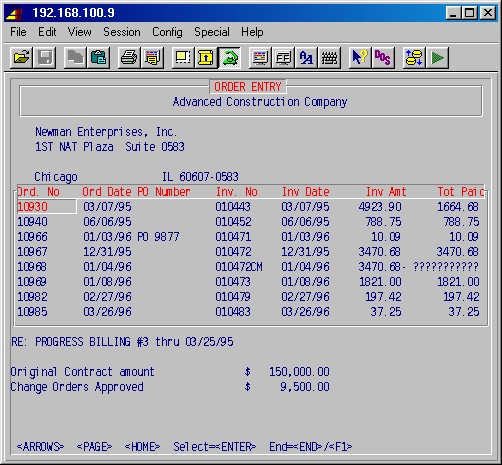

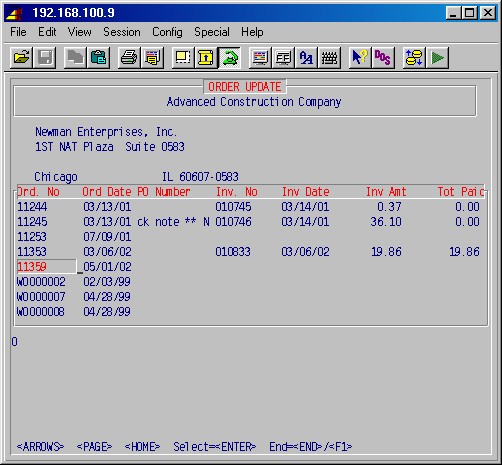

Specify the customer ID [H] of the customer to receive this invoice. The system will display the order history (all orders except counter sales) which you may view by using combinations of the ARROW, PAGE and HOME keys. An example of the order history is shown below :

Press F1 or END if you want to exit this procedure. Otherwise, highlight the correct order and press ENTER. The system will display the order and prompt:

CORRECT ORDER? YES

Answer NO ENTER to exit this area and start over. If this is the correct order, press just ENTER and the system will allow you to update each field. When you have reached the bottom (press F1 at any time to ship over the remaining fields) the system will prompt:

ENTER A FIELD NUMBER TO CHANGE, <A> TO ABORT, <D> TO DELETE

If you need to make corrections, enter a field number to change and make the changes; you may exit this area now by pressing "A" to abort; or you may delete this order by pressing "D" to delete. Press ENTER to continue.

You'll then be allowed to update, add and delete items on the order.

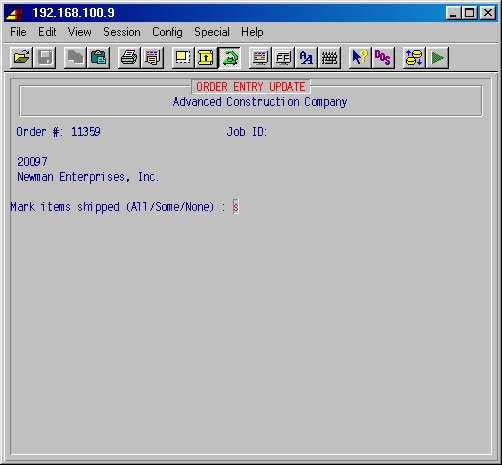

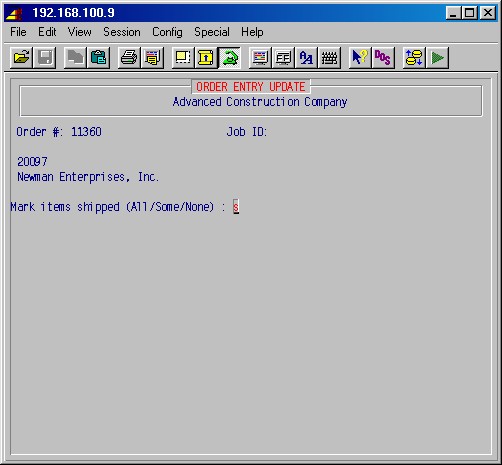

Next, the following screen will be displayed :

If you are shipping all items, press A and ENTER to mark all items as shipped.

If you are not shipping any item, press ENTER.

If you are shipping only some items, type S and press ENTER to select the items. The following is an example of this screen :

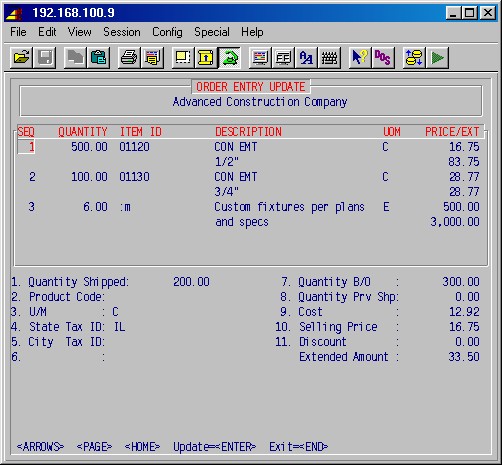

Highlight the item by using the arrow keys and select the item by pressing ENTER. You are primarily marking the quantity shipped on this screen for each item on the order. Other fields may be updated as required. Use your F1 key to accept the current values in the remaining fields and skip to the bottom. In a similar manner, select each item as required to mark the quantity shipped.

When you are finished, press END to exit. The following input screen will be displayed, a portion at-a-time as follows :

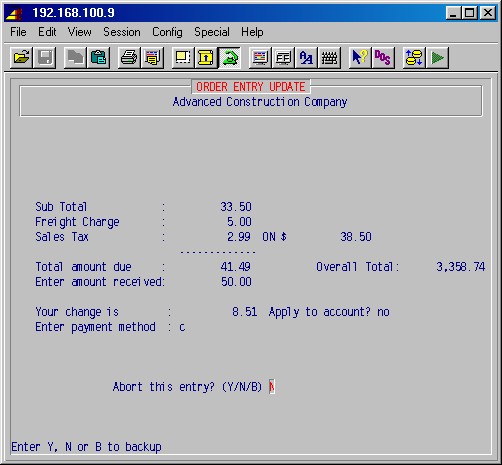

The system will first display the sub-total, prompt for the freight charge and then display the sales tax.

Freight charge

Enter the cost of shipping as applicable and press ENTER.Amount received

Enter the amount received and press ENTER.Enter payment method

Specify how payment is being made and press ENTER.C = cash

CK = check

CC = credit cardThe system will then prompt:

Abort this entry (Y,N,B) N

If you specify B for back, the system will move you back to the item screen where you may make changes. Press Yes to exit without processing this order, and press just ENTER to continue.

The printer selection screen will now be displayed. Specify the printer number and the number of copies and press ENTER. You'll then be prompted:

Print $ amounts:

Answer Yes if you want unit of measure, cost and price for each item; press ENTER.

A shipping/picking ticket will be printed detailing the order as you have marked it in this procedure.

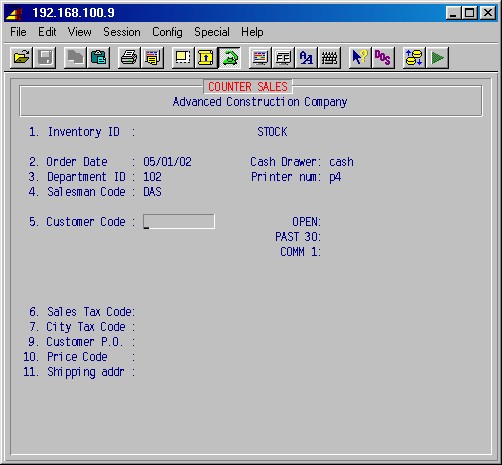

This procedure is used for counter sales where the customer walks up, buys material you have on hand and takes it with him. The material is keyed in by hand or with a bar code reader, an invoice is printed, and the customer pays for the material or it is put on account.

This procedure will first prompt:

Enter default counter sales tax ID:

Enter the sales tax ID for counter sales and press ENTER. The following entry screen will be displayed :

Items 1 through 3 below, plus the default counter sales tax ID above, are set up once each morning for the day as is shown on the screen above.

1. Inventory ID

Normally just press ENTER and the system will default to the main stock inventory. Specify another inventory ID as required.

2. Order date

Today's date is filled in by the system.

Cash drawer

Specify the cash drawer [H] you are using.

3. Department ID

Mandatory. Specify the sales department for this sale.

Printer number

Specify the printer number to print this sales receipt.NOTE: For expediency, the first three fields are filled in for you as you completed the last order. To exit this area, enter the salesman code and press just ENTER for the customer code.

The following fields are then completed for each sale:

4. Salesman code

Mandatory. Specify the salesman's code [H].

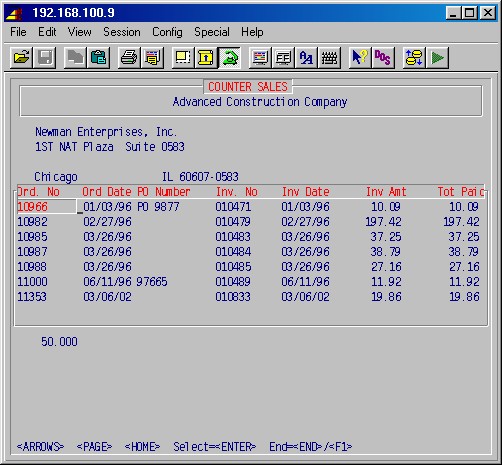

5. Customer code

Mandatory. Specify your customer ID number [H] for this transaction. The system will fill in the name and address, the balance of open unpaid invoices, the balance of late invoices past 30 days, and any comments (comm 1) entered in the customer miscellaneous screen. The system will prompt:CORRECT CUSTOMER (Use F2 to see order history) ? YES

Press F2 to see the order history for this customer (counter sales only. The following is an example of this screen ;

This screen is used for viewing only. Press END or F1 to exit and the system will again prompt:

CORRECT CUSTOMER (Use F2 to see order history) ? YES

Press NO ENTER to exit and start over. If this is the correct customer, press just ENTER to continue and you'll be prompted:

FIELD TO CHANGE, <A> TO ABORT, <U> Update customer, RETURN TO CONTINUE

If you want to change any information on the screen, type its field number

and press ENTER.

To abandon this order, type A and press ENTER.

If you need to correct the customer information, e.g. address, press U

and you'll be allowed to update basic information about the customer.

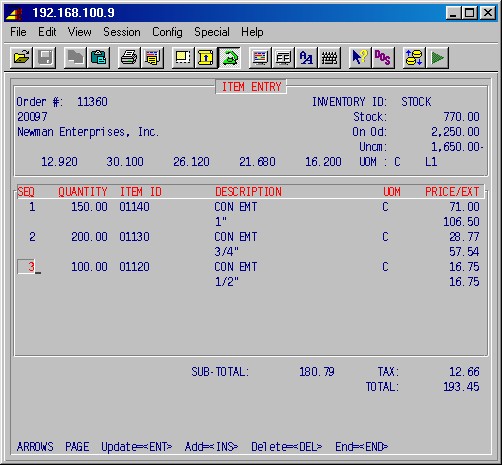

Press ENTER when you are ready to continue and the system will display the following input screen to enter stock items for the sale invoice :

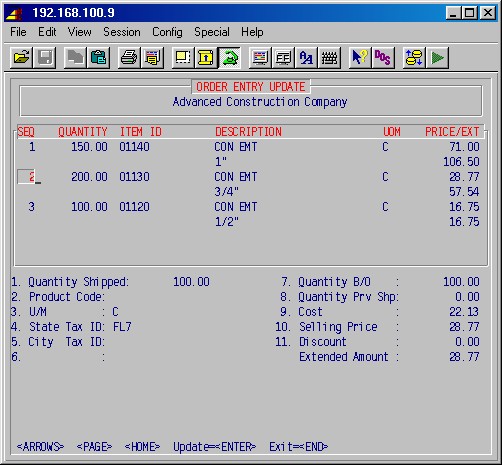

Seq

This is a computer generated sequence number to number each line.

Quantity

Enter the quantity of this item and press ENTER.

Item ID

Type the item ID of this item and press ENTER. If this is a valid item ID, the system will display the description, the unit of measure, and the price and extension. In addition, the values of the various cost and selling prices for this item will be displayed in 5 fields across the bottom of the top box on the screen. These values are:Unit Cost Sell Price 1 Sell Price 2 Sell Price 3 Sell Price 4

If you are entering a :M item, you will also be able to fill in the unit cost and price for this item.

NOTE: If you are scanning items with a bar code reader, the quantity of one (1) and the item description will be entered by the bar code reader as you scan each item.

Description

The description for this item form the inventory record will be displayed here. If this is a :M item, you may enter a two line description.

UOM

The unit of measure for this item will be filled in by the inventory records. If this is a :M item, you may enter the unit of measure.

Price/Ext

These fields are the selling price and the extension amount (quantity x price). A :M item will allow you to enter the cost value and the selling price.

As you are entering items, the system will display a running total of the order, including tax, at the bottom of the screen. When you are finished entering items, press E to end at the next item ID prompt. The system will show you the total of the invoice and allow you to update any of the items if necessary. If required, use the INS, DEL or ENTER keys to add, delete or update any line. When you are finished, press END, and the system will prompt:

If you are shipping all items, press A and ENTER to mark

all items as shipped.

If you are not shipping any item, press ENTER.

If you are shipping only some items, type S and press ENTER

to select the items. The following is an example of this screen :

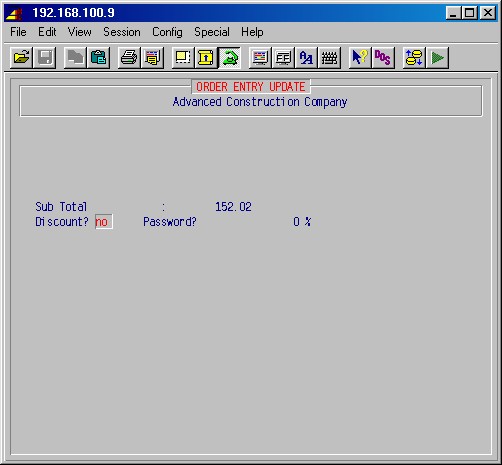

Mark each item for the quantity shipped and press END to exit. The system will now prompt:

If there is no discount, press just ENTER. If you want to give an immediate discount, type YES ENTER. The system will then prompt for a password, which is required to give discounts. The password is tied to each cash drawer and is set in the control records for cash drawers in 13-8-13 Cash Drawers. Enter the password and press ENTER. The system will then prompt for the percentage discount. Enter the percentage in whole numbers (decimals are not allowed) and press ENTER. The screen will now look something like this :

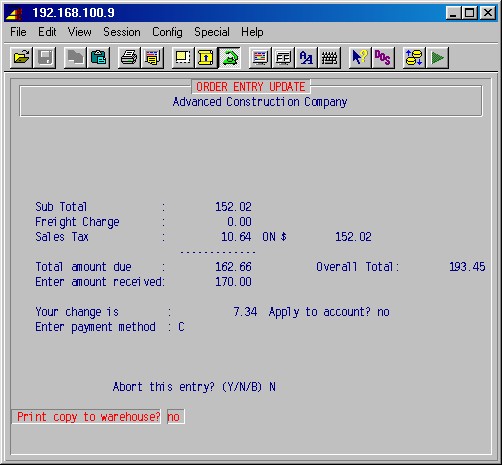

TopSales tax

Sales tax is entered automatically from the default counter sales tax ID specified at the start of this counter sale.Enter freight charge

Type the amount of the freight charge, if any.Enter amount received

Type the amount of funds (cash, check, or credit card) received from the customer.Enter payment method

Specify the payment method as follows:

C = cash

CK = check

CC = credit cardAbort this entry? (Y/N/B) N

Answer YES to abort this counter sale as if it had not happened. Answer Backup to go back to the item entry screen to make changes and then finish the order from that point. Answer No, by just pressing ENTER to continue. The system will prompt:Print copy to warehouse? NO

Here you may print a copy of this order on the printer in the warehouse if your procedures are designed for the warehouse to pull the order. The printer number for the warehouse is tied to each cash drawer and is set in the control records for cash drawers in 13-8-13 Cash Drawers.

Answer YES if required or press just ENTER. Your order will be printed (and the warehouse copy as well, if you answered YES) and you will return to the first screen ready to enter another order.

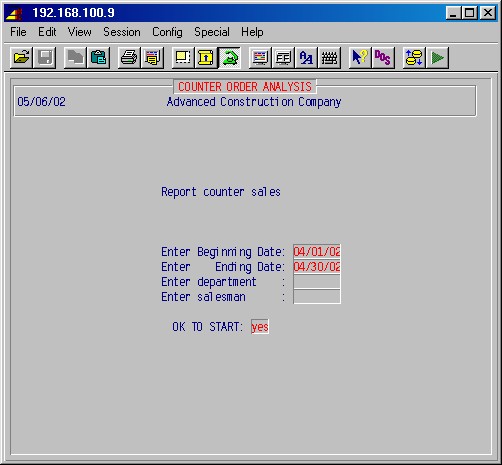

This selection allows deletion of old counter sale orders. It will not delete the accompanying AR invoice(s) for an order. You'll be prompted:

Enter Beginning Date: 01/01/01

Enter Ending Date: 12/31/88

OK TO START DELETE: no

Enter the first and last dates through which you wish to delete counter orders, and answer Yes.

This procedure allows you to reprint order invoices generated from 1-10-1, 1-10-2, and 1-10-3. The system first prompts:

Enter invoice # of Order:

Specify the invoice number of the invoice you wish to reprint.

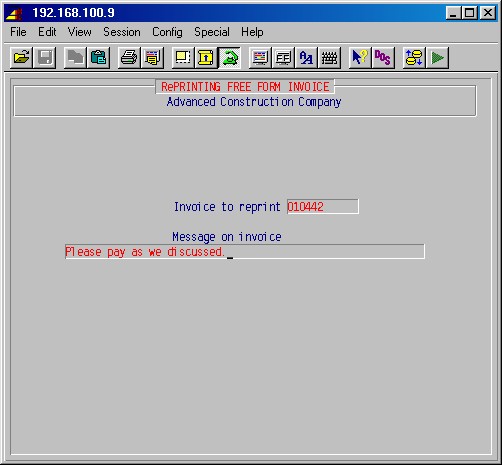

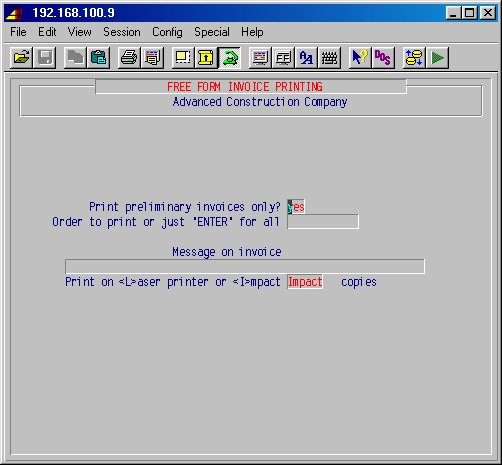

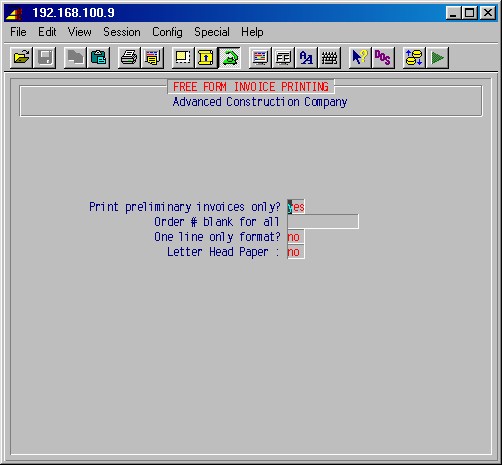

This procedure allows you to reprint an invoice created in free form.

TopThe printer selection screen will next be displayed. Type the printer number and the number of copies and press ENTER.

1-10-8-1 Enter/Update Free Form Billing

FREE FORM ENTRY

This entry/update area allows you to do accounts receivable invoicing in a free-form entry area where you may make descriptions as long or as short as you wish. This procedure provides ways to produce invoices both related to jobs and not related to jobs. There is little forced structure, allowing whatever words of description and dollar amounts are needed to be entered on the invoices. Provision is made for sales taxes and for retainage. Either manual or computer assigned invoice numbers are allowed.

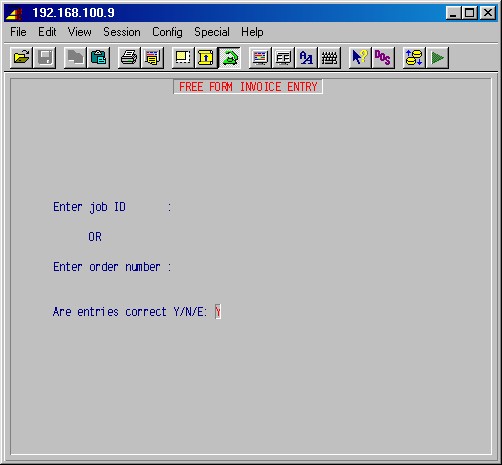

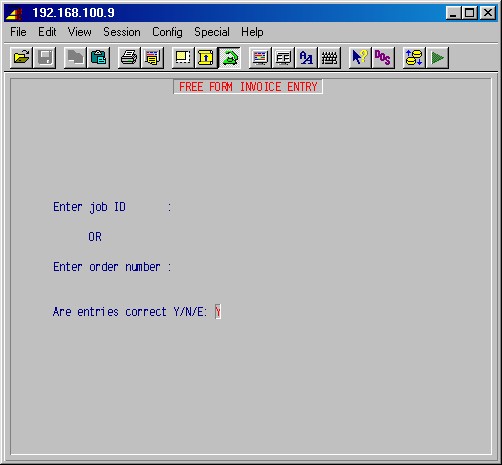

This selection will first display the following input screen:

Enter job ID

blockquote> Optional. If this invoice is job related specify a valid job ID, or leave blank.<.blockquote>Enter order number

If you are creating a new free form invoice leave blank, or specify a SO number as discussed in "1)" below. If you are updating a previously entered free form invoice which has not been printed in final form, enter the order number as discussed in number "2)" below.This order number field is used here for two different functions:

1) Service Order tied to this invoice

Enter a valid SO number (must start with "SO" and 5 or 6 digits) for a service order which you intend to bill through free form. This will cause information previously entered when that service order was created to be entered into the first free form entry screen. On the second screen, after the date and the invoice number are entered, the system will prompt, "Merge work description into invoice". Answering YES will merge the work description only into the invoice. The dollar amounts will need to be entered like a regular free form invoice.2) Updating previously entered free form invoices

At the time an invoice is entered, an order number is assigned by the system. At any time before this invoice is printed in final form, it may be updated and changed by specifying its order number here any making changes. Enter the 5 digit order number which appeared on a preliminary printing, or press F2 to see a list of all invoices by order number, and select the invoice you wish to update by highlighting it with the arrow keys and pressing enter.Are entries correct Y/N/E:

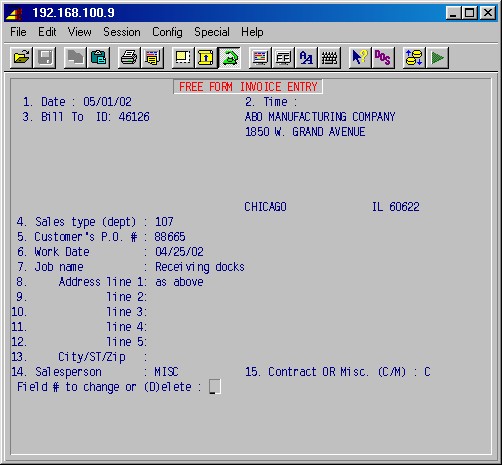

Press N ENTER to correct the job ID or the order number field, or E ENTER to exit this procedure. Press Y ENTER to continue. The following input screen will be displayed :

1 Date

Specify the invoice date; the default is today's date.

2 Time

Not being used at present.

3 Customer ID

If a job was specified, the customer ID associated with that job will be displayed. Otherwise, specify a customer ID and press ENTER. If a valid customer ID was specified, the customer's name and address will be displayed as well as a prompt "yes". If you have chosen the wrong customer, you may now answer NO and change it. As the screen prompts, you may also press F2 to see a list of service orders. Press ENTER to continue.

4 Sales type (dept)

If a job was specified, the sales type associated with that job will be displayed. Otherwise, specify the sales department [H] for this invoice.

5 Customer PO

Optional. You may insert a memo entry of your customer's PO number if you wish.

Fields 6 through 12 are job related and will be filled in by the system if a job was specified. You may complete or update any of these fields as required, or press F1 to skip over them.

6 Work date

Optional. Specify the date the work was done.

7 - 13

Job name and address. This information will already be known if a job was specified.

14 Salesman

Mandatory. Usually this is known from the customer.

15 Contract OR Misc. (C/M):

If you have entered a job ID above, this answer determines whether the billing amount is to be added into the "Billed" totals for the job, or to the separate "Misc Billed" total for the job ("Misc Billed" is not included in the "Job Billed" totals in job cost reports.) This is a way of keeping for example subcontractor work on a job out of the job cost and job profit calculations.

Enter field to change, (D)elete, or <RETURN>

You may now update any of these fields or press D to abort this invoice and return to the previous screen. Press just ENTER to continue to the next screen.

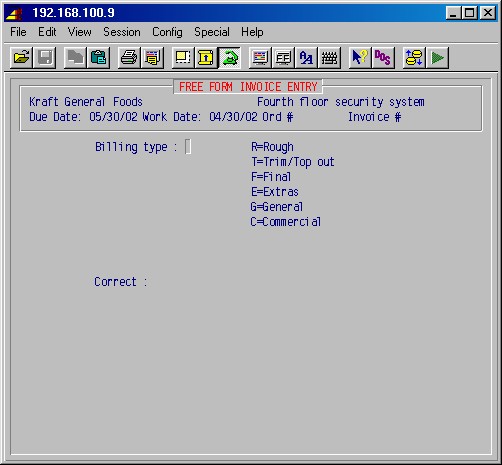

The next screen prompts first for the due date and the invoice number.

Due date

Specify the correct due date as required. If you did not specify a payment terms option in the customer set up, the system will display a due date the same as the invoice date. If you specified terms, the correct due date for this customer will be displayed.

Invoice number

Specify an invoice number or leave blank and the system will provide a unique sequential invoice number.

Order number

System code for this transaction; not user updatable. This is a unique number generated by the system to label this preliminary invoice before it is printed in final form.

If a job was not specified at the beginning of this procedure, you'll go directly to the item entry screen. If a job ID was specified and Residential was specified in 13-8-4, Free Form Setups, the system will next prompt for the type of billing. The screen will look similar to this :

Next select the type of billing. Except for residential applications, always select "G" - general.

Are entries correct : YES

Answer NO to change the billing type or press just ENTER to continue. The system will prompt:

MERGE JOB SCOPE INTO INVOICE:

If you want the words you entered into the job scope area of the job setup to be printed on the invoice, answer Yes here.

CREATE T&M INVOICE:

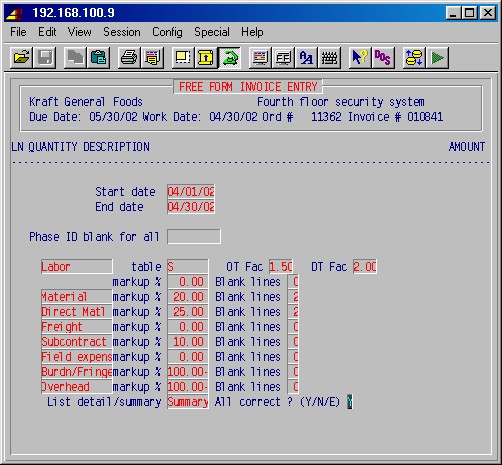

This is an alternate way of billing a job, rather than using AIA (stage) or Unit billing in the job cost module. This step allows you to create an invoice based on actual job cost detail lines (e.g. labor and material and manual cost postings to a job, as shown on 7-12: Job Cost History Report). If you answer No here, you'll go directly to the item entry screen. Answering Yes here displays the following screen:

Start date:

End date:

Enter the date range you wish to bill. Job cost lines will be marked as having been billed, so you would typically leave the start date blank to pick up the earliest unbilled job cost line.

Phase ID blank for all:

If you wish to bill just one phase, enter its ID here.

Otherwise leave blank to bill all phases.Labor table

This table determines the billing rate for labor, and is set up in 2-13: Labor Rate Maintenance. Make sure that you have an entry for each work class used on the job in the table chosen, or the billing rate will be zero!

OT Fac

Enter the overtime factor to be used in billing labor on this invoice.

DT Fac

Enter the doubletime factor to be used in billing labor on this invoice.

Labor markup %

If you want to add an additional percentage to the billing rate in your labor rate table, enter it here, e.g. 30%

Note: A markup % of -100 means that the expense category (Labor, Material, etc.) will be disregarded.

Blank lines

Enter the number of blank lines you want added on your free form invoice, between this category (Labor) and the next category (e.g. to allow for manual additions to the invoice).

Material markup %

Maintenance markup %

Equipment markup %

Subcontract markup %

Other markup %

The names of these phase expense categories may vary from job to job and are set up in 7-1-1 -5: Phase Expense Categories, and may be changed here for the purpose of the text on the invoice.

List detail/summary

Type D if you want each single job cost line listed on the invoice.

Otherwise type S to just have one summary line for each phase expense category.All correct ? (Y/N/E)

Y to proceed.

N to go back and correct the above entries.

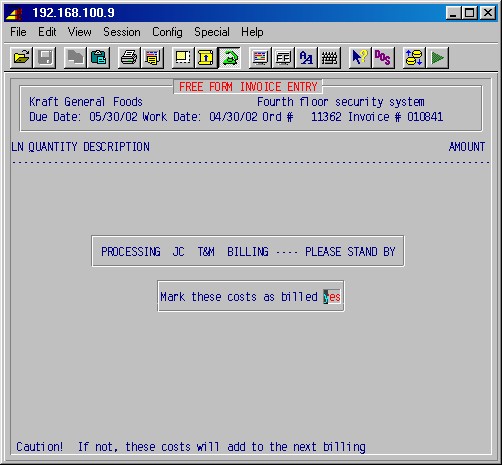

E to abandon automatic creation of lines on the invoice.If you answered Yes you will next see:

Mark these costs as billed

You would normally answer Yes here.

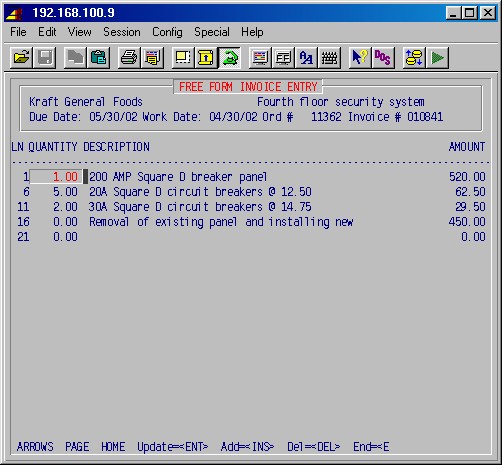

The item entry screen where you specify the item descriptions and the charges is next displayed as follows :

Ln

This is the line number numerically numbered by the system.

Quantity

The quantity is optional. If specified, it can be used to extend a unit price using the "@" sign and the dollar amount per item as in the example above.Description

The description is any words you want to use to describe the work that was done. If you need two or more lines, press ENTER through the amount on this line and move down to the description part of the next line and continue. This description area can also be used to show a unit price which will be extended.To accomplish the extension, use the format "@ NN.NN" where the NN.NN represents the unit price. This unit price must be to the right of any other text on its line. After the extension, if any, the result may be updated manually.

Amount

The amount must be specified here or updated as required.You may update any line as needed by using the ARROW, PAGE and HOME keys to move to that item and press ENTER.

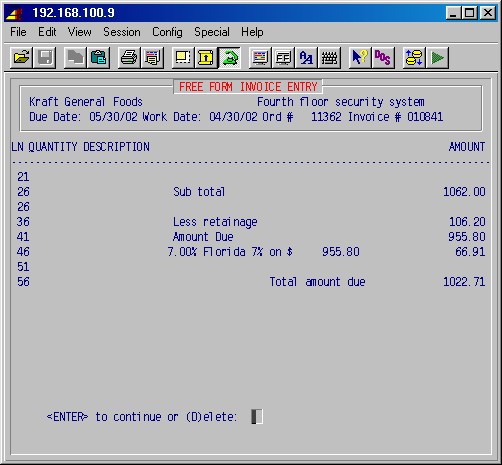

Use the INS and DEL keys to add and delete lines, as needed.When all lines are finished, press END. The system will display the "sub total" and prompt:

Enter retainage % OR <RET> when done :

If this is job related and a retainage percentage is to be deducted from this invoice, enter that percentage here. The "less retainage" will be displayed and may be updated if required.

Next, the "amount due" will be drawn and sales taxes requested.

Enter tax ID code OR <RET> when done :

Mandatory. You must specify a valid sales tax code [H] and press ENTER. The system will suggest the sales tax code entered for this customer in your customer setup, but you can override it here. The system will prompt:

Enter adjusted taxable amount OR <RET>:

Mandatory. The system requires you to apply a sales tax code to all monies in the "amount due" and it won't let you leave this area until you do; however, you may enter multiple lines of sales tax with different amounts as long as the total of the amounts equals the "amount due". The system will suggest for each line of tax the balance left which you may override as required.

NOTE: This feature is generally used when part of the invoice is taxable and part is not. For example, shipping charges are not subject to sales tax in Florida. Specify your normal tax code for the amount due less the shipping, and then XX for the shipping charges. (Note that you can specify if freight is taxable in 13-8-3: Accounts Receivable Customer setup.)

Press RETURN to continue or (D)elete:

You may abort this entire invoice at this point by pressing Delete, or press ENTER to continue and you will return to the first screen to enter another invoice.

FREE FORM UPDATE

This entry/update area allows you to update and make changes to preliminary invoices before they are printed in final form. After they are printed in final form they are not available for update and any changes must be done through additional invoices and/or credit invoices.

You need the invoice order number to access the preliminary invoice for updating. This order number was printed on the invoice if it was printed in preliminary form or may be obtained using the F2 key to display current orders as shown below.

The 1-10-8-1: Enter/Update Free Form Billing selection displays the following input screen:

Press ENTER for the job ID and go directly to the order number.

Enter order number

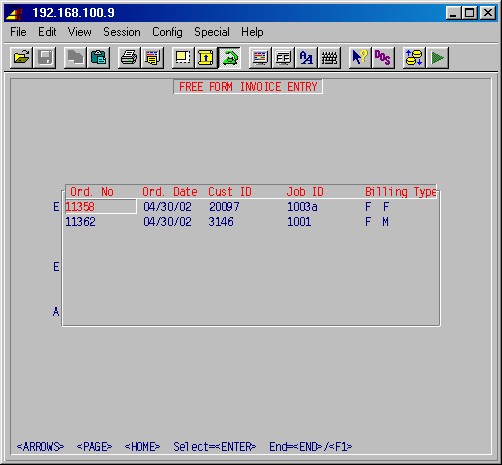

If the order number is known from a preliminary invoice printing, type the number and press ENTER. Otherwise, press F2 to see a list of all invoices by order number, and select the invoice you wish to update by highlighting it with the arrow keys and pressing enter. The following is a sample of what the screen looks like when you press F2:

Are entries correct Y/N/E:

Press N ENTER to make corrections, or E ENTER to exit this procedure. Press Y ENTER to continue.

From this point on, the update function works the same as the original free form invoice entry procedures as explained in detail on page 95 above. Specifically, on the first entry screen, note that you may update any field that you had access to when the original invoice was created and you may void the whole invoice using the Delete function. On the item entry screen, lines may be updated or deleted, and new lines added. The system will then require you to go through the same totaling procedures for retainage, and sales tax.

This update function may be performed as required until the invoice is printed in final form, after which it is not available for update.

1-10-8-2 Enter/Update Overhead Billing

This procedure is similar to 1-10-8-1 above but this step allows a user to bill for service rendered and to apply overhead charges to the bill which are visible to the customer.

First, the system allows you up to four lines of text which will appear on this invoice, starting with "Re:" where you may type any special message you wish for this billing. It is suggested that you start with "Re: Overhead Billing", but you may type anything, or leave blank as required. On the next screen enter the voucher # (or service order #), the amount of labor incurred, and the amount of material used. The program will extend the labor and material values to a total for that line. You may enter as many lines as required. When done entering lines, press END to end. The system will sub-total the lines and then ask for a percentage burden amount. It will default to the percentage burden specified on the job you are billing.

If there is no job, it will default to zero. You may override the default. Next it will ask for the percentage overhead to apply. The default will come from the job again which the user may override. Finally, the system will ask for the percentage fee to apply. The default comes from the job and may be overridden. As the system prompts for the percentages, it applies the percentage on the current running total. So, for example, the overhead percentage will be applied to the sub-total amount plus the burden amount. Next, enter the percentage of retainage. The system will prompt for tax which is applied and then the final amount due displayed.If you want to update this invoice, simply call it up using the order number and walk through it again. This time the numbers will be filled in from the existing invoice and it will allow you to update them.

1-10-8-3Enter/Update No Overhead Billing