From the main menu, if #5 Payroll is selected, this payroll menu is displayed.

The selections on this menu are divided into three groups.

The first group, selections #1 through #7, consists of the file maintenance programs. This is the area where employees names, addresses, social security numbers, etc. are maintained. Information relating to departments, workmen's compensation classes and tax tables is also maintained here.

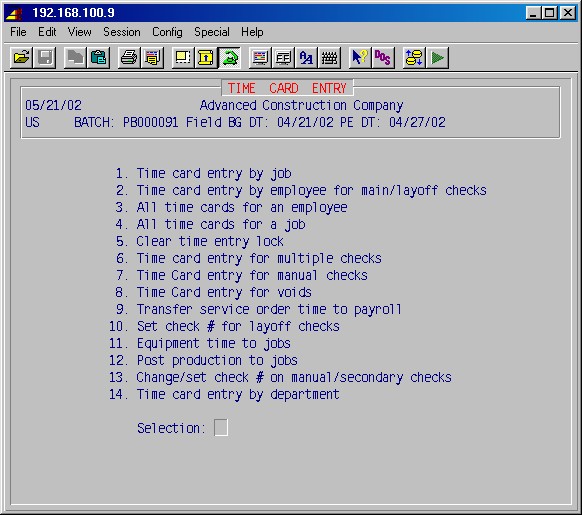

The second group, consisting of selections #8 and #9, is the time entry group. It is here that information from time cards is entered and then printed for verification and editing as necessary.

The third group, consisting of selections #10 through #21, is the payroll processing and reporting group. Here the information entered in step #8 above is processed and eventually printed on checks, distributed to the general ledger and job cost.

Please note: Steps 8 through 11 are preliminary - any data entered may be changed or deleted. Steps 8 through 11 may be run repeatedly until the results are as required. Running step 12 commits the payroll.

The regular weekly payroll cycle starts with step #8 and goes through step #18.

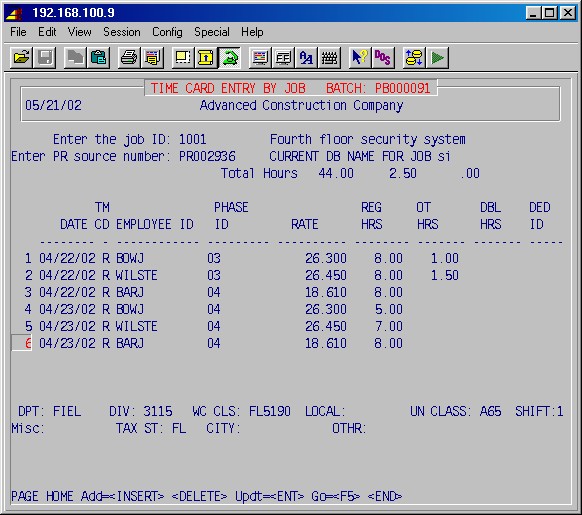

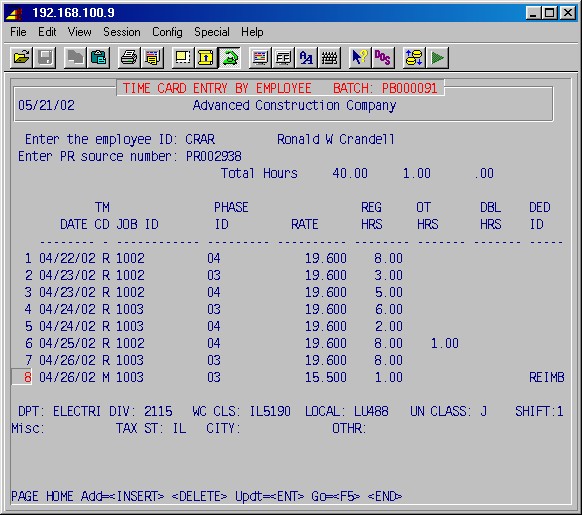

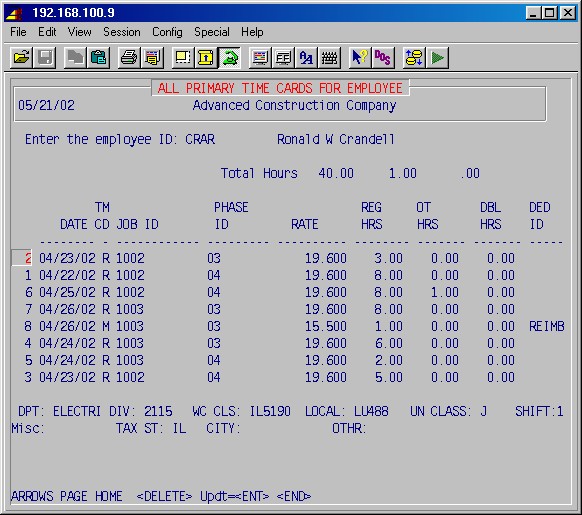

Time can be entered in any order you wish. Time can be posted to several different

jobs or items, different workmen's comp rates and more.

There are several payroll areas that must be set up before you can process a payroll. The following setups must be completed in order:

General setup

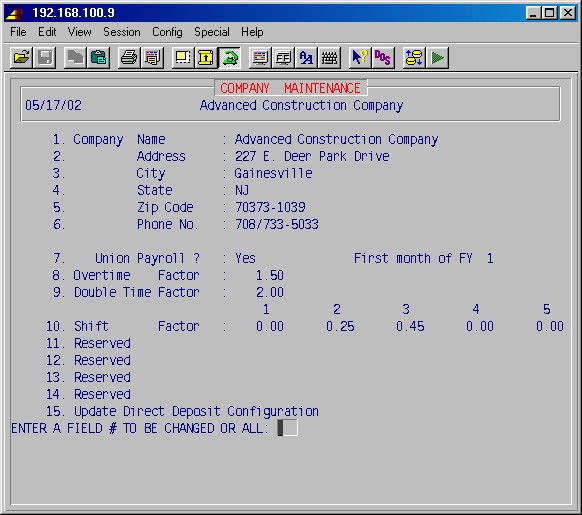

Step 13-1: Client information has several fields related to payroll that must be completed, including the company name and address as it will appear on official reports and bank account information for direct deposit. Selecting 13-1 will display the following input screen :

1-6. Company name, address, & phone

Complete these fields with your company's name and address as you wish them to appear on all reports and transmittals. This address will appear on W2s, magnetic media, and all union, governmental, and other system reports.

7. Union payroll? First month of FY

Answer YES if this is a union payroll. This will cause union areas to be accessible for input and payroll will be processed as a union payroll.

Specify the first month (1-12) of your fiscal year (FY). This is a GL setup, but must be completed because it controls the accounting.

8. Overtime factor

Specify (as a decimal) the hourly pay factor for overtime pay. Example: Overtime pay is typically one and one-half times the normal hourly pay and would be entered as 1.50.

9. Double time factor

Specify (as a decimal) the hourly pay factor for doubletime pay. Example: Doubletime pay is typically two times the normal hourly pay and would be entered as 2.00.

10. Shift factor 1 2 3 4 5

Specify, if applicable, the shift premium (extra pay per hour), you pay for employees working different shifts. This is entered as a dollar amount (Example: 25 cents per hour is entered as 0.25) and may be entered for up to five shifts. The amount is added to the employee's basic rate at time card entry.

11. Reserved

12. Reserved

13. ReservedThe next three fields are for direct deposit only and may be left blank if you are not using the direct deposit feature of payroll.

NOTE: #14 and #15 should be left blank unless you are utilizing the direct deposit feature

14. Company direct deposit account # Bank ID:

Enter your bank account number (generally your payroll account number) from which direct deposits from payroll will be deducted. The bank ID number is the nine digit bank routing number which identifies your bank to the banking system. This number is on your checks or you may call your bank for the proper number.

15. ACH receiving bank ID

Enter the nine digit bank routing number for the ACH (automated clearing house) bank ID. This is the bank where your bank will send the direct deposit deducted from your payroll account for routing to your employee's bank. This bank number must be obtained from your bank.

Miscellaneous Pay & Deductions

Step 5-3-1: Deduction Maintenance is used to create a list of all possible employee deductions, miscellaneous pay, reimbursements and company overhead categories.

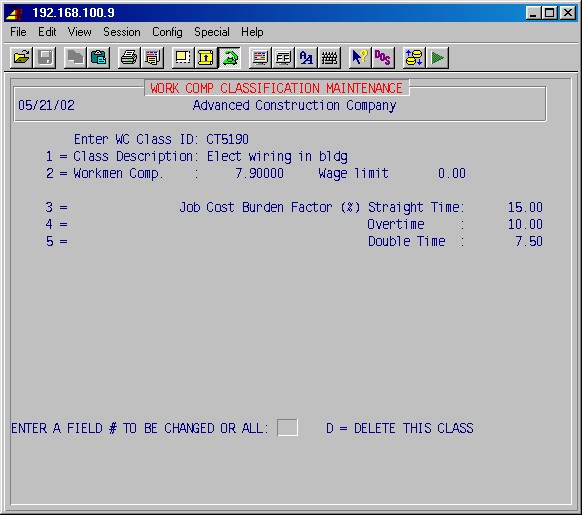

Work Comp Classifications

Step 5-4-1: Work Comp Classification Maintenance is used to input the work comp classification codes and rates for your employees.

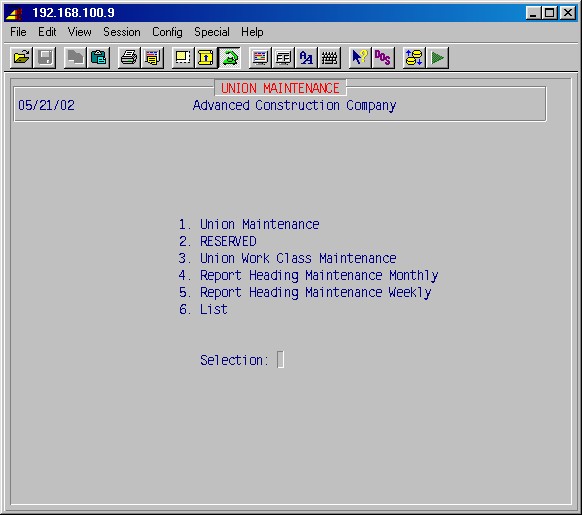

Union Maintenance

Step 5-4-3-1: Union Maintenance is used to input the master files for each union.

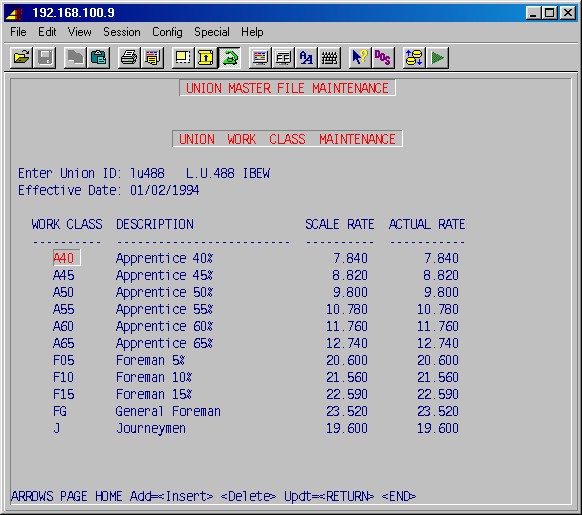

Union Work Class

Step 5-4-3-3: Union Work Class Maintenance is used to input union work class information.

Union Contribution

Step 5-4-3-2: Contribution Maintenance is used to input the union contributions for each union entered above.

Payroll Departments

Step 5-5-1: Department Maintenance is used to set up the various payroll departments and the general ledger numbers associated with each department, which control the accounting.

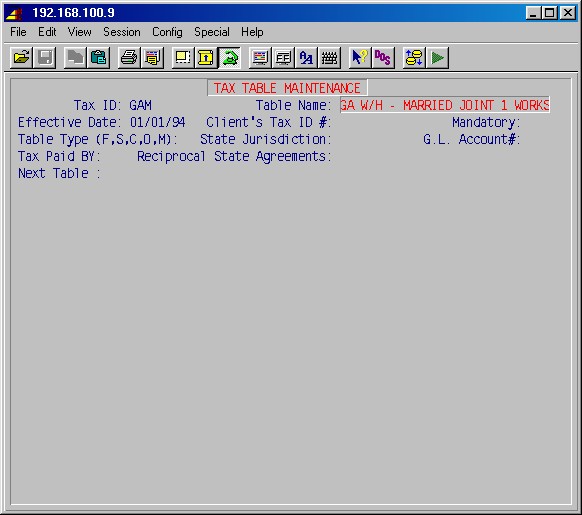

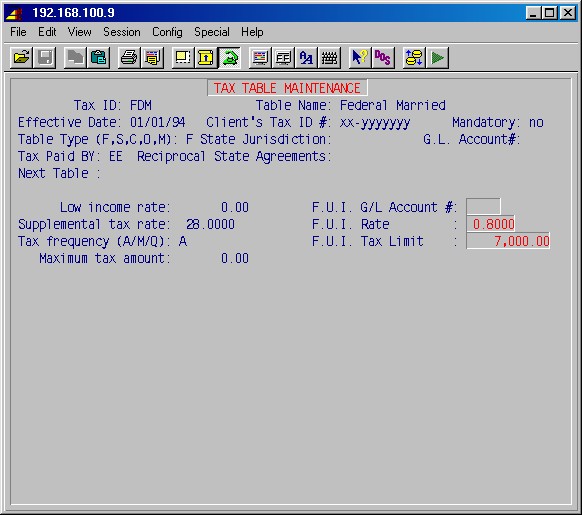

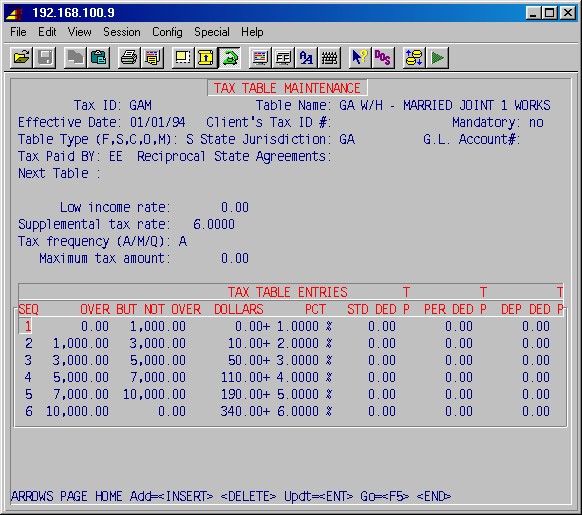

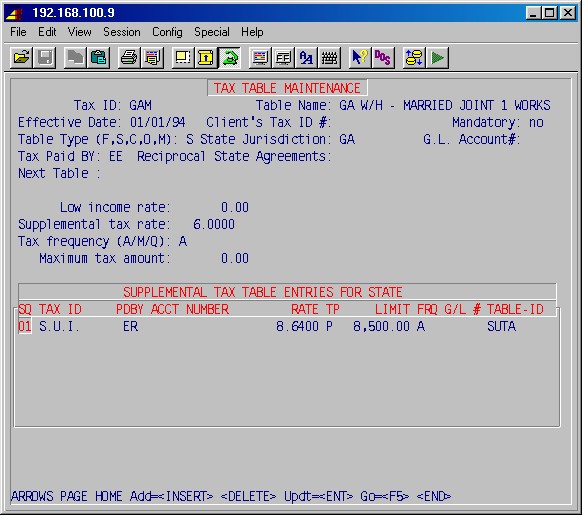

Tax Tables Setup

Step 5-7-1 Tax Table Maintenance must be used next to maintain tax tables for federal, state, and local taxes. Note that the FDM and FDS (Federal) are the master tax tables from which the system pulls various information. In addition to federal tax table information, the federal tax ID for all federal reports including W2s, magnetic media, and direct deposit, as well as the FUTA percent and limit are pulled from these tables. It is essential that all information on these tables be accurate.

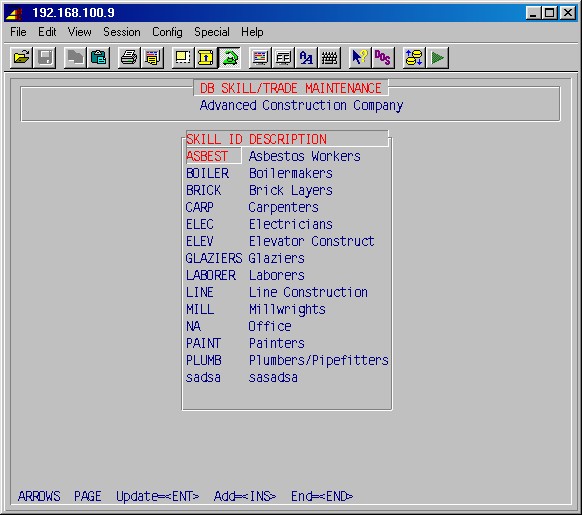

Davis-Bacon Skill Setup

Step 5-7-6: Davis-Bacon Skill Maintenance must be done.

Employee Information

Step 5-1-1: Employee Maintenance is where employees are set up and most employee information is entered.

Employee Deductions

Step 5-3-2: Employee Deduction Maintenance may now be used to enter each employee's deductions and miscellaneous payments.

Time Entry Setup

There are several options for time entry which must be set before you process a payroll for the first time. These are set according to your preference and company policy, and are normally set once at installation and not changed again.To access this setup screen, go to the main menu and choose #13 Utilities, then #8 Control record maintenance, then #8 Time card entry/tax control.

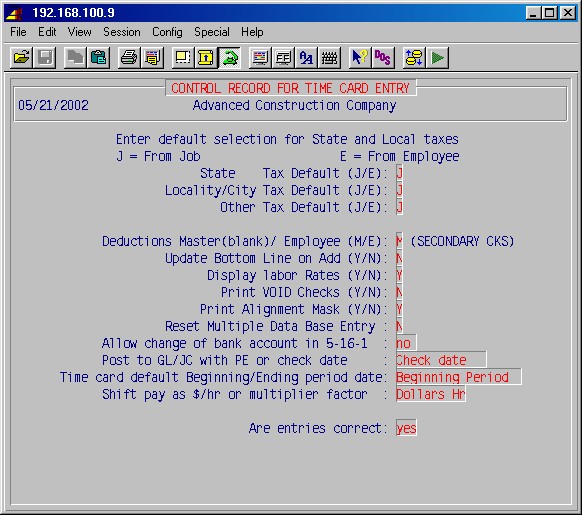

Selecting 13-8-8: Time Card EntryTax Control, will display the following input menu :

State tax default (J/E):

Specify whether you want the location of the job, or the home state of the employee to control the taxes. If your jobs are primarily in one state, you will generally set this to Employee. If your jobs are in several states, you will generally set this to Job.Locality tax default (J/E):

This is similar to the state tax default option above. If your jobs are in different localities that have local taxes, set this option to Job. If not, set it to Employee.Other tax default (J/E):

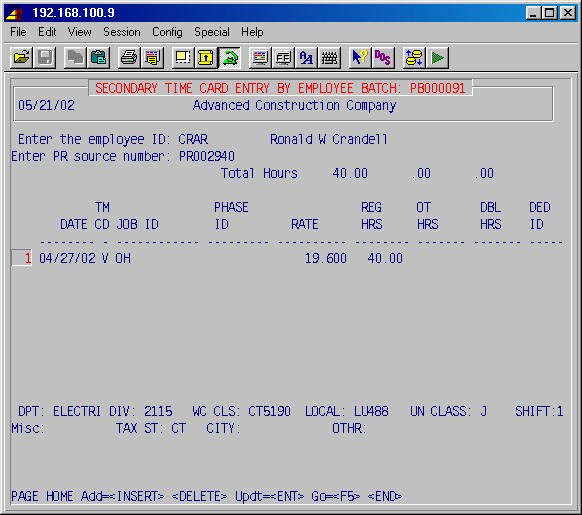

This is similar to the state tax default option above. If your jobs are in different localities that have local taxes, set this option to Job. If not, set it to Employee.Deductions from master or employee (M/E):

This option relates to secondary or multiple checks created in step 5-8-6.It is often necessary to omit or change all or some of the normal deductions, as entered in 5-3-2: Employee Deduction Maintenance, on a secondary check. This requirement necessitates the use of a deduction screen if you are writing a secondary check.

This deduction screen may either be a complete listing of all possible deductions with no amounts from the Master list in 5-3-1 Deduction Maintenance, or the Employee deduction record for this employee with the amounts per regular pay period, from 5-3-2: Employee Deduction Maintenance.

Update bottom line on ADD (Y/N):

The time entry screens have a horizontal line of fields on the lower third of the screen to input information for department, class and union information, shift, and tax state. These fields are filled in with information from the master files.If you often need to change any of these fields in time entry, set this option by typing Yes. This will allow you to access these fields in the normal Add mode when you are doing time entry.

If you seldom change these fields, set this option to No. This will cause the cursor to skip over these fields in the Add mode. They may be changed, but only in the Update mode.

Display labor rates (Y/N):

This option allows you to omit the labor rates from time card entry fields to maintain confidentiality of employee pay rates. If you set this to No, you can have operators enter time without revealing pay rates to them.Print VOID checks (Y/N):

This option gives you the choice of printing void checks. This is a matter of preference, sometimes for internal control purposes. If you set this to Yes, you will have a paper check to account for each check number.Print Alignment Check: (Y/N):

This specifies whether option to print alignment check is offered during check printing.Are entries correct: YES

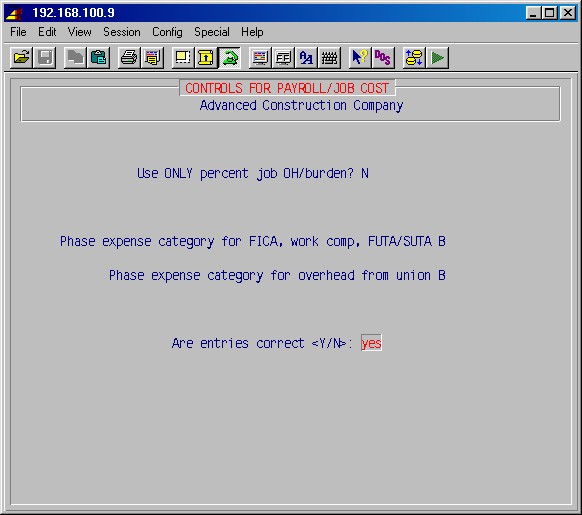

If you need to make changes, type NO ENTER and make your corrections. Otherwise press just ENTER.Selecting 13-8-5: Payroll to Job Cost Burden/Fringe/Overhead, will display the following input menu :

Use only percent job OH/burden? N

If you want to use a fixed percentage of payroll for job overhead/burden cost, rather than actual cost (FICA, work comp, FUTA/SUTA, Medicare, Company Overhead, etc.) type Y and press ENTER. The system will prompt:Percent job OH/burden 0.00

Phase expense category for OH/burden B

Enter the percentage and phase expense category (one of L, M, N, C, E, S, O or B, as viewed in 7-1-1-#5).

Please note that the choice of these categories is a company policy issue.Otherwise just press ENTER, and the system will prompt:

Phase expense category for FICA, work comp, FUTA/SUTA B

Phase expense category for overhead from union B

Enter the phase expense category to be used for each.Are entries correct <Y/N>: yes

If you need to make changes, type NO ENTER and make your corrections. Otherwise just press ENTER, and the system will prompt:

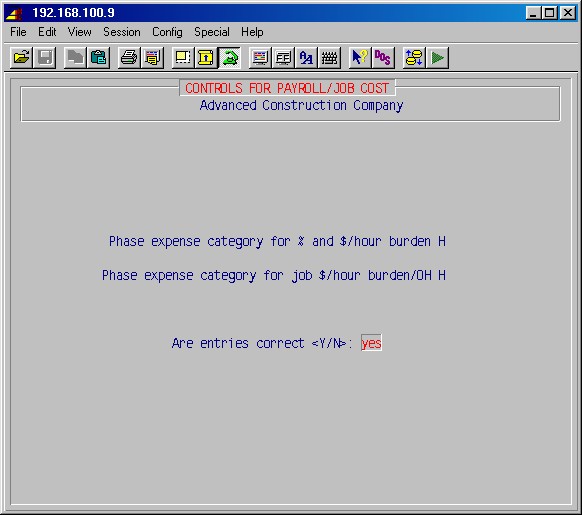

Phase expense category for % and $/hour burden H

Phase expense category for job $/hour burden/OH H

Enter the phase expense category to be used for each.Are entries correct <Y/N>: yes

If you need to make changes, type NO ENTER and make your corrections. Otherwise just press ENTER, and the system will prompt:

Phase expense category union fringes H

Enter the phase expense category to be used for union fringes.Are entries correct <Y/N>: yes

If you need to make changes, type NO ENTER and make your corrections. Otherwise press just ENTER three times until you return to the main menu.

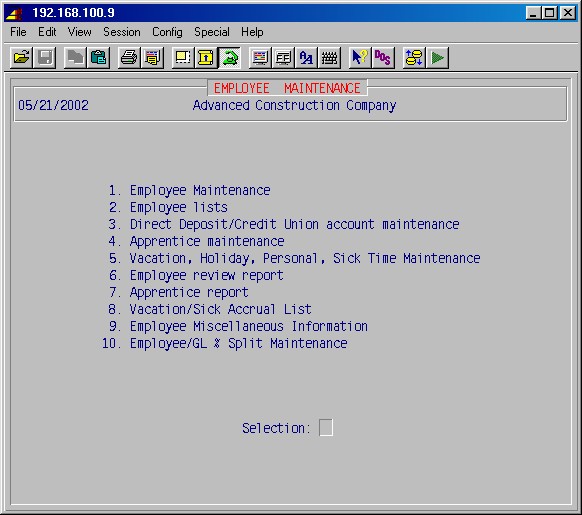

The procedures in this area allow adding, modifying, viewing or deleting employee records. Selecting 5-1 Employee Information from the payroll main menu will display the following menu (to change confidential status type all):

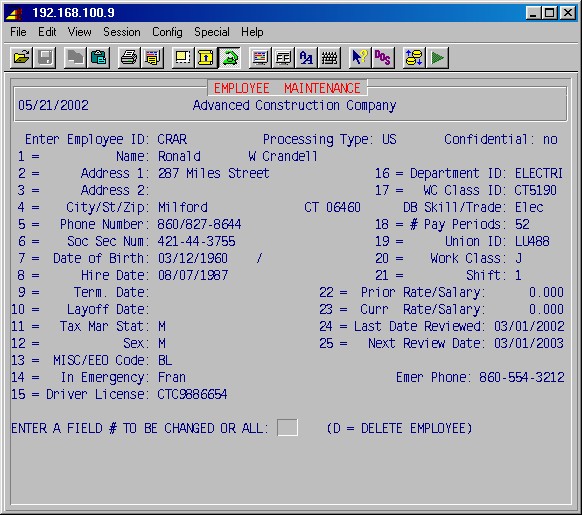

This selection will display the following input screen :

Enter Employee ID:

This is a unique ID which you specify to identify your employee to your company. You may use any combination of letters or numbers up to 12 characters long (sufficient for social security numbers which are sometimes used). If an employee already exists with this ID, the system will display the information on file for this employee.

Processing Type:

Specify type of payroll, US or Canadian.

Confidential:

Specify whether this employee is part of the field or confidential payroll. Employees specified as confidential are not available for maintenance or time entry unless operator is authorized to access confidential payroll.

1 = Name:

Type the employee's first name, middle initial (if any), and last name.

2 = Address 1:

Must be filled in.

3 = Address 2:

Optional second address line.

4 = City/ST/Zip

Type the city, state, and zip code. Entering the zip code will automatically enter the city and state. Note: No comma should be entered after the city.

5 = Phone number:

Type the employee's telephone number - optional.

6 = Soc sec num:

Type the social security number - mandatory. Required to be unique - no two employees may have the same SSN.

7 = Date of birth:

Type the birth date - optional.

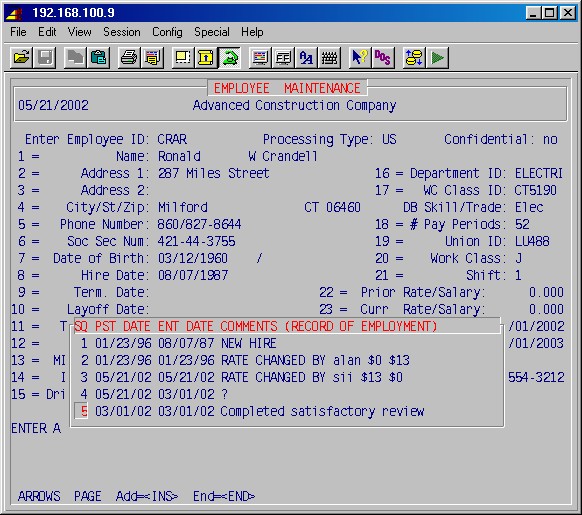

Fields 8, 9, 10, 23, and 24 give access to Record of Employment for the employee. The Record of Employment is an automatically created list of hires, fires, reviews and pay changes:

You can use the ARROW, PageUp, PageDown and HOME keys to scroll through the entries, as needed. Press INS to add a new line, or END to leave this screen.

8 = Hire date:

Type the date the employee was hired.9 = Term. date:

Type the date of termination - use only if the employee is really terminated.

If a terminated employee is rehired, merely change the termination date to a "?" to reactivate. This area MUST be filled in to allow you to "delete" an employee.10 = Layoff date:

Type the date the employee was layed off. If a layed off employee is rehired, merely change the layoff date to a "?" to reactivate.11 = Tax mar stat:

Type M or S -marital status for federal tax purposes.12 = Sex:

Type Male or Female as needed.13 = Misc/EEO code:

This field may be used for a miscellaneous or minority code (up to two spaces), as needed for EEO reporting. Enter minority codes only. Normal minority codes are:

Ca Caucasian

BL Black/African American

HS Hispanic

AS Asian American

AI American Indian14 = In Emergency:

Type the person and phone number to call in case of emergency.15 = Driver License:

Type the driver license number - optional.16 = Department ID:

Specify the accounting department normally used for this employee. If the department ID is in doubt, press the space-bar to scroll the existing department IDs; then press ENTER to select the one you want.Specify the work comp class ID normally used for this employee. If the class ID is in doubt, press the space-bar to scroll the existing work comp class IDs; then press ENTER to select the one you want.DB skill/trade:

The DB skill/trade is the Davis-Bacon Skill Description to be reported on certified payroll reports. This is a required field; if this is an office employee or other employee who will never appear on a certified report, enter NA. Skill IDs must be set up first in 5-7-6: Davis-Bacon Skill Maintenance, before they may be entered here.18 = # Pay periods:

Specify the number of pay periods per year. (Example: 52 designates weekly pay).19 = Union ID:

Type the union number, as needed.20 = Work class:

Specify the union work classification, as needed. This work class will be reported on the certified payroll in combination with the Davis-Bacon skill in #17 above.21 = Shift:

Specify shifts 1 through 5, as needed. Normally 1. Using shifts from 2 to 5 will pay the employee the additional dollars/hour specified in 13-1: Client Information, #10.22 = Prior Rate / Salary:

Type, as needed, the hourly pay rate or salary prior to the last review.23 = Curr Rate / Salary:

Type the current hourly pay rate or salary - mandatory unless the pay rate is controlled by a union. If a salaried employee will have time charged to jobs, the equivalent hourly pay rate must be entered here.24 = Last date reviewed:

Type the date of last performance/salary review, as needed.25 = Next review date:

Type the date of the next performance/salary review scheduled, as needed.ENTER A FIELD # TO BE CHANGED OR ALL: D = DELETE EMPLOYEE

1. Press ENTER to accept the information as shown and continue to the next screen.

2. Type ALL and press ENTER to update all of the fields, including type of PR and confidential specification.

3. Select a field number from 1 to 25 and press ENTER to update a specific field.

4. Type a D and press ENTER to delete the employee.NOTE: This delete employee only works now, before a payroll is processed for this employee.

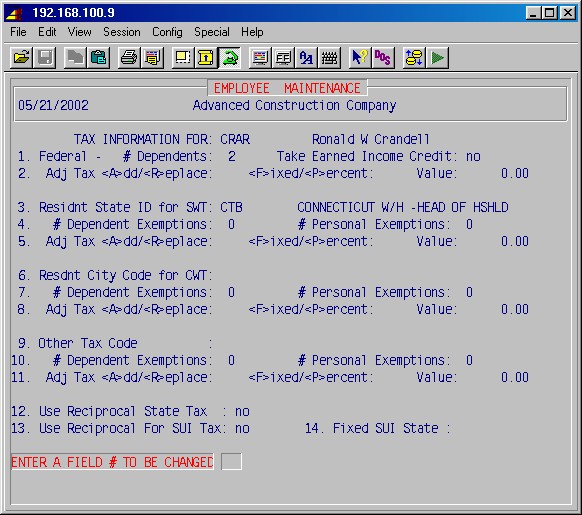

When you have completed all of these fields, press ENTER and the next set of input fields will be displayed as follows :

1 = Federal - # Dependents:

Type the number of dependents claimed by the employee on the W4 form for federal taxing purposes. If no tax is to be withheld, specify an Adjustment to tax of zero, and Replace in the next step.

Take Earned Income Credit:

Enter Yes if employee is to take Earned Income Credit, as entered in the tax tables. Otherwise No.2 = Adj tax:

If the employee wishes to have additional federal tax withheld, or wishes to replace the tax-table calculated federal tax with a fixed amount or a percentage, specify the method here. Specify <A>dd to or <R>eplace the tax table calculated tax, using a <F>ixed amount or a <P>ercentage of gross.NOTE: If your state has no income tax, then skip steps 3 through 5 below, which do not apply to you.

3 = Residnt state ID for SWT:

Type the code assigned to this employee's state of residence for state withholding tax.4 = # Dependents / personal exemptions:

Type the number of dependents and/or personal exemptions claimed by the employee for state income tax purposes.5 = Adj tax:

If the employee wishes to have additional state tax withheld, type the additional amount per pay period here. Specify <A>dd to or <R>eplace the tax table calculated tax, using a <F>ixed amount or a <P>ercentage of gross.NOTE: If you have no city or local income tax, then skip steps 6 through 8 below, which do not apply to you.

6 = Resdnt city code for CWT:

Type the code assigned to this employee's city or locality of residence for local income tax.7 = # Dependents / personal exemptions:

Type the number of dependents and/or personal exemptions claimed by employee for city or local income tax purposes.8 = Adj tax:

If the employee wishes to have additional city or local tax withheld, then enter the additional amount here. Specify <A>dd to or <R>eplace the tax table calculated tax, using a <F>ixed amount or a <P>ercentage of gross.NOTE: If you have no other county or local income taxes, then skip steps 9 through 11 below, which do not apply to you.

9 = Other tax code:

Type the Tax ID for any other county or local income tax to be withheld from this employee.10 = # Dependents / personal exemptions:

Type the number of dependents and/or personal exemptions claimed by employee for this tax.11 = Adj tax:

If the employee wishes to have additional "other" tax withheld, then enter the additional amount here. Specify <A>dd to or <b>eplace the tax table calculated tax, using a <F>ixed amount or a <P>ercentage of gross.12 = Use reciprocal state tax:

If YES, takes work state taxes instead of home state taxes, even if states have reciprocal agreements. See table below.13 = Use reciprocal SUI tax:

If YES, takes work state taxes instead of home state taxes, even if states have reciprocal agreements. See table below.Fields 12 and 13 only take effect if states have reciprocal tax agreements. Taxes are calculated as determined in the following table (using states MI and WI as examples):

14 = Fixed SUI state:

If a state is entered here, that state is used for all SUTA taxes calculations. If left blank, the table above determines SUTA tax calculations.ENTER A FIELD # TO BE CHANGED OR ALL:

1. Press ENTER to accept the information as shown and continue to the next screen.

2. Type ALL and press ENTER to update all of the fields.

3. Select a field number and press ENTER to update a specific field.When you have completed all of these fields, press ENTER and the next set of input fields will be displayed as follows :

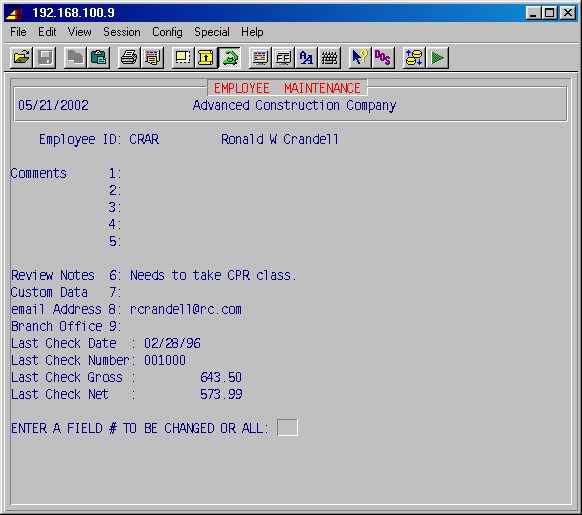

Comments 1: through 5:

Here you may write comments or notes regarding this employee.Review notes 6:

This may be used for one line of notes concerning this employee's review. This note will print on the Employee Rreview Report (5-1-6).Custom data:

This is a screen of user defined data entry areas which may be set up in step 13-8-16 (PR).The following fields are strictly informative and are updated each time payroll is processed.

Last check date:

Last check number:

Last check gross:

Last check net:The above fields may not be updated here and are simply a convenient place to review this last check information for a specified employee.

When you have completed fields 1 through 6, press ENTER and the first employee maintenance input screen will be displayed ready to specify another employee ID.

At this point, you may input another new employee or make changes to an existing record, or simply press ENTER to leave this area and return to 5-1: Employee Information Menu.

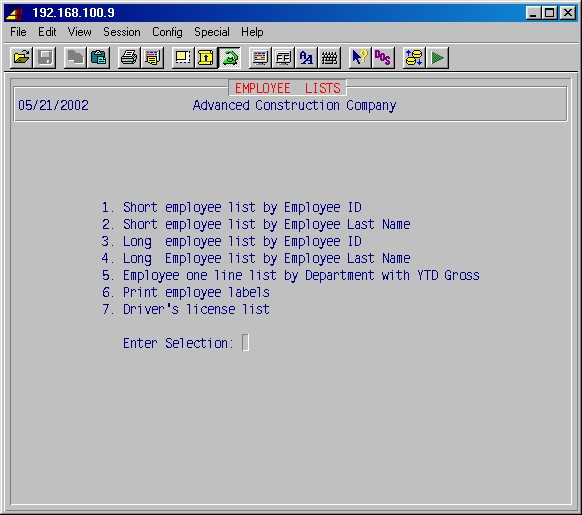

These selections will print various lists of employees organized by employee ID or employee last name. This selection will display the following menu:

This procedure will print, for one or more departments, an abbreviated list of employees by employee ID, listing the full name, address (if desired), phone number, social security number, department, WC class, hire date, and termination date.

If the standard report is specified then select to design your own report, or use the standard report.

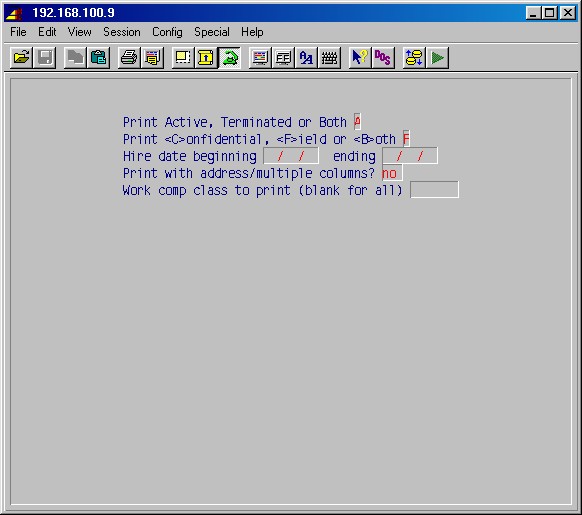

Selecting this procedure will display the printer selection screen. Type the printer number and the number of copies and press ENTER. You will then be asked:

Top

Print Active, Terminated, or Both

The default is Active employees presently on the payroll. You may also print only terminated employees by specifying Terminated, or Active and Terminated by specifying Both.Print <C>onfidential, <F>ield or <Both>

This question is normally answered Both. The other two choices are not used by most companies.Print with address/multiple columns?

The default is names-only with no addresses. If you want to print addresses also, type YES.Work comp class to print

Enter a workman's compensation class if you want to limit the list to one class. Otherwise leave blank for all.Enter departments to print or <ALL>:

You may specify one or more departments by typing in the name of the departments or simply type ALL to print all employees in all departments.Are entries correct:

Verify the entries and press ENTER. Your report will now be printed and you will return to the 5-1-2: Employee Lists Menu.

This procedure will print, for one or more departments, an abbreviated list of employees, alphabetically, by employee last name, listing the full name, address (if desired), phone number, social security number, department, WC class, hire date, and termination date.

Selecting this procedure will display the printer selection screen. Type the printer number and the number of copies and press ENTER. Next, specify which groups of employees you wish to print as described in 5-1-2-1. Your report will now be printed and you will return to the 5-1-2 Employee Lists Menu.

This procedure will print, for all departments, a detailed list of employees, by employee ID, which includes all required information entered in 5-1: Employee Maintenance.

Selecting this procedure will display the printer selection screen. Type the printer number and the number of copies and press ENTER. The system will the prompt:

TopPrint Active, Terminated or Both <A/T/B>:

The default is Active employees presently on the payroll. You may also print only terminated employees by specifying Terminated, or active and terminated by specifying Both.

Print Confidential, Field or Both <C/F/B>:

This question is normally answered Both. The other two choices are not used by most companies.

Work comp class to print

Enter a workman's compensation class if you want to limit the list to one class. Otherwise leave blank for all.

Your report will now be printed and you will return to the 5-1-2: Employee Lists Menu.

5-1-2-4 Long employee list by employee last name

This procedure will print, for all departments, a detailed list of employees, alphabetically, by employee last name, which includes all required information entered in 5-1 Employee Maintenance.

Selecting this procedure will display the printer selection screen. Type the printer number and the number of copies and press ENTER. Next, specify which groups of employees you wish to print as described in 5-1-2-3 above. Your report will now be printed and you will return to the 5-1-2: Employee Lists Menu.

This procedure will report of specified employees by department, one line per employee, showing the employee ID, name, YTD gross earnings, department, hire date, and termination date, if any. Options include: active/terminated/both, confidential/field/both, all/select work class, and all/selected departments.

Print with address/multiple columns

Answering Yes to this will print employee address/phone labels in 3 columns across.

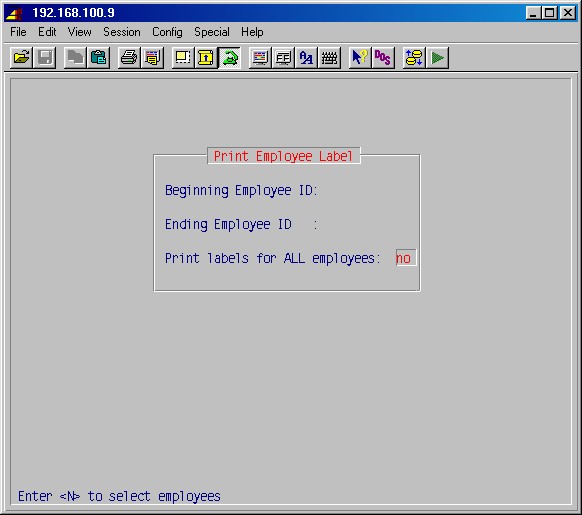

Beginning Employee ID:

Enter ID of the first of a range of employees or leave blank to exit or to start with the first employee. If you leave it blank you'll be given the option to exit the program here.Ending Employee ID:

Enter the ID of the last of a range of employees or leave blank to use all employees from the beginning ID.Print labels for ALL employees:

If you answer Yes here, labels for all employees in the selected range will be printed, regardless of their status.

Answering No here will prompt:Change these options as needed to select the status of the employees you want to print labels for.

Then, when the printer and number of copies have been selected, the labels will print and you'll be returned to the 5-1-2: Employee Lists Menu.

If you chose to design your room own report, these selections are avaliable:

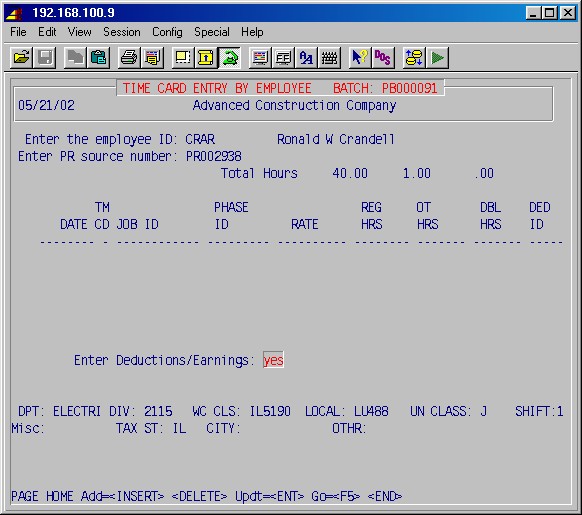

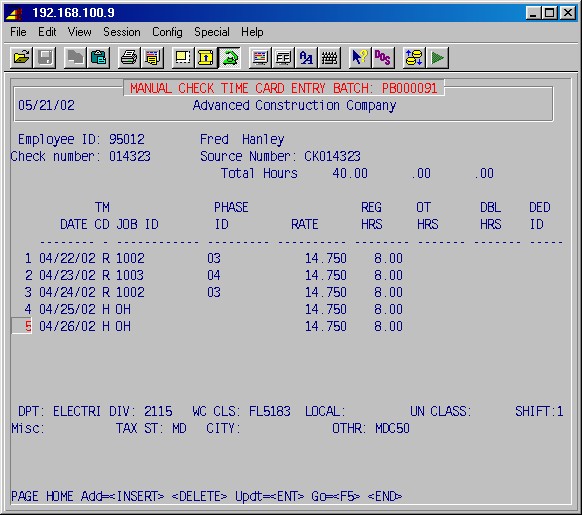

This step is used to input information for two procedures:

Direct Deposit to Checking or Savings

This procedure allows you to input one or more of an employee's bank checking

accounts or savings account(s) number(s), and other related information

to enable direct deposit of specified amount(s) of an employee's pay directly

to his bank(s) using the Automated Clearing House (ACH) services of the

banking system - if this is set up on your system. This setup and dialing

out procedure is unique for each company. Before you can complete this step,

you need to set up a deduction ID for direct deposit in 5-3-1.

For direct deposits, all of the fields below must be completed.

NOTE: Direct deposit also requires fields #14 & #15 to be completed in 1-13-1: Client Information, and tax table FDM must have a valid federal ID number.

Credit union deductions

This procedure allows you to input credit union account number(s) to enable

deductions for credit union(s). For credit union deductions, the bank account

field must be completed (with the credit union account number) and the rest

of the fields left blank. These accounts numbers will print out on the 5-17-10:

Credit Union Deduction Report.

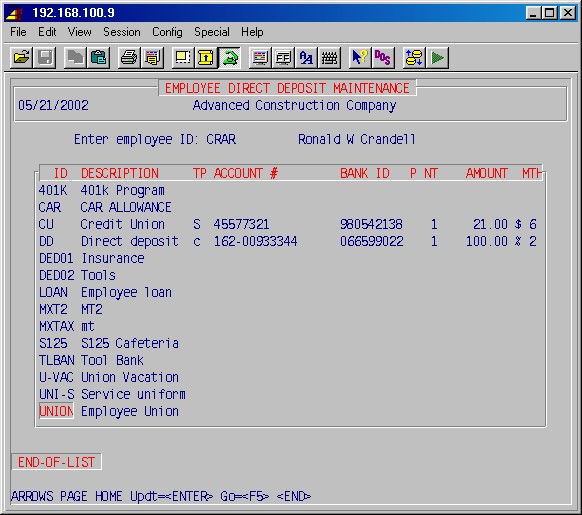

This selection will first prompt you for the employee ID [H]:

Enter The Employee ID:

Type the employee ID and press ENTER and the system will display the following screen :

Use ARROW, PAGE and HOME keys to scroll/select a deduction.

Press ENTER to update the fields for deductions, as applicable:

ID

This is the Deduction/Earnings ID, as entered in 5-3-1: Deduction/Earnings Maintenance.

Description

The deduction/earnings description, as entered in 5-3-1: Deduction/Earnings Maintenance.

TP

Specify the type of account. Leave blank for credit union. The C or the S is what activates the system for direct deposit.C = Checking

S = Savings

blank = Credit union

Account #

Type either the bank checking or savings account number or the credit union account number for this employee deduction/direct-deposit and press ENTER.

Bank ID

Bank routing ID for direct deposit. Leave blank for credit union. For direct deposits to checking or savings, specify the complete bank routing number for the employee's bank account. This must be a nine digit number.

P NT

Pre-note counter. Begins 0, shows number of times dummy data has been sent with direct deposit for a new account. Actual direct deposit begins only when the pre-note counter is 2.

Amount

Enter the deduction or direct deposit percentage or amount. If the next field (MTH) is 2 then the figure is a percentage of net pay. If the MTH field is 6, then the figure is a fixed dollar amount.

MTH

Enter 2 for percentage of net pay, or 6 for a fixed dollar amount.

Press END when done with this employee.

You may now type another employee ID or press ENTER again to return to the previous menu.

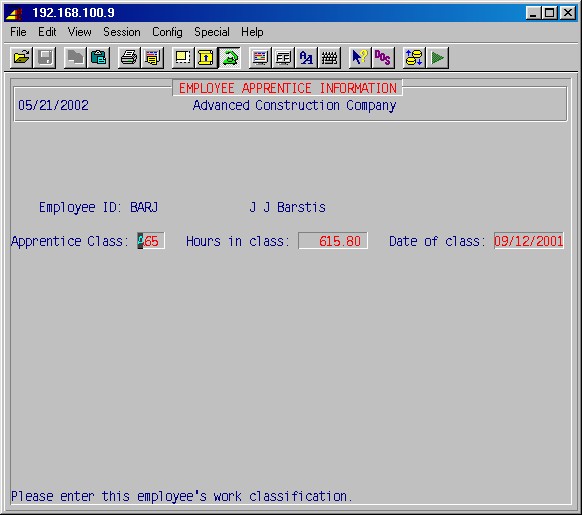

This procedure will allow you to maintain a running total of employee's hours in apprentice classes.

Selecting this procedure will display the following input screen :

Employee ID

Type the employee ID [H] and press ENTER.

Apprentice class

Type the employee's work classification and press ENTER.

Hours in class

When you first input an apprentice class in this area, it is necessary to reset the number of hours to zero. Simply type 0 and press ENTER.This field will be updated each pay period from the payroll system and will show a running total of the hours accumulated in this work class. These hours will continue to accumulate until the apprentice class is changed and the hours reset to zero.

Date of class

Type the date the employee started in this work class and press ENTER.

You may now type another employee ID and repeat the procedure for that employee, or simply press ENTER to return to the payroll system main menu.

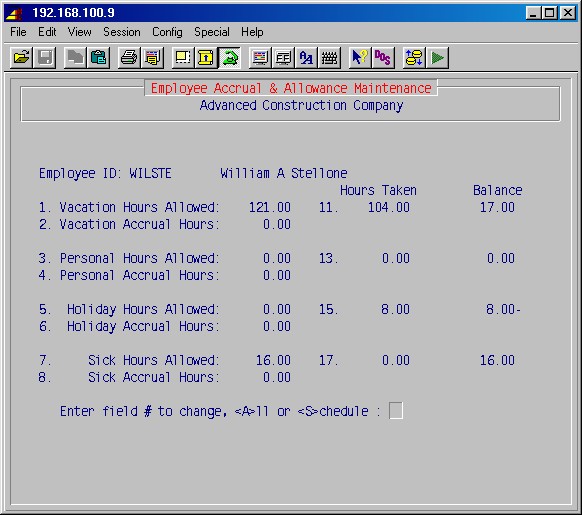

This procedure will allow you to maintain a record of vacation, personal, holiday, and sick time allowances for each employee, and review the number of hours of each taken, and the balance of time remaining in each category.

You will input, for each employee, the number of hours allowed and the number of hours that accrue per pay-period for each of these four categories.

The field for hours taken will be updated each pay period from the payroll system and will show a running total of the hours accumulated in each of the four categories. The running balance of hours allowed in each category will be computed and displayed in the balance field.

This selection will display the following input screen :

Employee ID

Type the employee ID and press ENTER.The fields for hours allowed and accrual hours in the vacation, personal, holiday, and sick leave categories are normally entered when an employee is hired, and adjusted at events when these allowances change, in accordance with your personnel policies (i.e. after probation period, after one year of service, promotions, etc.).

You may change all fields at once by pressing All ENTER, or type the number of the field you wish to change and press ENTER.

Hours allowed

Type the annual number of hours allowed to this employee at this time for vacation, personal time off, holidays, and sick leave in accordance with your personnel policies, union contracts, or terms of employment.Accrual hours

Type the number of hours that accrue on a per-pay basis for each of these categories that have "hours allowed" filled in.EXAMPLE: If an employee is eligible for a two week vacation (80 hours), and he is paid weekly (52 pay periods per year), then the vacation accrual hours for that employee is 1.54. (# hours divided by # pay-periods).

When all fields have been entered, press ENTER and you will be prompted for another employee ID. You may now type another employee ID and repeat the procedure for that employee, or simply press ENTER to return to the payroll system main menu.

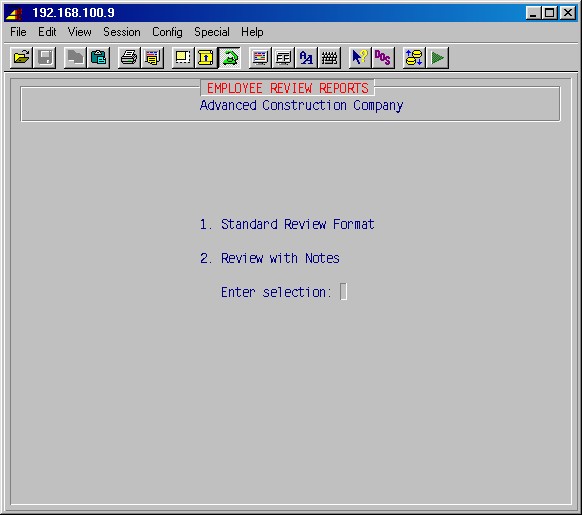

This procedure will print a report of all employees whose "next review dates" fall in a specified date range. The report will show the employee ID, full name, social security number, department, review date, and present rate of pay.

Selecting this procedure will first display the printer selection screen. Type the printer number and the number of copies and press ENTER. The screen will then prompt:

Beginning review date / /

Ending review date / /

Specify the period of time for which you want a report of next review dates by typing a beginning and ending review date, pressing ENTER after each entry.

Your report will now be printed and you will be returned to the payroll system main menu.

This procedure will print a report by employee ID of all employees for which you are monitoring apprentice classifications. The report will show the employee ID, full name, class, date of class, and number of hours. You may print the report for a particular work class or all work classes.

This selection will first prompt:

Enter work class to be reported or hit <ENTER> for all: _____

Specify a particular work class or just press ENTER to print all classes.

Next, the printer selection screen will be displayed. Type the printer number and the number of copies and press ENTER.

Your report will now be printed and you will return to the payroll system main menu.

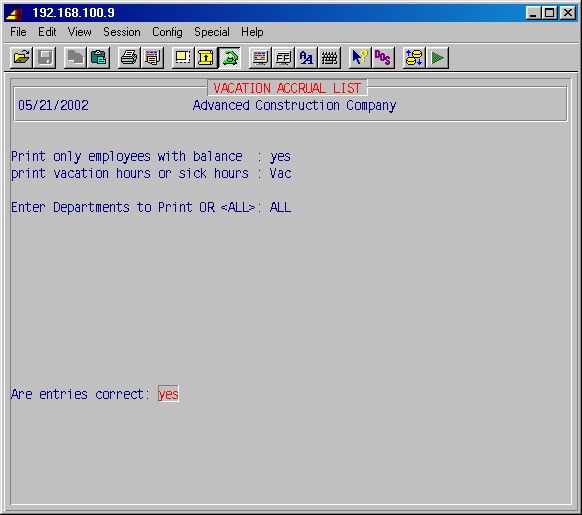

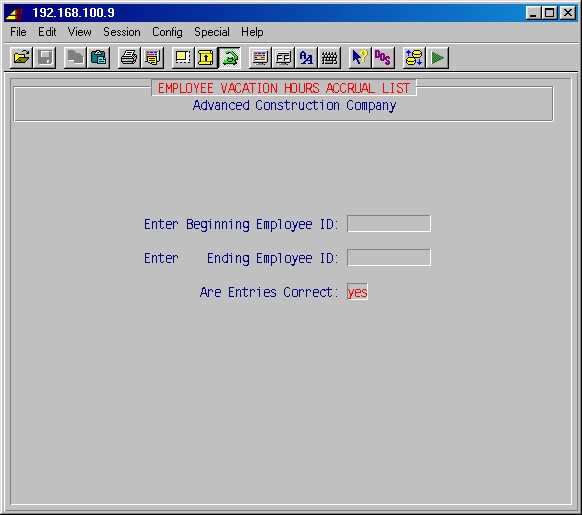

This procedure will print a report by employee ID of vacation time accrued, taken, and unused for one or more departments. The report will show the employee ID, full name, accrued vacation time, vacation time taken, balance, rate, and the liability (dollar value of the vacation time accrued but not taken).

Selecting this procedure will first display the following input screen:

Top

Enter departments to print or <ALL>:

You may specify one or more departments by typing in the name of the departments or simply type ALL to print all employees in all departments.Are entries correct:

Verify the entries and press ENTER.Next, the printer selection screen will be displayed. Type the printer number and the number of copies and press ENTER. Your report will now be printed and you will return to the payroll system main menu.

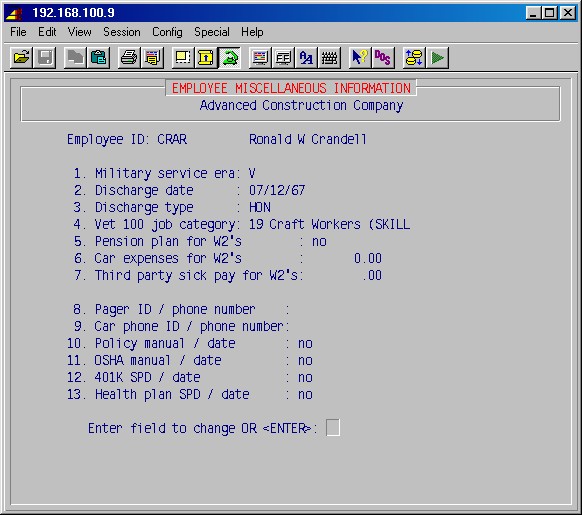

Use these entries as needed. Choices #5, #6, #7 are operator entered and used with W2s.

When in field #4 (Vet 100 job category), you can press F2 for a

list of valid categories.

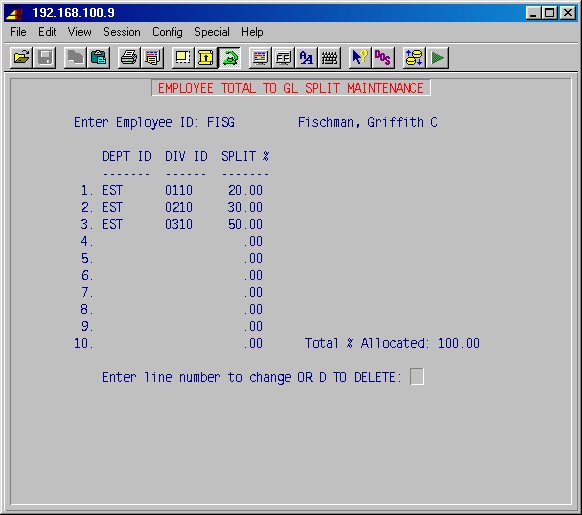

This procedure is a set up area which allows you to split an employee's payroll cost between two or more departments/divisions on a percentage basis. The system will first pay the employee in his "home" department, then step 5-16: Distribute to GL, will re-allocate the cost among the GL accounts of the departments as you have specified in this procedure.

This selection will display the following input screen:

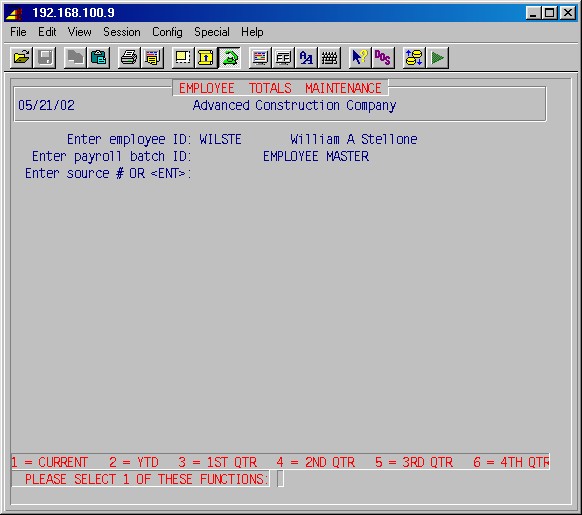

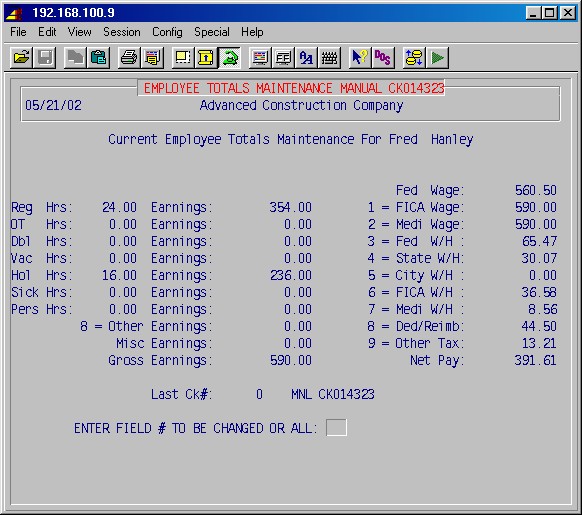

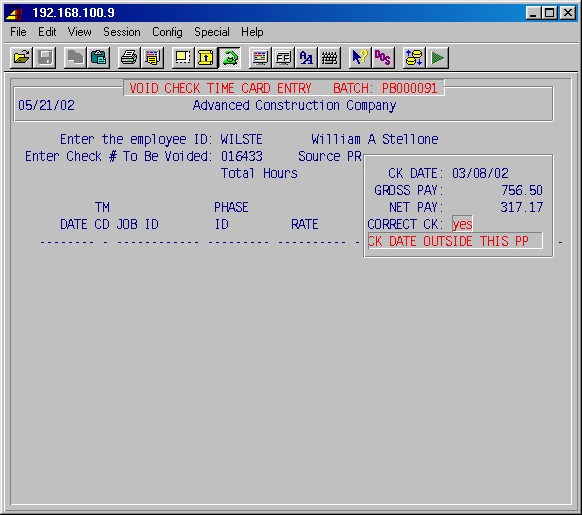

The following procedures allow viewing and updating of employees' current week, year-to-date (YTD) and quarterly totals. You may also make changes in the withholding and deduction amounts on these various screens.

This area is used primarily to adjust tax withholding and deduction amounts when the system is first set up or when paying bonus checks. This will be explained more fully in 5-8: Employee Time Entry.

CAUTION: If you change any deduction after step 5-10: Process Payroll has been run, you must run step 5-10 again.

Any changes made to an employee's totals here do not change the employee's history records, and thus should be used with caution.

This selection will display the following input screen :

Enter employee ID

If just ENTER is pressed the system will return to the payroll system main menu.Type the employee's ID [H] for whom you wish to update totals. Only valid employee IDs are accepted. If the employee ID entered is valid, the system will display the employee's name.

Enter payroll batch ID

To access the current totals for a certain payroll, enter the payroll batch ID, or leave blank for the employee's master records for the quarters and YTD.

Enter source # or <RET>

For secondary and void checks, type the source number here. For the employee main records, just press ENTER.

A menu will be displayed on the bottom of the screen with the following options:

| 1 = CURRENT | Displays current week employee totals (this is only available when a batch is entered) |

| 2 = YTD | Displays year-to-date employee totals |

| 3 = 1ST QTR | Displays 1st quarter employee totals |

| 4 = 2ND QTR | Displays 2nd quarter employee totals |

| 5 = 3RD QTR | Displays 3rd quarter employee totals |

| 6 = 4TH QTR | Displays 4th quarter employee totals |

Select one of these menu items for the totals you wish to view or adjust. For

illustration we will look at selection 2 = YTD as follows :

You may now make adjustments to the Hrs column, the Earnings column or one of the nine numbered fields:

1 = FICA Wage:

2 = Medi Wage:

3 = Fed W/H:

4 = St W/H:

5 = City W/H:

6 = FICA W/H:

7 = Medi W/H:

8 = Deducts:To update the figures in the Hrs column, enter H

To update the figures in the Earnings column, enter E

or specify the field from 1 through 8 you wish to change,

and press ENTER.

For fields #1, #2, #3, #6, and #7,simply type the new figure and press ENTER. You may now choose another field to change or just press ENTER.

For fields #4, #5 and #9, the following input screen will be displayed :

These selections allow you to correct or change the state and/or city tax paid and the gross earnings related to those taxes. Type the new figure and press ENTER, or just press ENTER to leave unchanged. When you are finished, press END and you will return to the previous screen.

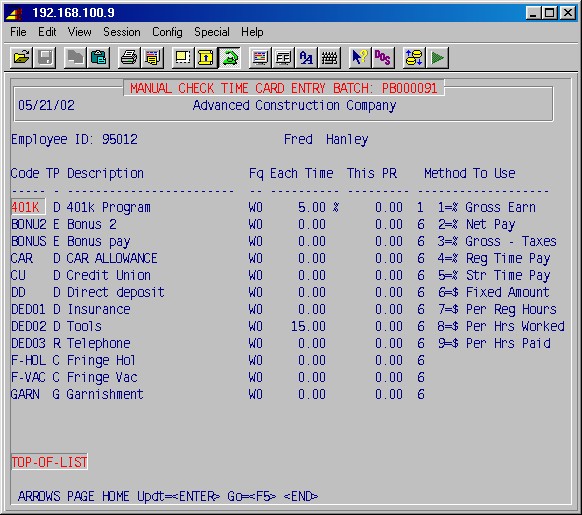

For field #8 for the current payroll, the following input screen will be displayed :

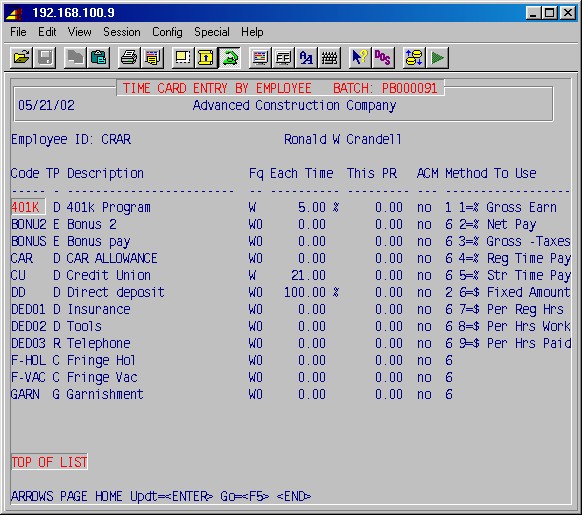

This screen is similar to the employee deduction setup screen in payroll 5-3-2: Employee Deduction Maintenance with the additional column, "this PR". This will show you all deductions, the deduction amount, and the frequency previously set for this employee in 5-3-2, and, if you have run step 5-10: Process Payroll, the amounts scheduled to be deducted for this payroll.

This selection may be used to change a deduction amount for this payroll for the batch specified.

If you to change the deduction amounts for this payroll only, add or

change figures only in the "this PR" field.

You may now select other fields to change or correct or just press ENTER again.

The screen will again display the bottom menu of employee totals as described above (current, YTD, 1st QTR, etc.). You may select another to view or update in the same manner as was just detailed, or simply press ENTER and return to the first screen in this procedure where you will be prompted for another employee ID.

To exit this area, simply press ENTER again and you will return to the payroll system main menu.

NOTE: You must re-process step 10 after any changes to deductions, and must NOT re-process step 10 after any changes to taxes!

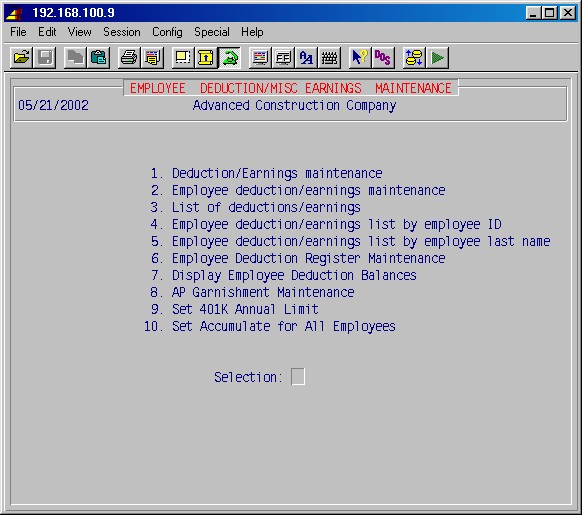

The following procedures allow adding or modifying employees' miscellaneous pay and deductions. This selection will display the following menu:

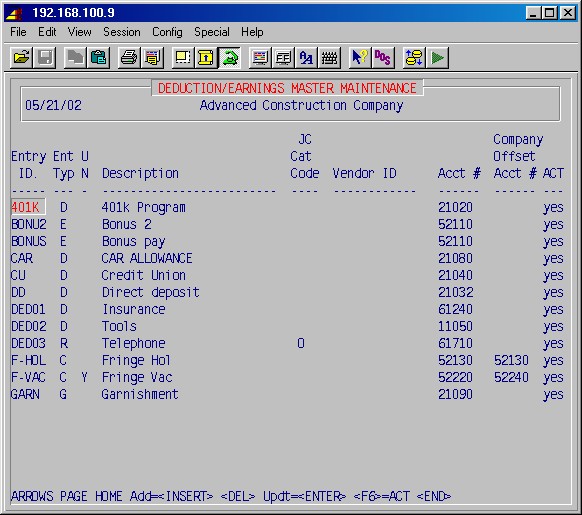

This procedure is used to build a list of all possible deductions used by employees. Not every deduction will be used by every employee. This area is also used to make entries for miscellaneous non-taxed reimbursements such as tolls and phone calls.

This selection will display the following input screen :

TopAdd new deductions as needed.

Deduct ID

Type the ID (up to 5 letters or numbers) to be used for this deduction. While just numbers may be used, try to make the ID meaningful. For example:LOAN - for deductions made to repay a loan made to an employee

S125 - for deductions made under the S125 plan of the IRS (cafeteria plan)

INS - for deductions made for insurance plans

UNIF - for deductions made for uniform services

REIMB - for reimbursements to be made to employees for expenses paid by them

CU - should be used for credit union

401K - 401K plan deductionsNOTE: Deduction IDs for 401K or S125 MUST begin with the letters 401K or S125.

You can make entries in the tax tables (5-7-1) for variations you may wish to use

(For example: you may wish to designate S125A, S125B, etc.). 401K loans must NOT begin 401K. An example: L401K would be acceptable as a 401K loan ID.Deduction type

(C)=CMPY OVH Company overhead accrual (used for JC and GL only) (D)=DED Normal deductions (E)=EARN Miscellaneous earnings added to gross for W2s (R)=REIMB Reimbursement for employee expenses added to net pay, not on W2s (G)=GARNISH Garnishments and/or tax levies maintained in the garnishment processing U N

Answer Y only for those types of deductions which are loaded by the union calculations.Description

Type a short description of this deduction or reimbursement.NOTE: In the case of a 401K or a S125 plan, or any similar pre-tax benefit plans, setup in the tax tables may be required.

Cat code (Used only for reimbursements)

Specify the job cost category for this deduction if it is not labor and leave blank for labor.NOTE: These are examples. These may not be the names used on your system.

M =

Material O = Other N/C = Consumables B = Burden/Fringe E = Equip. Rental H = Overhead S = Subcontract Vendor ID (Not used at present)

Acct # (CREDIT)

Specify the general ledger account to credit with this deduction (or debit as in the case of miscellaneous non-taxed reimbursements such as tolls and phone calls).Company offset account # (DEBIT)

Used only for accruing company fringe or overhead, not deducted from employee. This fringe or overhead IS charged to the jobs on which the employee worked on a proportionate basis.ACT

Specify Yes if the deduction is currently to be used (Active), or No to disable the deduction for all employees.Use the END function to exit this procedure.

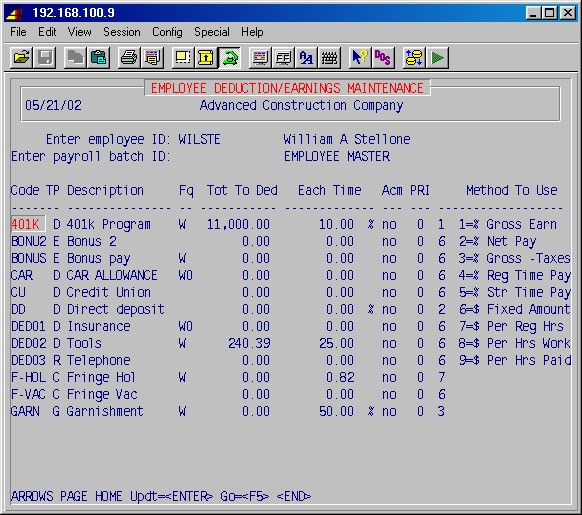

This procedure is used to designate the individual employees' deductions for the frequency, and the amounts to deduct. You may set the frequency and amounts either for the employee master file which will affect all future payrolls, or specify a payroll batch, which will affect that batch only.

CAUTION: If you change any deduction in a specified batch after step 5-10: Process Payroll has been run, you must run step 5-10 again.

Employee ID

Type the employee ID [H] for which you wish to input or update employee deductions. If the employee ID entered is valid, the system will display the employee's name and all available deductions and reimbursements.Payroll Batch ID

Leave this blank if you want to adjust the employee master records, or specify a payroll batch if you want to adjust deductions for the specified batch only.Code

TP

Description

These fields will be filled in automatically from the list of all possible deductions you entered in 5-3-1 Deduction Maintenance.Select the function needed to change this list as required.

Frequency

The frequency indicates how often this item should be deducted from the employee's check. The choices are:W0 = One time only; the next pay check

W1 = 1st pay period of the month

W2 = 2nd pay period of the month

W3 = 3rd pay period of the month

W4 = 4th pay period of the month

W5 = 5th pay period of the month

W = Every pay check

BM = 1st and 3rd pay period of the month

BW = 2nd and 4th pay period of the month

M = Monthly on the first week of the month or the first week the employee works in the month.

If ACM (see below) is yes, missed deductions are automatically caught up.

Tot to deduct

This is filled in automatically from the information entered in 5-3-6: Employee Deduction Register Maintenance. The specified "Amt each time" will be deducted each week until this total to deduct is reached.NOTE: This field, "Tot to deduct" is a total only for the current year, and therefore is adjusted by the system as part of year end.

Each time

Type the flat amount to be deducted per check, or percentage to deduct.

Note: for garnishments for child support and alimony, always specify 50. For Federal Tax levies, always specify 100.ACM

If answered YES, will accumulate missed deductions for employees not paid, to be deducted from their next paycheck. Caution: If the master deduction for an employee is changed, then the changed amount will be what accumulates. Generally, make temporary changes for an employee's deduction during time entry.PRI

Priority, if the employee earnings are not enough for all deductions. Low priority deductions are removed in whole or in part until a zero net check is obtained.

0 = always; 1 = top priority; 99 = low priority (discards deductions with highest numbers first).Method to Use

Specify by number from the list, the method or formula to use for this deduction. For all garnishments, always use method 3.

This procedure will print a report listing all possible deductions as

entered in 5-3-1: Deduction Maintenance.

Selecting this procedure will display the printer selection screen. Type

the printer number and the number of copies and press ENTER. Your

report will be printed and you will return to the 5-3 Miscellaneous

Pay and Deductions Menu. Press ENTER again to return to the payroll

system main menu.

This procedure will print a report, by employee ID, listing all deductions designated for any specified employee, or all employees as entered in 5-3-2: Employee Deduction Maintenance.

Selecting this procedure will display the printer selection screen. Type the printer number and the number of copies and press ENTER.

Next you will be prompted:

Employee ID to print or just <ENTER> for all __________

Deduction to list <ENTER> for all ____________

Specify a particular employee ID and press ENTER to print a report for that one employee, or just press ENTER to print a report of all employees. Your report will be printed and you will return to the 5-3 Miscellaneous Pay and Deductions Menu. Press ENTER again to return to the payroll system main menu.

This procedure will print a report, alphabetically by employee last name, listing all deductions designated for any specified employee, or all employees as entered in 5-3-2: Employee Deduction Maintenance.

This selection functions just like 5-3-4 above.

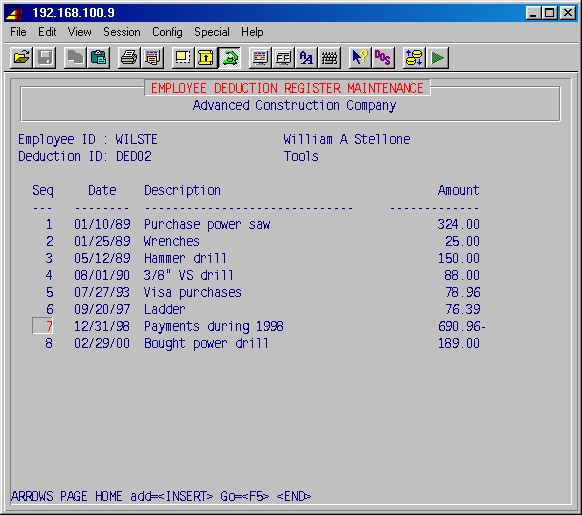

This procedure provides a register that allows you to input the dollar amount due for various employee purchases or loans related to certain employee deductions. The total of these transactions sets the total to deduct for the selected deduction. This function works in conjunction with 5-3-2 Employee Deduction Maintenance, where you input the amount and frequency to be deducted.

This selection will first prompt:

Print deduction register: NO

If you wish to just print the deduction register, answer YES. You may print a report for a specified employee or a range of employees, and a specified deduction ID or range of deductions.

If you want to update the deduction register, answer NO. This will prompt for Employee ID and Deduction ID:

Employee ID

Type the employee ID and press ENTER. If the ID typed was a valid ID, the system will display the full name of the employee.

Deduction ID

Type the deduction ID of the deduction category for which you wish to register a total amount to be deducted over one or more pay periods.

Date

Type the date of the transaction which now requires a deduction.

Description

Type a description which will identify this transaction for your records.

Amount

Type the total amount to be collected and press ENTER.

At this point, check your entries to see that they are accurate. If not, use the update function and make the changes. When you are through, press END and you will be transferred to the 5-3-2 Employee Deduction Maintenance screen for this employee.

Changes to the "total to deduct" in this register will update the employee master records and this employee's information in all batches in progress.

Notice that the amount you entered in the deduction register is now part of the "total to deduct" field of the specified deduction ID. Go to that deduction ID using the arrow keys, then press ENTER and type in the frequency and the amount each time.

Then, press END and you will return to 5-3-6: Employee Deduction Register Maintenance. You may now type another employee ID and input another deduction, or simply press ENTER to return to the 5-3: Miscellaneous Pay and Deductions Menu. Press ENTER again and you will return to the payroll system main menu.

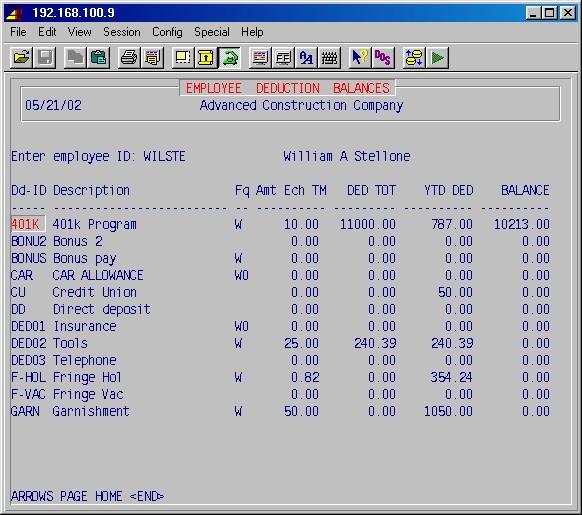

This selection displays the employee deductions that were set up in 5-3-2: Employee Deduction Maintenance, showing the total to deduct, the total deducted, and the balance left to be deducted. This selection allows viewing only with no update.

This selection will display the following screen :

Enter the employee ID

Type the employee ID and press ENTER. If this is a valid employee ID, the system will display the employee's name and deductions.If you want to view another employee's deduction balances, press END and the system will prompt for another employee ID.

When you are ready to exit, press ENTER and the system will return to the 5-3: Miscellaneous Pay and Deductions Menu.

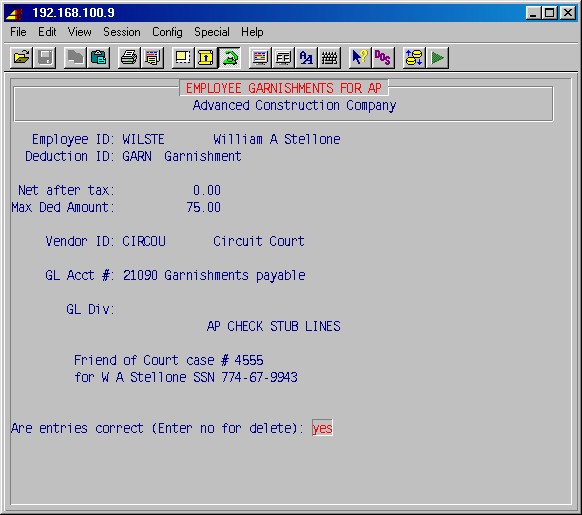

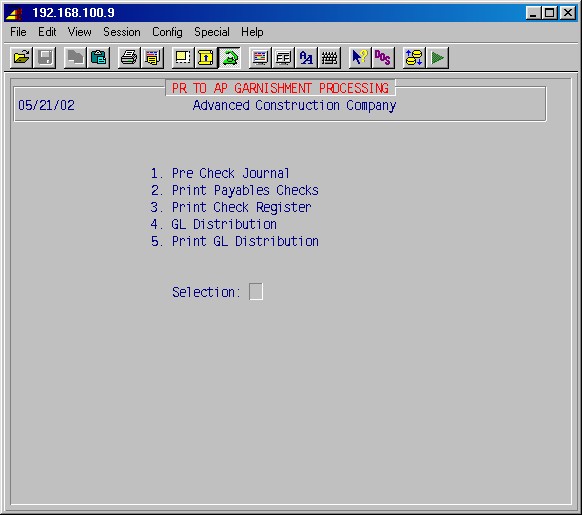

This is a set up area for a feature of the payroll system which will print AP checks for garnishments. In this procedure, you specify the AP vendor, the GL number, and the check stub information for each garnishment for each employee.

Prior to this step it is necessary to set up one or more deduction ID's for garnishments (Example: GARN1, GARN2, GARN3), set up the vendor to pay in AP Vendor Maintenance, and possibly set up a GL liability account number for garnishments. Since it is possible for an employee to have more than one garnishment, you need a garnishment ID for the number of garnishments possible per employee. The amounts to be deducted are set through 5-3-2: Employee Deduction Maintenance, and the actual processing of the AP garnishment checks is done through 5-17-15: AP Garnishment Processing.

This selection will display the following input screen :

Employee ID:

Specify the employee ID [H]. If this is a valid ID, the system will display the employee's name.

Deduction ID:

Specify the deduction ID [H] for this garnishment. If this is a valid deduction ID, the system will display the deduction description. If there are no entries for this employee for this deduction ID, the system will prompt:No entry found ADD: YES

Press just ENTER to continue.

Net after tax:

Minimum net pay amount after taxes (Used only for Federal tax levies - type 3 calculation method only)

Max Ded Amount:

Maximum garnishment deduction amount (Child support and alimony type 3 calculation method only)

Vendor ID

Specify the vendor ID [H] for the payee of this garnishment.

GL acct #

Specify the GL account number [H] for garnishments. This is generally a liability account (example: garnishments payable) and should be the same account number that was entered when the deduction was set up.

GL Div

If the GL account was divisionalized, specify the division here.

AP check stub lines

Three lines are provided to enter the description for the check stub in accordance with the requirements of the payee.Are entries correct (enter no for delete): YES

If the entries are correct, press just ENTER and this record will be created and you will be prompted for another employee ID.

You may delete this record or make corrections by pressing NO ENTER. The system will prompt:

Delete record (YES/NO): NO

Press just ENTER and you will be prompted for the employee ID. Enter the same employee and the deduction ID and the previous information will be displayed for you to revise if necessary. If you answer YES ENTER this entry will be deleted from the system.

When you are ready to exit, press ENTER again. The system will prompt:

Print List of Garnishments (YES/NO): NO

Answer YES to print a list or just press ENTER to exit this

area.

If answer Yes, the printer sleection screen will be displayed.

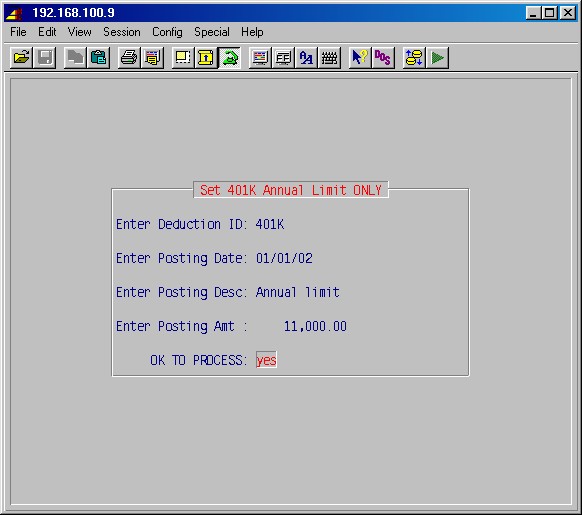

This procedure allows setting, for all employees at once, the total to deduct for the selected deduction. This is usually run once a year at the beginning of the year. This procedure will erase the existing total (e.g. yearly limit) for the selected deduction ID for all employees, and set the new amount entered for all employees as of the date entered.

For example: A maximum of $9400 may be deducted on a 401k plan, starting from the first of the year. Later in the year, after a total of $9400 has been deducted for an employee, no more money will be deducted for 401k for that employee. This step should be run at the beginning of the year, before any employee has reached the limit.

This selection will display the following input screen:

Top

Enter deduction ID:

Specify the deduction ID.Enter posting date:

Specify the date as a notation of when this limit was entered.Enter posting description:

Type your description for this deduction.Enter posting amount:

Specify the total to be deducted.Ok to process: no

This allows you to exit without the changes. Answer YES to finalize the entries and exit this area.

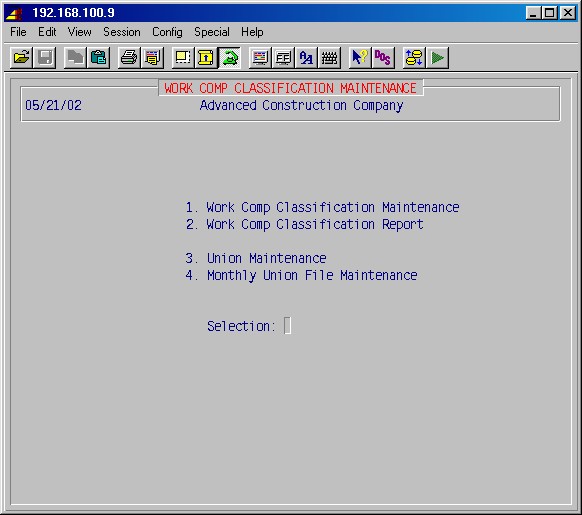

These procedures are used to set up and modify the various classifications for workman's compensation and union information files and pay scales. This selection will display the following menu:

Classifications needed for employees must be entered in the list here first. There must be entries for each work comp class for each state in which the employee works. With each workmen's comp class, a labor burden percentage for that class may also be entered. This percentage is used to help appropriately reflect real labor cost in the job cost system, above the FUTA, SUTA, Work Comp, FICA and Union.

This selection will display the following input screen :

Enter WC class ID:

Specify an identification code consisting of the two letter state code + the four character work comp class code to designate the workman's compensation classification ID + an optional 5th character for work class extension.

1 = Class description

Type a short description of this classification.

2 = Workmen comp:

Enter the workmen's comp rate for this group of employees (e.g. 7.90 for $7.90/$100 wages).NOTE: Fields 3 through 5 are optional, but may be used alone or in combination as the specific situation requires. This information is used in charging overhead and other costs above SUTA, FUTA, FICA, and Work Comp to jobs. The labor is "burdened" with these other costs.

3, 4, 5 = Job cost burden factor

Type the labor burden percentage for these employees, (e.g. 18.6 for an 18.6% burden), for each category of hours. The earned pay for the employees in this class will be multiplied by this factor; the result will show on the job cost reports as additional job cost burden as well as post to General Ledger.

This procedure will print a report, by work comp class IDs, which will list all of the items entered in 5-4-1: Work Comp Classification Maintenance.

Selecting this procedure will display the printer selection screen. Type the printer number and the number of copies and press ENTER. Your report will now be printed and you will return to the 5-4: Class & Union Information Menu.

The procedures in this area will allow you to input union information and pay rates and print reports of that information.

This selection will display the following menu screen:

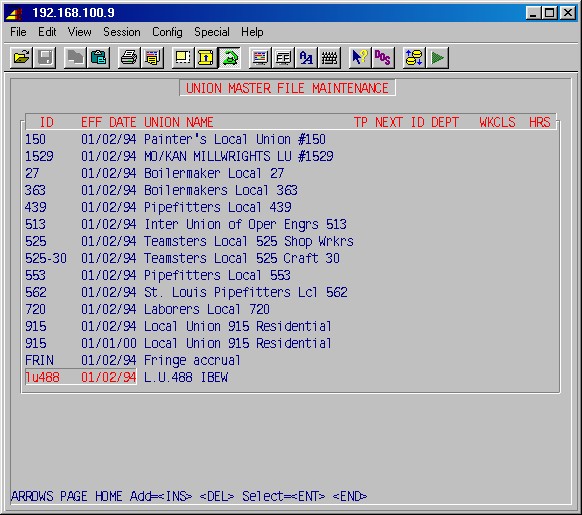

To do maintenance on a union in the list, use the arrow keys to highlight the union and press ENTER. If you wish to enter a new union, press <INS>. The following entry screen will be displayed:

Union ID:

If you are adding a new union, specify an identification code of up to seven letters or numbers to designate the union. If you specify an existing union, the system will assume you are trying to record the contract with this local with a different effective date. If you do start a new effective date in this manner, all the contributions and work classes will be copied from the prior effective date.Union name, address, phone, contact person:

These fields are self-explanatory. Type this information as you want it to appear on reports.G.L. Account number:

Leave blank or enter the appropriate GL account number for this union if different from the department setup.Report ID 1:

Report ID 2:

Employer identification numbers to print on the union reports.The following five fields may be used in a "master union" configuration to allow the system to automatically choose an appropriate set of benefits for various sets of circumstances. You must set up a sub-union for each set of conditions which may occur and "chain" these sub-unions together using the "next union ID" field. The system will search through the sub-unions until it finds a matching set of conditions and use that benefit package. If it reaches the end and hasn't found a match, it will use the last one.

Entry type:

This is either blank or M. Entering an M here designates a "master union". If you have a master union, you may have several sub-unions, but you must have at least one sub-union. If you designate this union as the master union, this is the union ID the employees are listed as belonging to, but all benefits will be calculated from the sub-union(s).If you enter M here and designate this as a master union, you must also complete the field "next union ID". This field is used in conjunction with a master union, and signifies the first sub-union to look at for a matching set of conditions.

For example: A member of a union may have a different benefit package for his work class depending on whether he works in the shop or the field.

Next union ID: (Only on master unions and sub-unions)

Specify the sub-union here for the first sub-union to search for a matching set of conditions.Department: (Only on sub-unions)

Specify the department here for the benefit package that matches this department.Work class prefix: (Only on sub-unions)

Specify the work class prefix. This is usually an "A" for apprentice. This is used in conjunction with the number of "hours in class" entered in the next field.Another reason to use the master/sub-union configuration is the following example:

For example: An apprentice in one class may be qualified for the next level of benefits based on the number of hours he has worked in that class, prior to having passed his exam for the next class. Additionally he may be eligible for different levels of benefits based on both the number of hours he has worked in a class and the department where he is working.

Hours for class: (Only on sub-unions)

Enter the number of hours in this class. The sub-union with the highest number of hours, should be the first "next union ID" used on the "master union" and the sub-union with the lowest number of hours should be later in the chain.Example of a Master/Sub-Union Configuration

Sub-unions should be numbered as the conditions progress from the most specific to the most general. The system will go down the chain of sub-unions until it finds a set of conditions that match an employee and a time entry.

Employees working in local 915 have different benefit packages depending on whether they work in the shop or in the field. In addition, apprentices with more than 3000 hours in their work class qualify for different benefits from those available for apprentices with less than 3000 hours in a class.

Joe is an apprentice with 2500 hours in his class who works in the shop. His union benefits/contributions will calculate using sub-union 915B.

Fred is an apprentice who has more than 3000 hours in his class (he hasn't finished the tests yet) who works in the field. His benefits/contributions will calculate using sub-union 915C.

Sarah is a journeyman who works in the field. Her benefits/contributions will calculate using sub-union 915F.

When all entries have been make and corrected if necessary, press ENTER, and you will be prompted to update union work classes. If you answer YES, the following screen will be displayed:

You may use this entry area to add union work classes and rates as needed to match your union agreement.

Work Class

Type a work class designation of your choosing of one to four letters or numbers. Note that the system will group these work classes by the first letter. It is important to have the same number of characters in use for each type of class. For example, to set up several journeymen, J1, JA, JB, J2, etc. are fine. J, JA, J1 are not correct since the first entry J has one character, JA and J1 have two characters. Examples of commonly used first letter designations are listed below:Work Class Prefix

F = Foreman

J = Journeyman

A = Apprentice

N = Non bargaining

P = Pusher (lead off mechanic)

O = Operator

G = General foreman

C = Clerical

E = Expeditor

S = EstimatorDescription

Type a short description for this work class.Scale rate

Type the union scale rate for this work class.Actual rate

Type the actual rate of pay for this work class. (This is mandatory)When all work classes are entered, press END to exit. The next screen allows you to set up union contributions.

NOTE: Before you set up union contributions, you must first set up the union work classes.

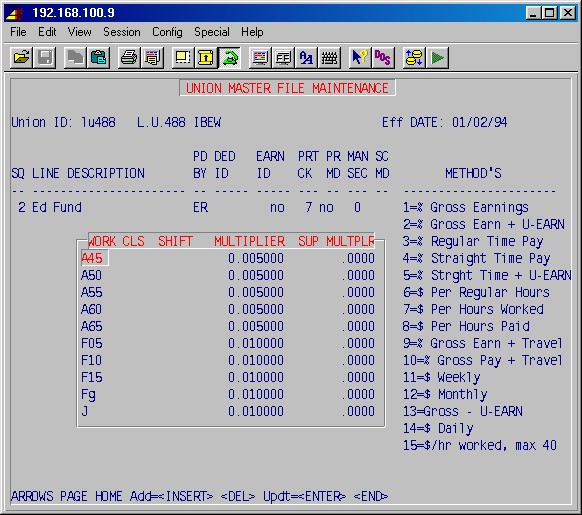

These procedures allow you to input for each union, the various union benefits, the contributor (company or employee), the method of calculation, and the contribution multiplier for each work class by shift.

This selection will display the following input screen :

TopEnter the Union ID:

Type the union ID and press ENTER. If this is a valid ID, the system will display the full name of the union.Line Description

Type a short description (up to 22 spaces) of the contribution.Paid by

Specify whether the contribution is paid by the employee or the employer.

EE = Employee ER = Company/EmployerDed ID

Specify the deduction ID from the miscellaneous pay and deductions area to accumulate this union deduction. Mandatory for EE (employee paid contribution).Earnings ID

Specify the deduction ID from the miscellaneous pay and deductions area to accumulate this union benefit. Optional, normally used only for ER (employer paid contribution). If this is a non-taxable benefit, then enter this deduction in the tax tables.PRT CK (Not Used)

PR MD

Primary union calculation Method: Specify the method by which the contribution is calculated from the 13 choices shown on the right side of the screen. The formulas for these 13 methods are detailed below:Calculation Method Summary

1 = % Gross Earnings

Regular hours x rate

+ Overtime hours x 1.5 x rate

+ Doubletime hours x 2 x rate

= Gross Earnings2 = % Gross Pay

Gross earnings + vacation = Gross Pay3 = % Regular Time Pay

Regular hours x rate = Regular Time Pay4 = % Straight Time Pay

(Regular hours + overtime + double time) x rate = Straight Time Pay5 = % Straight Time + Vacation

(Straight time pay) + (straight time pay x vacation factor) =

Straight time + Vacation6 = $ Per regular hours 7 = $ Per Hours Worked

Regular hours + overtime hours + doubletime hours = Hours Worked

(clock hours)8 = $ Per Hours Paid

Regular Hours + (overtime hours x 1.5) + (doubletime hours x 2) actually paid9 = % Gross Earnings + Travel

Gross earnings + travelNOTE: Travel is the compensation entered on the time entry line in 5-8 designated as type T.

10 = % Gross Pay + Travel

Gross earnings + vacation + travel11 = $ Weekly

Flat dollar amount per week (amount specified by the multiplier on the next screen).12 = $ Monthly

Flat dollar amount per month (amount specified by the multiplier on the next screen).13 = Gross - C1

Gross earnings - contribution 1MAN SEC

Mandatory Secondary union: If employees from a different union works in this union and need to pay partial benefits to this union, set this to Yes, and all deductions/benefits for the home union plus the one specified here will be calculated.SC MD

Specify the Calculation Method (as described above under PR MD) to be used for the secondary union.The system will number the contributions as they are entered. Select the contribution and press F7 to input multipliers.

NOTE: When the contributions are first set up, it is necessary to type each line number (one-at-a-time) and complete the next screen. Later, if you are simply adding a contribution, or making a change, you will select just that one and fill in the next screen.

Work class

Type the work class from the list that was entered in union work class maintenance. Type ALL if the contribution is the same for all employees.Using the first letter for a group of work classes if they all have the same multiplier:

A would specify the multiplier for all Apprentices, J for all journeymen. Do not specify the first letter and the complete work class in the same group: A and A50.Shift

Type the shift code from the list below:

- All Shifts - First Shift - Second Shift - Third Shift Multiplier

Type the multiplier for this contribution based on the method specified on the previous screen.Sup Multplr:

This is for the second union, if dues are split between two unions. Type the multiplier for this contribution based on the calculation method specified on the previous screen.It is necessary to define a record for each work class and shift if they are different. When all records have been entered, press END and you will be returned to the previous screen with the prompt:

ENTER THE LINE NUMBER FOR ENTERING WORK CLASSES, ET AL ___

Type number 2, and repeat the process until all contributions have been defined. When you are finished press ENTER and you will be prompted for another union ID.

Update Weekly & Monthly Report Fields?: YES

Press ENTER to Update Seven Column Report Fields

This procedure allows you to input, for each union, the various work

classes, scale rate, actual rate, and the vacation factor. This procedure

is available through 5-4-3-1: Union Maintenance

where you may choose the Union and effective date from an F2 list.

See 5-4-3-1 for detailed instructions.

Enter Union ID:

Type the union ID and press ENTER.Effective Date:

This is the contract effective date. Note that there may be more than one entry for each union with different dates and it is necessary to specify both the Union ID and the effective date to specify a particular Union contract.If this is a valid Union ID and Effective date, the system will display the full name of the union and the following screen:

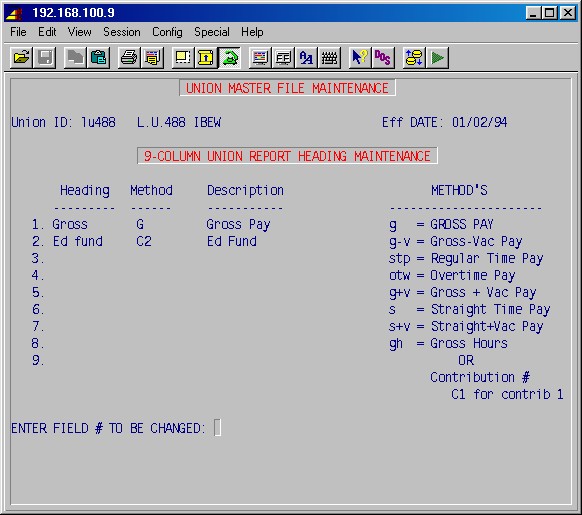

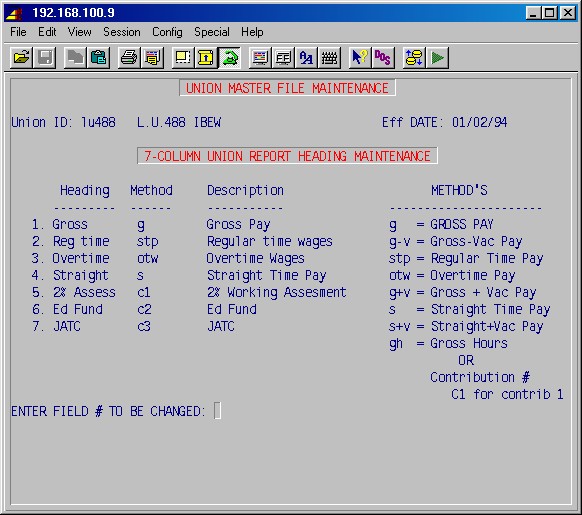

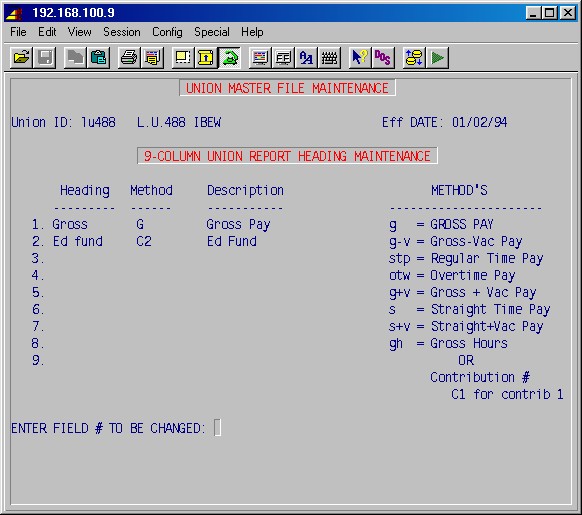

This procedure provides the means to specify a user-defined report used for reporting monthly totals to the union. The report may have up to seven user-defined headings. After entering a valid union ID and effective date, this selection will display the following input screen :

TopEnter the Union ID:

Type the union ID for which you wish to specify the headings for the monthly union report.The next seven fields define the report headings and the method by which you wish to extract union information from the database and display it on the report. The headings will be positioned from left to right on the report.

Heading

Type the heading name exactly as you want it to appear on the report (up to 9 letters or numbers).Method

Specify the method designation from the list below:

g = Gross Pay stp = Regular Time Pay otw = Overtime Wages g-v = Gross Pay - Vacation Pay g+v = Gross Pay + Vacation Pay s = Straight Time Pay s-v = Straght Time Pay - Vacation Pay s+v = Straight Time Pay + Vacation Pay gh = Regular Time Hours + OT Hours * 1.5 + DT Hours * 2 c1 = Union Contribution 1 c2 = Union Contribution 2 NOTE: Union contributions were entered and numbered in 4-3-2: Union Contribution Maintenance. These are user-defined and may range from contribution 1 through contribution 99 (c1 - c99).

Description

The system will fill in the description from the description you entered in 4-3-2: Union Contribution Maintenance.You may make changes or corrections by typing in the field number to be changed and pressing ENTER. When you are finished press ENTER and you will exit this procedure and return to the union maintenance menu.

This procedure provides the means to specify a user-defined report used for reporting weekly totals to the union. The report may have up to nine user-defined headings.

This selection will display an input screen similar to the one in 5-4-3-4: Report Heading Maintenance Monthly, except there are nine fields to specify.

Refer to the instructions in 5-4-3-4: Report Heading Maintenance Monthly to complete this selection.

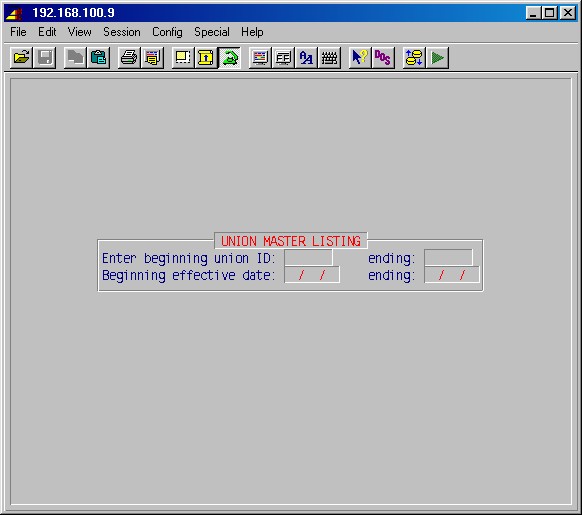

TopEnter beginning union ID:

Enter ending union ID:

Specify one or a range of union IDs for this report.The printer selection screen will now be displayed. Type the printer number and the number of copies and press ENTER. Your report will be printed and you will return to the union maintenance menu. Press ENTER again to return to the 5-4: Class & Union Information Menu.

Not operable as of this writing.

This will allow you to change the pay rate, shift, and payroll week of the monthly union contribution for a selected employee, union, and work class. It also allows change to a specific payroll union contribution (for a secondary, voided, or manual check).

Not in use at this time.

This area will be used to calculate the union contribution entered in

5-4-4 above.

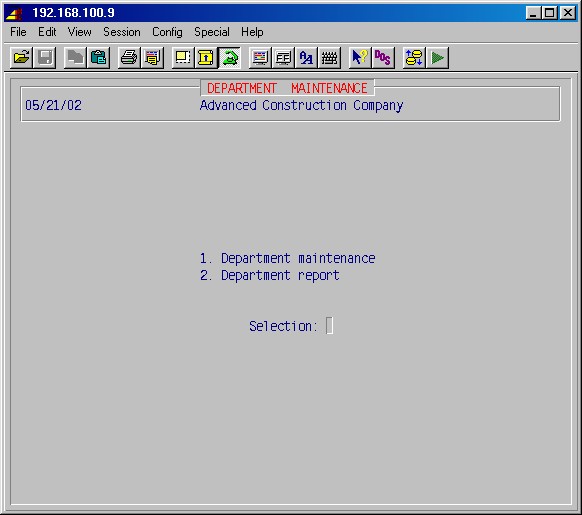

Departments are set up in payroll to allow grouping employees for accounting purposes. Subtotals are shown for each department, and each department's subtotals may be posted to its own group of ledger accounts.

The following procedures allow adding, modifying, viewing and deleting department

information.

This selection will display the following menu screen:

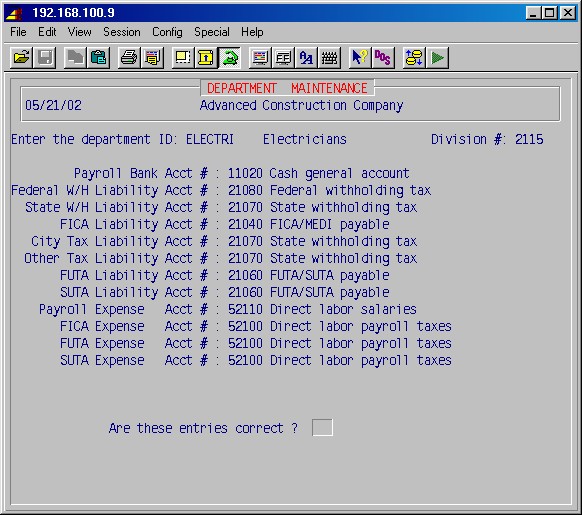

In this procedure you may add new departments or update existing departments. This selection will display the following input screen :

Enter the Department ID

If you are adding a new department, first call up an existing similar department. This will fill in all the account numbers from the existing department, requiring only changes to the new department. Type a descriptive department ID (a minimum of three characters is recommended to a maximum of seven letters or numbers) and press ENTER. Next, type a description for this department ID which will be printed on reports and press ENTER. A list of accounts will be displayed on the left side of the screen, for which you must specify the general ledger account for this department of employees.If you are viewing or modifying an existing department, type the department ID [H] and press ENTER. If this is a valid department, the system will display the name of the department and display a list of accounts on the left side of the screen, for which you must specify the general ledger account for this department of employees.

The following fields relate to your general ledger account numbers. For employees in this department, it is these accounts that will be credited and debited when payroll interacts with the general ledger. For each account displayed, specify the general ledger account number [H] appropriate for this department of employees, pressing ENTER after each. You must type a GL number for each account.

Payroll Bank Acct #:

The account from which pay checks will be drawn. (credit)Federal W/H Liability Acct #:

State W/H Liability Acct #:

FICA Liability Acct #:

City Tax Liability Acct #:

Other Tax Liability Acct#

FUTA Liability Acct #:

SUTA Liability Acct #:

The above accounts will be credited from payroll as appropriate. Each of the above fields must have a valid general ledger account number. If you do not have a city income tax or a state income tax, then use the federal liability account number.Payroll Expense Acct #:

FICA Expense Acct #:

FUTA Expense Acct #:

SUTA Expense Acct #:

The above accounts will be debited from payroll as appropriate. Each of the above fields must have a valid general ledger account number. If you do not have union expenses, then use the payroll expense account number.Are these entries correct ? ___

When all GL numbers have been entered, you will see this prompt. If correct, just press ENTER and the next screen will be displayed.

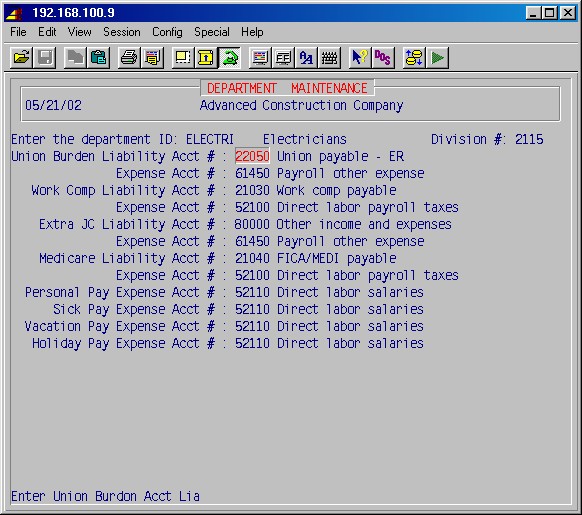

Type NO ENTER to make changes or corrections. When all entries are correct, type YES ENTER and another screen will be displayed with more accounts for which you must input general ledger numbers as follows:

Continue specifying the general ledger account numbers [H] appropriate for this department of employees.

Division #:

If your company is divisionalized, type the division number here for this department.Are these entries correct ? ___

When all GL numbers have been entered, you will see this prompt. If correct, just press ENTER and you will be returned to the first screen and prompted for another department ID.

Type NO ENTER to make changes or corrections. When all entries are correct, type YES ENTER and you will be returned to the first screen and prompted for another department ID. Type ENTER again to return to the Department Maintenance Menu.

This procedure will print a report by department ID of all departments with the department description and the general ledger numbers entered for each account. Selecting this procedure will display the printer selection screen. Type the printer number and the number of copies and press ENTER. The report will be printed and you will return to the department maintenance menu. Press ENTER again to return to the payroll menu.

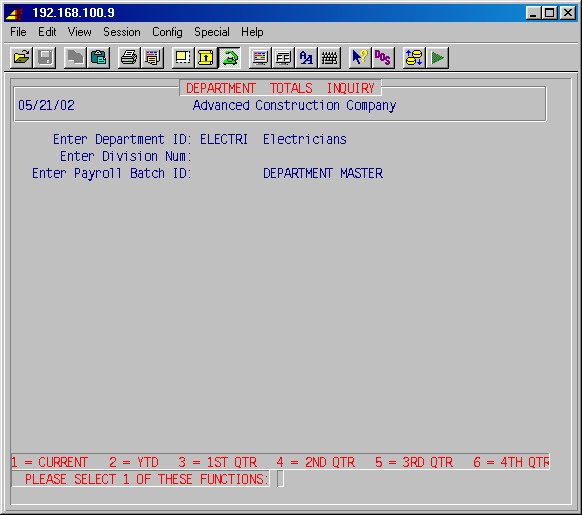

This procedure allows viewing department totals for the current payroll, year-to-date and quarters. This selection will display the following input screen :

During time entry, both a department and a division must be specified. This

reduces the number of departments that must be set up (we don't need a department

for every division). However, totals are collected for each department/division

combination.

Enter Department ID:

Type the department ID [H] and press ENTER. If the department ID is valid the system will display the department description.

Enter Division Num:

Type the division ID and press ENTER. If this is a valid division ID, the system will display the division description.

Enter Payroll Batch ID:

The system will specify the current batch ID you are working on. If you want to see the totals for that batch, just press ENTER. If you want to see the totals for another batch, enter that batch ID. If you want to see the department master, blank out the payroll batch ID and press ENTER.Please Select 1 of These Functions:

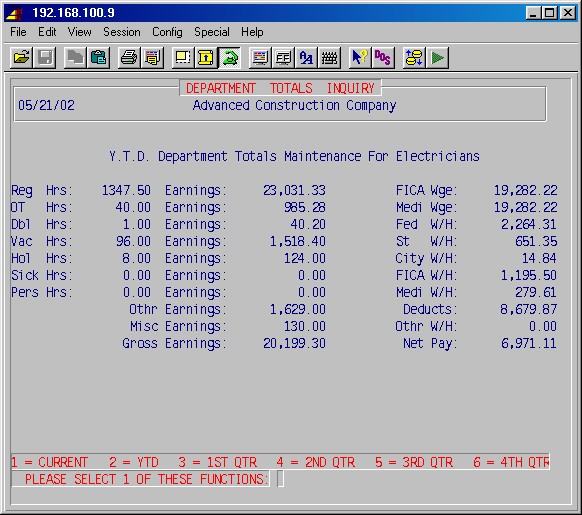

1 = CURRENT Displays current department totals 2 = Y.T.D. Displays year-to-date department totals 3 = 1st QTR Displays 1st quarter department totals 4 = 2nd QTR Displays 2nd quarter department totals 5 = 3rd QTR Displays 3rd quarter department totals 6 = 4th QTR Displays 4th quarter department totals Type the number which is appropriate for the totals you wish to see and press ENTER. The system will display totals for hours, earnings, taxes and deductions for the department as follows :

The system will display totals for hours, earnings, and deductions for the department.

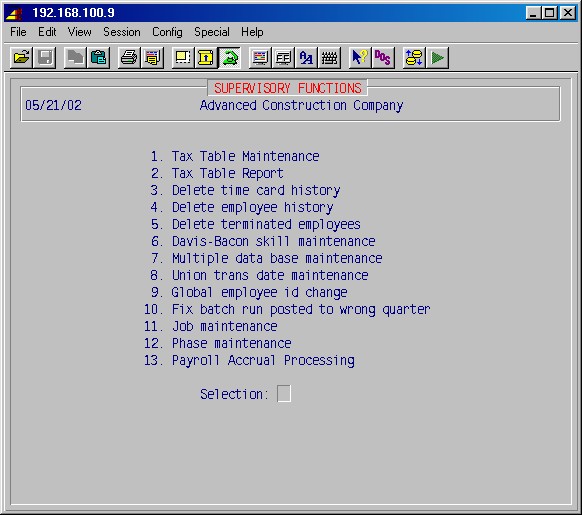

This menu contains selections to make corrections, delete data and change general setttings for the payroll module, and thus should only be used by personnel who are very familiar with the payroll module.

This selection will display the following menu screen:

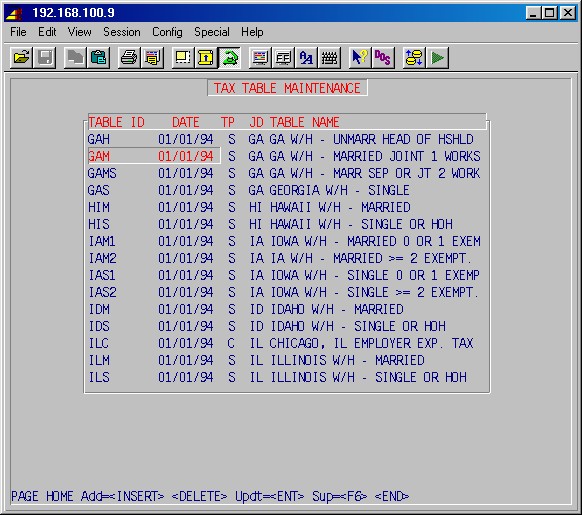

The payroll tax table procedures have been designed for completeness and ease of use. These procedures allow adding or changing the federal, state, or city tax tables without a programmer's assistance. The tax tables may be changed at any time and must be changed every time you receive new tax tables from federal, state, or city taxing authorities.

Note that the FDM (Federal married) is the master tax table from which the system pulls various information. In addition to federal married tax table information, the federal tax ID for all federal reports including W2s, magnetic media, and direct deposit, as well as the FUTA percent and limit are pulled from this table. It is essential that all information on this table be accurate.

NOTE: FICA and MEDICARE rates and amounts must be adjusted annually or any time you receive a circular E with new rates and limits. These are in the tax tables FICA and MEDI respectively.

This procedure allows adding or changing the federal, state, city, or local tax tables. Annual tax tables are provided for each state, city and county of the country, if needed. These are user maintainable from the circulars supplied by your tax authorities.

Table ID:

There are several reserved table IDs that the payroll system treats as special. These names CANNOT be used for state tax tables. The names are:

FDM - Federal Income Tax Witholding for Married Employees FDS - Federal Income Tax Witholding for Single Employees FICA - Federal Social Security Witholdings MEDI - Federal Medicare Witholdings SUTA - State Umemployment Tax Witholdings SUTANS - State Unemployment Tax - no S125 EIC - Federal Earned Income Credit The state tax table IDs start with the two letter U.S. Post Office abbreviation for the state followed by up to a three letter code that would identify the table as to what it contains.

Use the <ARROWS> and <PAGE> keys, or just type the two letter state abbreviation to reach the part of the list needed. Select from the displayed list the table to maintain.

The heading information is already supplied. DO NOT CHANGE THE EFFECTIVE DATE unless you want to create a new entry to replace the one supplied by SI Systems. Only your company's tax ID number needs to be entered. The ID must be entered on ALL THE TABLES relating to each state as well as FDM and FDS. Leave the G.L. Account# blank unless you want to specify an account to be used instead of the one specified in 5-5-1: Department Maintenance.

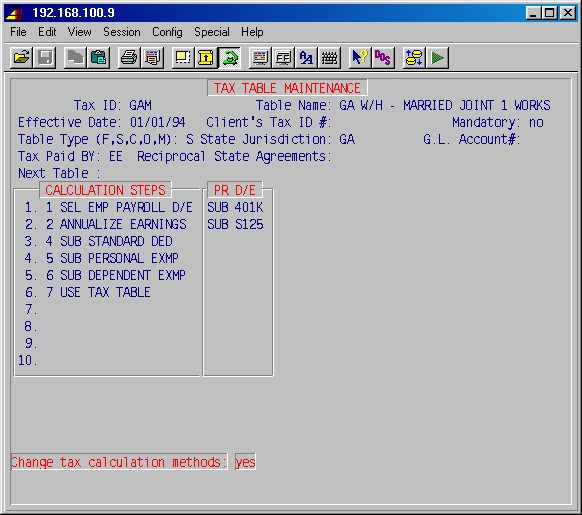

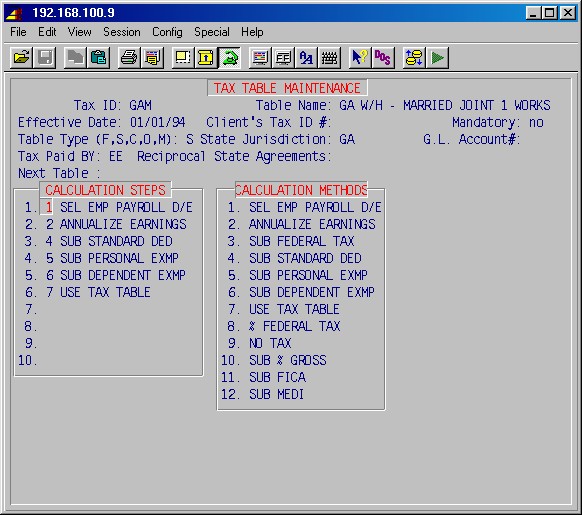

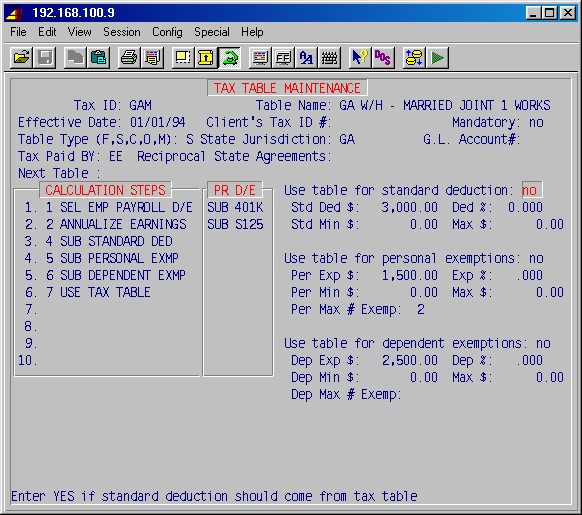

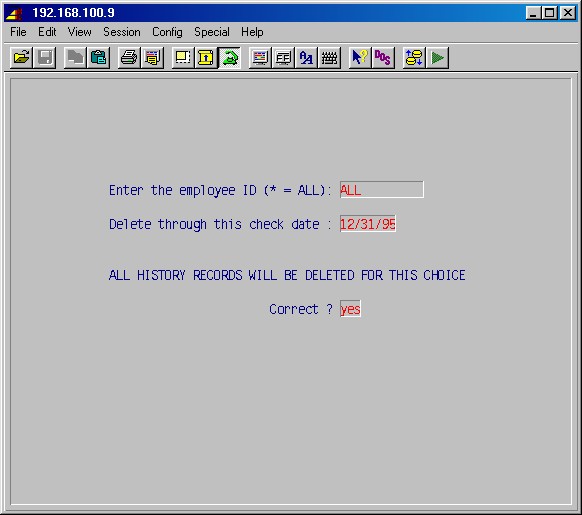

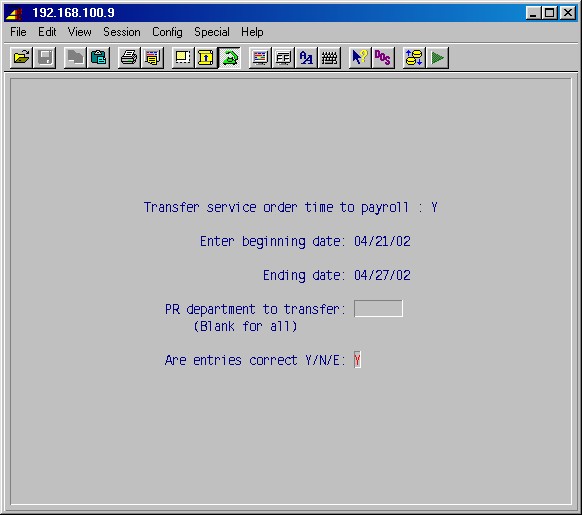

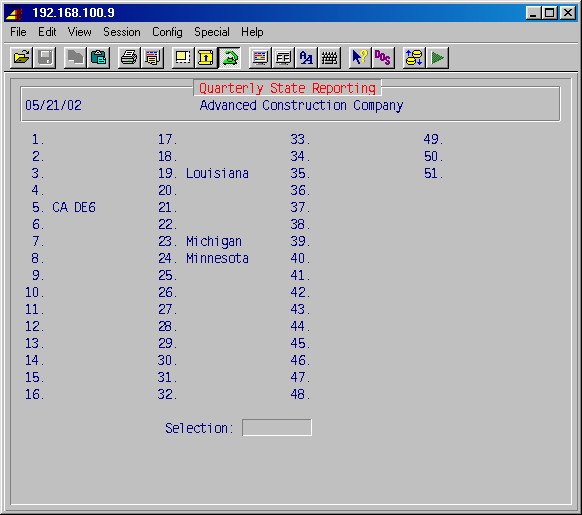

Answering YES to Change tax calculation methods displays this screen: