Payroll

- Complete final payroll of the year and make a backup of your database.

- Copy the payroll files to a new database and verify copy (run from root).

- Process W2s and check the results with a preliminary printing - In Payroll Database.

- Clear employee totals - Main Database.

- Reset the annual 401K limit.

- Delete terminated employees (optional) - In Main Database. SI recommends that you keep terminated employees in the database for at least three years.

- Adjust tax tables - In Main Database.

- Print W2s on forms (at your convenience) - In Payroll Database.

Accounts Payable

- Complete final run of payables checks for the year and make a backup.

- Process 1099s and check the results with a preliminary printing.

- After results are correct, SI recommends that you recaluclate year-to-date totals for the new year.

- Delete inactive vendors. SI recommends that you keep vendors for at least three years after they become inactive (optional).

- DO NOT PROCESS AGAIN. Print 1099s on forms (at your convenience).

Accounts Receivable (may be done as a part of the FYE).

- Print a list of customers showing total billings if your company wants this data (optional).

- Clear the year-to-date totals (optional).

- Delete paid invoices - normally keep at least 3 years of history (optional).

Print Permanent Reports at FYE

- Print a complete AP aging report that reflects FYE.

- Print a complete AR aging reprot that reflects FYE.

- Print a report of all job costs that reflects FYE.

General Ledger (Closing FYE after adjusting entries are made).

**DO NOT clear any old data until it is at least 4 years old.**

- Complete all entries to GL for the fiscal year.

- Update the journal.

- Make a backup of your data.

- Print any year-end reports required by management or accountant (detail GL report, etc.).

- Close the ledger for the fiscal year.

- Advance the date locks for fiscal year and general ledger open period.

- Update transactions posted in the new fiscal year.

General Ledger (closing FYE before adjusting entries are made).

Adding GL data to your year-end payroll copy database.

Supplemental date-lock examples.

Caution: After January 1 of the new year, any entries you make to the previous year must be entered with a complete date including the correct year. After the 1st, the system will automatically default to the new year and you must be sure to specify the previous year if you intend the posting to go to the previoius year.

1. Complete final payroll of the year through step #18 and make a backup of your database

Do all normal weekly and quarterly reports and any other procedures you normally perform with a payroll, then do a regular backup (bkupacct) before you close.

2. Copy payroll files only to new database (this step only, must be done from root login)

- Log in as root (must be done by a supervisor with the root password).

- At question about terminal type, just hit <ENTER>.

- At #, type cd $SI.

- Access your company data, usually your company initials, or type m3 <ENTER> if you have multiple companies.

- At the main menu, run step 5-20-3.

This step allows you to make a copy of the payroll part of your database as of calendar year end. You may then utilize this year-end copy of payroll to do your W2s at your convenience. This step is mandatory.

This payroll copy must be verified before you clear the totals.

5-20-11: Access prior year payroll database, and specify the two-digit year.

The copy will look just like the main database except the company name on the main menu will be followed by the two-digit year. You then need to verify the copy is good by looking at some employee YTD totals. Unless you have run this in the past, we suggest you call us for assistance in running and verifying this step. After you have made the payroll copy and verified that it works, log out of root, log back in under your name, and go back to your main company database and proceed to payroll steps 4 through 7 below.

Log out as root (at # type exit <ENTER>)

3. Process W2s and check the results with a preliminary printing - In Payroll Database

This Process W2s step must be done using the payroll copy of the database.

Payroll step 5-20-1 processes and saves the W2 information to a file on the fixed disk of your computer. This file may then be printed, using step 5-20-2, on plain paper to verify the accuracy of the W2s. If corrections are made, step 5-20-1 Process W2s must be run again and the W2s should be printed again on plain paper for final verification. This process may be repeated as necessary until all W2s are accurate.

NOTE: The results must be correct before payroll totals are cleared. Once the W2s have been processed and the terminated employees deleted or the totals cleared, do not process the W2s again. Doing so will destroy the original and only copy of the good W2s.

NOTE: The next two steps, clear totals and delete terminated employees, may only be run after all W2 processing, printing, and magnetic media steps are finished.

4. Clear employee totals - In Main Database

The system maintains totals for each quarter and for the year-to-date. After a year has been completed and the W2s have been processed, clear the employee totals, using step 5-20-10 so that the new year can be started with a 0.00 for the quarters and the year-to-date total. After the totals have been cleared, you may begin processing payrolls for the new year.

5. Reset 401K annual limit in 5-3-9

Specify the 401K deduction and for clarity, use January first of the new year as the date.

6. Delete terminated employees (optional) - In Main Database

During the normal course of a year, it is not practical to delete terminated employees from your payroll records because it is necessary to send them a W2 form at the end of the year. After the W2s have been processed, you may use step 5-20-9 to delete terminated employees. This is the only time of the year when you may delete terminated employees from your records.

NOTE: Terminated employees should not be deleted for at least 36 months due to the need for reports for worker's comp and unemployment claims.

7. Print W2s on forms (at your convenience) - In Payroll Database

The W2 file created in the process step may be used to print the W2s, using step 5-20-2, on forms at your convenience, even weeks later.

8. Adjust tax tables for the new year - In Main Database

The payroll tax tables in 5-7, called FDS (Federal Single) and FDM (Federal Married) should be adjusted to match the tables of your new circular E. Be sure to adjust the exemption amounts if they have changed.

If there are changes in any of your state income taxes, those tax tables are usually identified as the two-letter abbreviation of your state plus either an M or S for married or single. For example, the income tax tables for Georgia are GAM and GAS.

Adjust FICA and Medicare tax rates and limits in 5-7-1 Tax Table Maintenance.

1. Complete final run of payables checks for the year and make a backup

1099 forms sent to the IRS and to your vendors should show the amount of actual payments made to each vendor during the calendar year. Note that it is not the amount of purchases, but rather the amount of actual checks written - payments. Therefore, it is necessary to complete the final run of checks for the year before the 1099s can be processed.

2. Recalculate vendor totals 4-1-5-6

This step uses the invoices and payments for the date range specified to recalculate the totals needed for 1099s.

3. Process 1099s and check the results with a preliminary printing

AP step 4-1-5-1 processes and saves the 1099 information to a file on the fixed disk of your computer. This file may then be printed, using step 4-1-5-2, on plain paper to verify the accuracy of the 1099s. If corrections are made, step 4-1-5-1 Process 1099s must be run again and the 1099s should be printed again on plain paper for final verification. This process may be repeated as necessary until all 1099s are accurate.

NOTE: The next two steps, clear totals and delete inactive vendors, may only be run after the 1099s have been processed.

4. AFTER results are correct, recalculate year-to-date totals

After the final run of checks for a calendar year and after the 1099s have been processed, the year-to-date totals for the vendors should be recalculated for the new year. This will allow the computer to begin accumulating the total purchases and payments for the new calendar year. AP step 4-1-5-6 shifts the totals back one year and recalculates the year-to-date as appropriate.

5. Delete inactive vendors (optional) - keep vendors for at least 3 years after they are inactive

Step 4-1-5-4 will delete the vendors marked as inactive and reclaim the space.

6. DO NOT PROCESS again. Print 1099s on forms (at your convenience)

The 1099 file created in the process step may be used to print the 1099s on forms at your convenience, even weeks later.

1. Print a list of customers showing total billings if your company wants this data. (optional)

The system accumulates a total of monies billed to each accounts receivable customer. This total is for your own information only.

You may see these amounts for a customer by either going directly to the customer information in step 1-1-1, or by printing the customer list.

NOTE: Since all reports from SI may be printed to a file, it is suggested that these year-end reports be generated as files and saved to CD.

2. Clear the year-to-date totals (optional)

Normally, you might wish to reset this total at the end of the year (fiscal or calendar) so that the computer will begin accumulating from $0.00 for the new year. Whether these totals are cleared by fiscal year or calendar year is purely a choice based on your company policy. AR step 1-18 clears the totals.

3. Delete paid invoices - normally keep at least 3 years of history (optional)

This step is a matter of choice, partially governed by your need to free up disk storage space and the frequency with which you need to quickly refer to paid invoices. Most of our customers should leave 4 or more years of invoice history on the system. AR step 1-19 will delete the specified paid invoices.

NOTE: Since all reports from SI may be printed to a file, it is suggested that these year-end reports be generated as files and saved to CD.

1. Print a complete AP aging report that reflects FYE

After the final run of payables checks and invoice entry for the year, print one or more AP aging reports from step 4-9-7: AP Analysis Reports.

2. Print a complete AR aging report that reflects FYE

After the final billings and posting of cash receipts for the year, print the AR aging report via 1-17-1 and the AR retainage receivable analysis via step 1-17-3.

3. Print a report of all job costs that reflects FYE

After the final run of payables, the final billings and posting of cash receipts, and updating job cost via 7-8 through the year end, print a report of all jobs in progress via 7-10-1.

You may "hold open" the closing of the FYE until adjusting entries are available and still continue to process all work into the new fiscal year. However, you cannot update the ledger or print monthly balance sheet and income statements until adjusting entries are made and the ledger is closed.

1. Complete all entries to GL for the fiscal year

Normally it will be several weeks, or possibly a couple of months, after the end of the fiscal year before all adjusting or final entries are posted to the general ledger.

CAUTION: While you may continue processing your normal work, do not run step 6-6-1 using dates into the new year. Doing so will corrupt balances, which will later be shifted to previous year when you close the ledger for the fiscal year.

After you have made all final entries to the general ledger for the fiscal year, you may continue with the following steps.

2. Update the journal

Update the journal via GL step 6-6-1 so that the account balances will reflect the changes being careful to use the FYE date.

3. Make a backup of your data

4. Print any year-end reports required by management or accountant

The GL module has a variety of reports, which you may desire or be required to retain on a permanent basis. As a minimum, you will want to print the trial balance, MTD and YTD income statement, and the closing balance sheet. Optionally, print the detail GL via step 6-6-2.NOTE: Since all reports from SI may be printed to a file, it is suggested that these year-end reports be generated as files and saved to CD.

5. Close the ledger for the fiscal year

GL step 6-14 will close the ledger for the fiscal year. This step should only be run at the end of the fiscal year, and then only after all general ledger adjusting entries for the year just finished have been updated to the general ledger and all reports printed.This step closes out the general ledger income and expense accounts for the fiscal year and shifts the totals back one year, leaving zero balances in the current year for income statement accounts. Next, the current year's profit/loss figure is added into your retained earnings account (or whatever balance sheet account you have specified). That adjusted retained earnings balance, along with the other year end GL account balances, is then put into a separate FYE file which is not visible on the account totals 6-2-1 screen). Since these FYE balances are not visible, we sometimes refer to them as the "hidden 13th month". This FYE balance file is the source of figures for the financial statements and also supplies the beginning general ledger balances for the new year.

NOTE: The FYE balances may be printed by running step 6-8: Print Trial Balance, and specifying "no" for current balances, which selects FY beginning balances for the trial balance.

**DO NOT CLEAR ANY GL DATA WITHOUT CONSULTING SI SYSTEMS!!**6. Advance the date locks for fiscal year and general ledger open period.

Go to 13-8-15 and change the fiscal year dates and the general ledger open period dates to the new fiscal year.

7. Update transactions posted in the new fiscal year.

Run step 6-6-1 once for each month, starting with the first day of the new fiscal year. For each month specify a range of dates starting with the first day of the month following the month with correct YTD balances, and ending with the last day of the month you are updating. Do this for each month from your FYE through the last current month just ended. This will update from the journal the new postings and you may resume normal procedures from here on.

Adding GL data to your year-end payroll copy database (optional)

This option allows you to close the ledger immediately (after final AR, AP and cash postings), make adjusting entries later, and additionally prepare a set of year-end-after-adjusting-entries, financial statements. This is done by copying your GL data to the year-end PR database copy, where you may post before-closing adjusting entries and prepare a complete set of financial statements. Moving the GL data requires assistance by SI.

Many businesses choose to close the ledger at year-end and run the various reports and steps described above shortly after the FYE, long before year-end adjusting entries are available from the accountants. When these year-end figures are available several weeks or months later, take the adjusting entries and the final balance sheet figures from your accountant and follow these steps.

If you close the ledger after making year end adjusting entries, you will be able to produce a final balance sheet and income statement for the year. If you close the ledger before the adjusting entries are made, you will not be able to produce final statements that reflect the year-end adjusting entries; however these are normally produced by your accountant, or from a copy of your database.

Since closing the ledger at year-end sets all of the income and expense accounts to zero, the monthly statements produced after closing will be accurate. Monthly balance sheets will need to be run (or re-run) after the adjusting entries are posted and updated because the starting balances will be different.

1. Close the ledger for the fiscal year

If you choose to close the ledger prior to posting adjusting entries, you may close immediately after you have processed:

1. All AP invoices for the prior year finalized through step 8.

2. All AR invoices for the prior year prepared and printed in final form.

3. All AR cash posting completed for the prior year.Run GL step 6-14 to close the ledger for the fiscal year. This step closes out the general ledger income and expense accounts for the fiscal year and shifts the totals back one year, leaving zero balances in the current year for income statement accounts. Next, the current year's profit/loss figure is added into your retained earnings account (or whatever balance sheet account you have specified). That adjusted retained earnings balance, along with the other year end GL account balances, is then put into a separate FYE file which is not visible on the account totals 6-2-1 screen). Since these FYE balances are not visible, we sometimes refer to them as the "hidden 13th month". This FYE balance file is the source of figures for the financial statements and also supplies the beginning general ledger balances for the new year. When the year-end adjusting entries are available, they will be posted to the FYE balance area to balance sheet and retained earnings accounts only.

NOTE: The FYE balances may be printed by running step 6-8: Print Trial Balance, and specifying "no" for current balances, which selects FY beginning balances for the trial balance.

2. Advance the date locks for fiscal year and general ledger open period.

Go to 13-8-15 and change the fiscal year dates and the general ledger open period dates to the new fiscal year.

3. Post year-end adjusting entries into FYE totals.

Later when year-end adjusting entries are available, they may be posted into the FYE total area. The system will not allow this posting until you temporarily set your 13-8-15 fiscal and GL date locks back to the prior year. After the adjusting entries are made, don't forget to change your date locks back to the current year.

Post year-end adjusting entries to the FYE totals using step 6-5-1: Post Manual GL Entries. The system will first prompt, "Is this a fiscal year-end posting after the fiscal year has been closed?". Answer "yes" and you will be posting directly to the FYE file. Distribute those entries to the ledger with step 6-5-3.NOTE: Due to the fact that the ledger has been closed and income and expense accounts have been set to zero, this FYE file contains only balance sheet account balances. This necessitates posting adjusting entries to retained earnings and the appropriate balance sheet accounts only. After the ledger has been closed, you cannot post adjusting entries to income and expense accounts. Please check with your accountant to see if this is acceptable prior to closing the ledger.

4. Update transactions posted in the new fiscal year.

Run step 6-7: Recalculate YTD Totals, once for each month, starting with the first day of the new fiscal year.

CAUTION: Once the ledger has been cleared, you must not go back and enter a date before the last day of the fiscal year just ended. You must start with the first day of the new fiscal year and not before.

Starting with the first month of your new fiscal year, specify a range of dates starting with the first day of the month and ending with the last day of the month. Do this for each month from your FYE through the last current month just ended. This will update from the journal the new postings and you may resume normal procedures from here on.

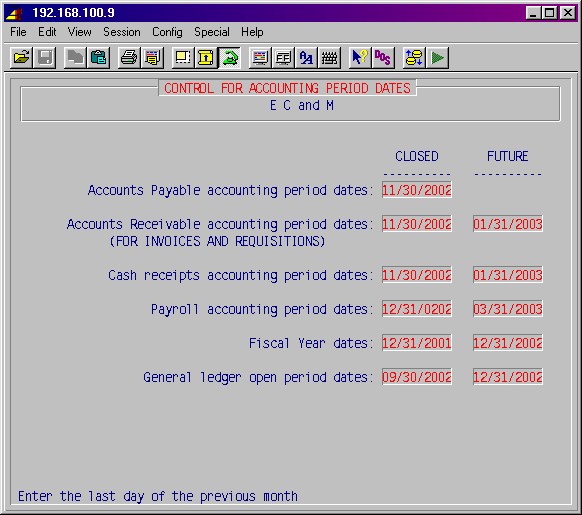

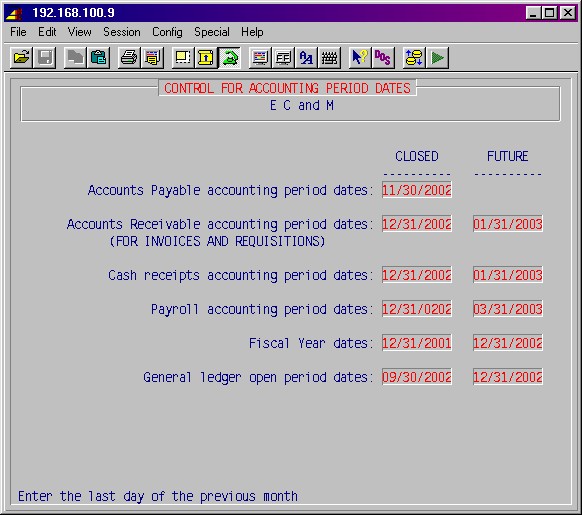

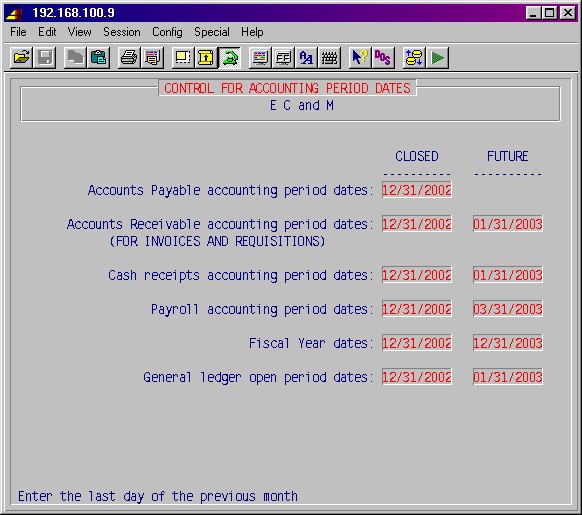

The following three screen shots are examples of how you might typically set your date locks for the year ending 12/31/2002.

1. This is typical of what 1/1/2003 would look like before AR and AP are finalized:

2. This is typical of what 1/5/2003 - 1/10/2003 would look like after AR is finalized:

3. This is typical of what 1/15/2003 -1/20/2003 would look like after AR and AP are finalized and the ledger is closed:

© 2005 SI Systems, Inc.

2323 Belleair Road

Clearwater, FL 33764

800/422-2277, 727/531-0669

Fax: 727/536-8858